Fixed Income Q1 Survey 2023: Will the banking blip cause managers to change course?

This survey was conducted in mid-February, before the latest U.S. Federal Reserve (Fed) rate increase and the turmoil in financial markets triggered by the failure of several regional U.S. banks and of Swiss giant Credit Suisse. The latter caused uncertainty around the future direction of monetary policy to increase dramatically. Expectations in the survey are that the Fed funds rate will peak in Q2 2023, although some respondents expect no further tightening after Q1. In Europe, investors expect the European Central Bank (ECB) to increase rates further in 2023.

Latest:

- Managers have become less bearish on credit spreads with ~40% expecting spreads to be range-bound in the next 12 months. Managers see U.S. credit spreads approaching 137 basis points (bps) on average and euro credit spreads moving towards 155 bps for the year ahead. More managers are seeing investment grade (IG) corporate fundamentals weaken. That said, expectations of default remain relatively low.

- Respondents expect the U.S. dollar to be broadly unchanged to a slight strengthening vs. other G10 currencies by year end. The Japanese yen is considered the strongest developed market currency this year, followed by the Australian dollar. Investors also expect emerging market currencies to strengthen against the U.S. dollar with the Mexican peso and Brazilian real the outperformers by year end. In contrast, the Turkish lira and Argentinian peso are seen as the least attractive currencies.

- Inflation and the prospect of recession are the major concerns among managers. However, the perceived risk of stagflation has receded somewhat since the last survey. Managers are less concerned about the risks of a recession in Europe.

Recession risk remains, stagflation fears subside

Views from interest rates managers: Expected yield reversion

- The prospect of a global recession is the biggest concern among managers, to which they attach a 40% probability of materialising between 2023 and 2025. However, compared to the previous survey in Q4 2022, the perceived risk of stagflation over the next five years has declined. Survey participants expect the U.S. core personal consumption expenditure (PCE) measure of inflation to fall to 3% from 4% by year end, with a significant number seeing it drop below 3%; very few respondents expect it to be above 4% by year end.

- At the time of the survey close on 15th February participants expected the Fed funds rate to peak in Q2 2023 with the Fed delivering 50 bps more of rate hikes until then, although a significant proportion maintained pervious market expectations for Fed tightening to peak in Q1 2023.

- Regarding yields, most managers expect the 10-year U.S. Treasury yield to have already peaked for this cycle and anticipate U.S. 10-year yields will hover around the 3.25%-3.75% range, with the skew slightly tilted to the downside but with a floor at 3.00%. Most respondents also expect the decline in yields to favour a re-steepening of the U.S. curve over the next 12 months.

- In Europe, those surveyed expect the ECB to hike by a further 100-125bps in 2023. However, they see German 10-year bund yields remaining within the 2.25%-2.50% range, although there is a strong downside bias as some respondents see yields dropping as low as 1.50%. Core-periphery spreads are expected to remain stable or widen by year-end, with little consensus for spread tightening.

Views from IG credit managers.

- Investors are less bearish on credit spreads with ~40% expecting spreads to be range-bound in the next 12 months. Last quarter, 62% of managers surveyed expected spreads to widen vs. 39% this quarter. Respondents anticipate U.S. credit spreads moving towards 137 bps (on average), with euro credit spreads moving towards 155 bps for the year ahead.

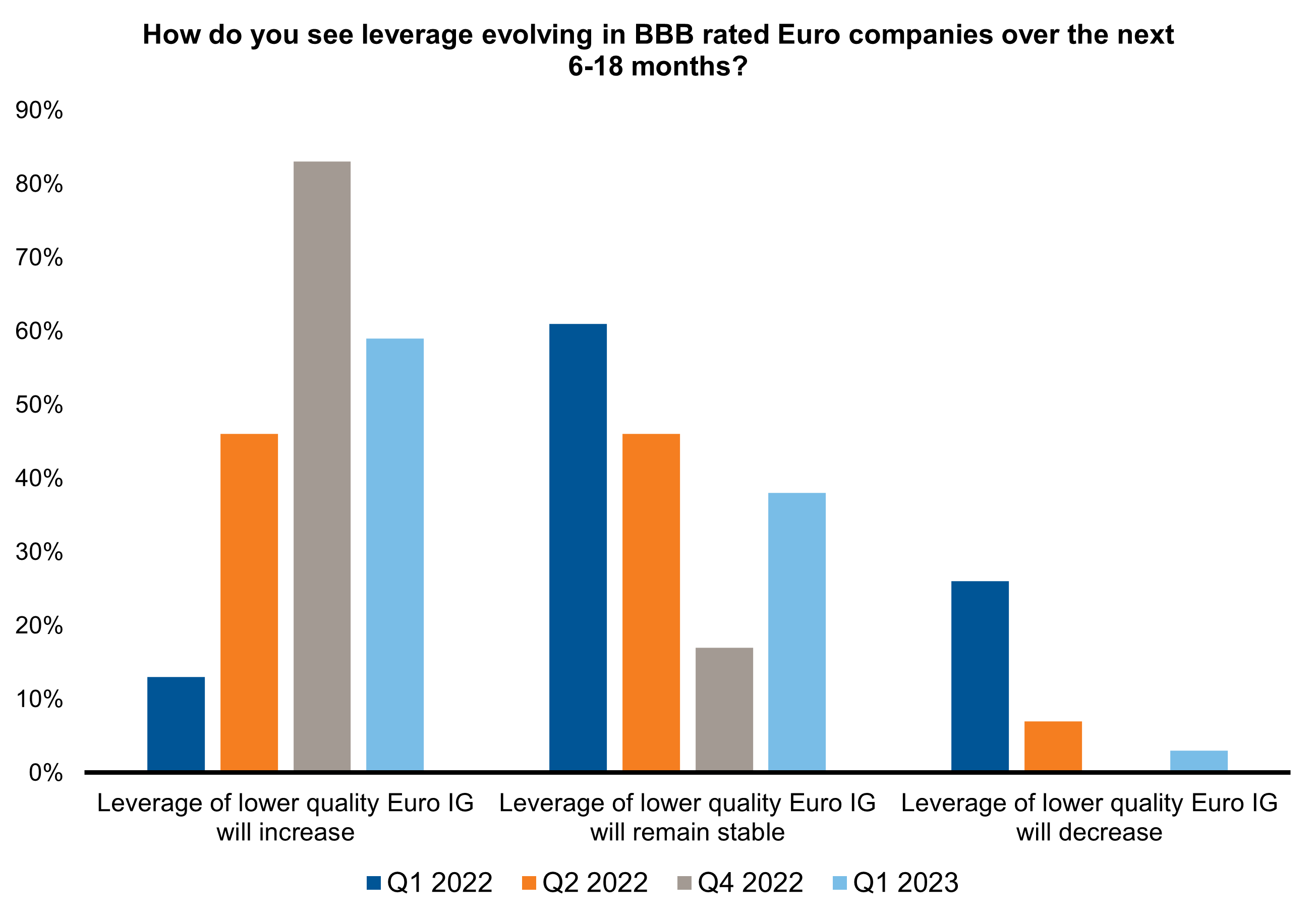

- 68% of those surveyed expect leverage of BBB-rated companies to increase vs. ~80% last quarter. Furthermore, 29% of managers expect leverage to remain stable in the next 12 months compared to 20% in the previous survey.

- Managers remain cautious around fundamentals for IG corporate credit. Most managers believe that current spreads somewhat compensate for potential risks (55%) with fewer managers either being outright comfortable or outright uncomfortable than last quarter.

- The biggest risk for IG credit markets is inflation remaining well above the Fed’s target, leading to a prolonged period of restrictive monetary policy, and ultimately a deep U.S. recession. However, managers are relatively untroubled by the risk of a recession in Europe.

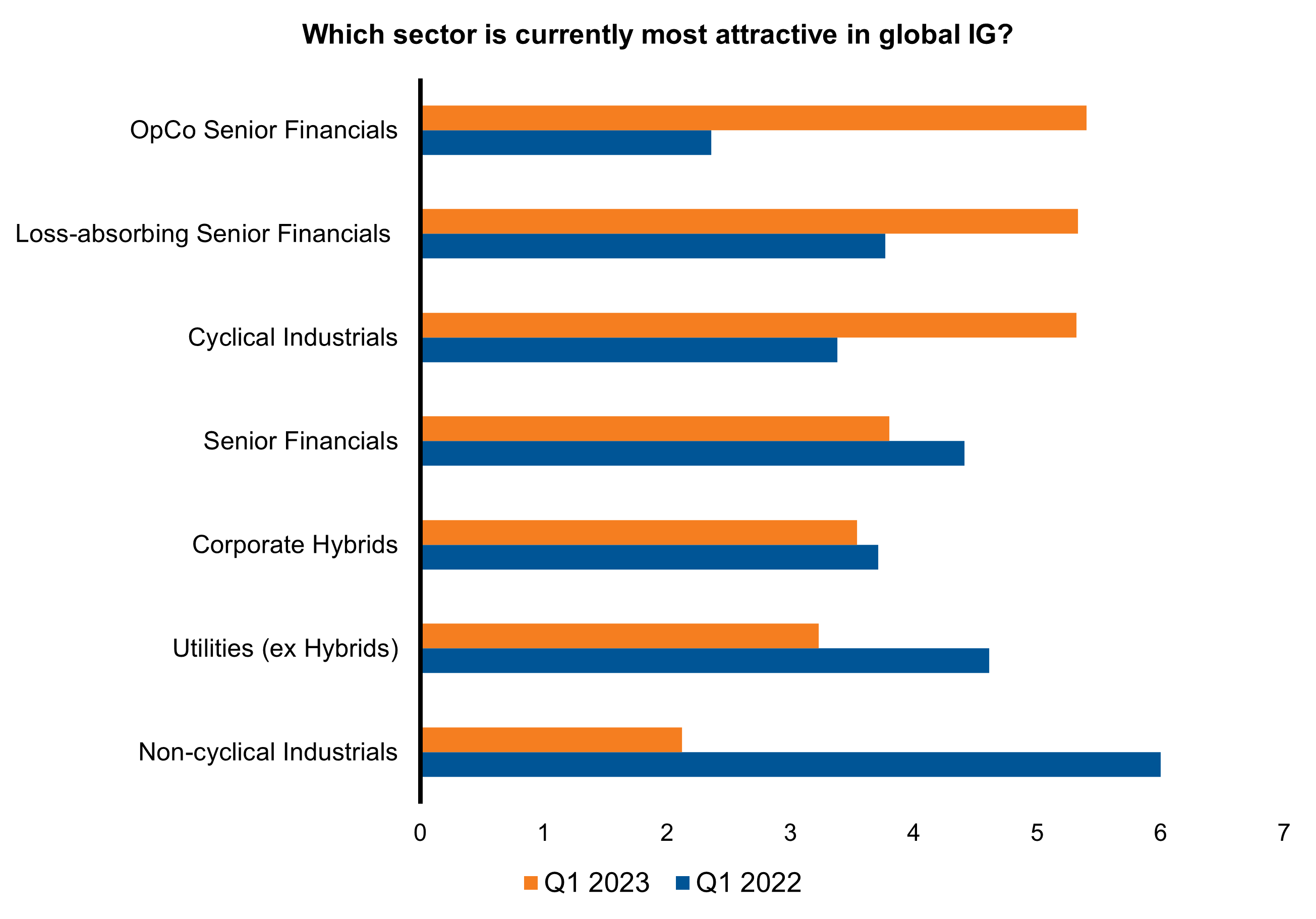

- Prior to the banking turmoil at the end of Q1, the survey showed managers saw sub-financials and loss-absorbing senior financials as the most attractive sectors for the next 12 months. But how will this view have been impacted with the repricing following Credit Suisse’s write down at AT1 bonds? We will be asking this question in the next survey.

Global leveraged credit

- The majority of respondents (80%) see a modest deterioration in corporate fundamentals and expect spreads to widen.

- Expectations of defaults remain relatively low for the next 12 months. 64% of those surveyed expect the default rate to be 3-5% for the coming year, compared to 70% in the last survey.

- While U.S. credit opportunities remain the most attractive, some participants see growing attraction in European high yield (HY) credit.

Risk across the globe

Emerging markets (EM)

- Respondents are more bullish on local currency emerging market debt (EMD) than hard currency EMD (77% vs. 22%) over the next 12 months, while over the next three years, the view is more balanced among local currency, hard currency, and corporate. Most survey participants have a positive view on emerging market currencies after a challenging 2022 and following a rebound in the U.S. dollar. As in the last survey, Latin American currencies are the top pick region over the next 12 months, particularly the Colombian peso, Brazilian real and Mexican peso. On the other hand, the Turkish lira continues to be the least favoured currency. The survey also shows that the stronger U.S. dollar is viewed as the biggest risk for EM local currency bonds.

- After two years of aggressive rate hikes by many emerging market central banks, investors consider the emerging market rates attractive as the overwhelming majority of participants forecast inflation will fall across emerging market countries. Inflation and higher U.S. Treasuries are also considered to be significant risk in local currency; however, risk of defaults among the 20 countries in the local currency EMD index is viewed as low. In terms of default, Turkey, Egypt, and Pakistan are considered at higher risk of debt restructuring, which may impact both local and hard currency indexes. Argentina, a country with a history of multiple defaults and debt restructuring, is also seen as being at risk, particularly as the debt-laden country has significant borrowing from the International Monetary Fund (IMF) and international bond holders.

- Expectations are for stronger emerging market currencies vs. the U.S. dollar, which are seen as increasingly likely to outperform compared to the previous survey, as well as for a fairly stable USD/CNY (Chinese yuan) – although with significant but balanced upside/downside risks after previous expectations for an orderly devaluation of 5% p.a. or less. In emerging markets, the Mexican peso and the Brazilian real are still seen as outperformers by year-end while the Turkish lira and the Argentinian peso are considered the least attractive with the latter replacing the Chinese yuan.

Developed market currencies

- Respondents expect the U.S. dollar to be broadly unchanged to slightly stronger vs. other G10 currencies by year end, with the EUR/USD exchange rate estimated at 1.10-1.15. This implies a stronger EUR compared to the previous quarter, but with a greater bias for a stronger USD testing and potentially breaking the parity with the EUR. Upside is seen to be limited to the 1.20-25 range. Similarly, the consensus view for GBP/USD is 1.20-1.25, pointing to a stronger pound sterling, but with prevailing downside risks concentrated around the 1.10-1.15 level and only modest potential upside towards 1.25-1.30.

- The Japanese yen is considered by survey participants to be the most promising developed market currency in 2023, followed by the Australian dollar. Compared to the previous quarter, the USD/JPY (Japanese yen) is expected to fall to 120-125 with some respondents seeing the pair even falling as low as 105, while upside risks are judged to be limited to 130-140.

- Respondents continue to see real interest rate and growth differentials as the key drivers of relative performance between currencies along with Purchase Power Parity and relative monetary policy considerations, albeit to a lesser extent. Implied volatility is expected to increase for both developed and emerging market currencies while correlations to equity markets are expected to remain very low or close to zero, with low yielding currencies continuing to be viewed largely as funding legs of carry trades rather than safe havens.

Securitised sectors

- In terms of overall risk appetite, the bulk of specialist managers (69%) prefer to maintain current risk levels amid ongoing uncertainty around commercial real estate, housing fundamentals, and potential deteriorating prospects for consumer balance sheets despite reasonably attractive spread levels and high absolute yields. Meanwhile, 19% of respondents will look to add risk in securitised credit in 2023 while 13% will opt to decrease risk.

- The favoured area (42% of respondents) for risk-taking currently looks to be in the legacy non-agency space. Here, securities are backed by residential mortgages issued before the global financial crisis. This means that the underlying housing collateral has well over a decade of home price appreciation built in along with increasing home equity, which provides a buffer against short-term housing market weakness. Elsewhere, investment managers remain positive on agency mortgage-backed securities after a challenging 2022, with 63% of respondents either already placed with a long mortgage basis position or the intention to add a long mortgage basis position in 2023.

- As commercial real estate markets continue to adapt to new post-Covid realities, investment managers have shifted away from conduit commercial mortgage-backed securities (CMBS) in favour of single asset, single borrower (SASB) CMBS where they have better clarity of the underlying collateral and greater ability to underwrite creditworthiness. The survey also revealed that 81% of respondents prefer to take idiosyncratic risk in SASB going forward.

The bottom line:

The big question is how much the banking crises in March will have affected the direction of travel of fixed income managers, especially after their bullish position on sub financials, which saw many beaten up by the turmoil. Once bitten twice shy? We look forward to seeing what our next survey says.