Municipal bonds finally succumb to the rise in Treasury yields

Technicals and politics kept muni returns resilient to government rate rises … until now.

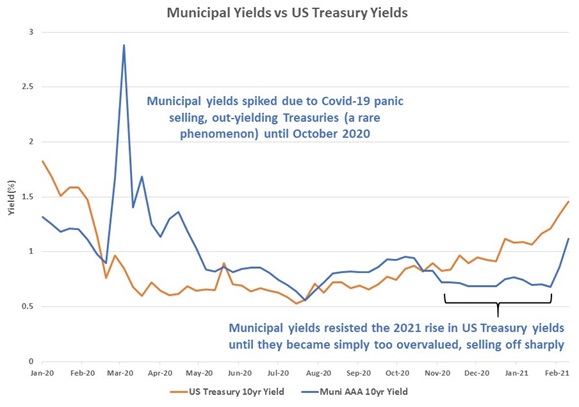

While Treasuries have been selling off (pushing up their yields) on the reopening of the economy and inflation expectations, municipal bonds (munis) had remained resilient. The last three months saw very strong muni performance on low new issue supply and high demand due to expectations of rising tax rates from the Biden administration and the Democratic-controlled legislature. This changed during the past few weeks as munis sold off sharply—they had simply become too expensive versus Treasuries (Figure 1).

Figure 1 (click image to enlarge)

Source: Bloomberg, Jan. 17, 2020 through Feb. 26, 2021.

This could potentially continue to play out in the weeks ahead as munis’ value relative to Treasuries normalizes. Once we get on the other side of this, it’s reasonable to expect muni outperformance as demand returns in response to the combination of cheaper valuations, improving fundamentals and the next potential government stimulus package (the version passed by the House on Feb. 28 included $650 billion in aid benefiting muni market issuers).

Munis have had worse starts in previous years. For example, the first two months of 2018, when the Bloomberg Municipal Bond Index returned -1.38% (versus -0.96% for the first two months of 2021). For full year 2018 the Bloomberg Municipal Bond Index returned 1.28%, which is closer to a 1.80% taxable return when adjusted for an assumed 30% effective tax rate—so we have seen munis recover from worse selloffs.

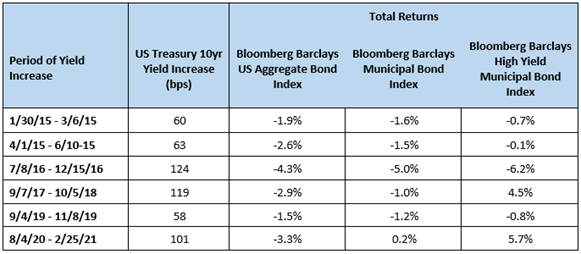

For potentially more resilient performance in the face of rising Treasury rates, we believe investors should consider high-yield municipal bonds. Looking at periods in the past six years when Treasury yields rose more than 50 basis points (bps), the Bloomberg High Municipal Bond Index outperformed the investment grade taxable and municipal bond markets in five out of the six cases (Figure 2).

Figure 2 (click image to enlarge)

Source: Bloomberg. Municipal returns not adjusted for taxes. Indexes are unmanaged and cannot be invested in directly. Past performance does not guarantee future performance.

The bottom line

Municipal bonds could not resist the gravitational pull of Treasury yields forever, and the recent selloff was an inevitable technical event, and not related to any municipal credit issues. While volatility related to interest rate increases may persist over the near term, this could create opportunities, especially in high-yield municipals, which have tended to outperform during certain periods of rising rates.