What is driving the demand for Fixed Income ETFs?

The ASX Exchange Traded Fund (ETF) Market Cap hit a new record high surpassing $100bn earlier this year, exhibiting huge growth over the last 12 months of approximately 80%. Within this universe we have seen strong demand for Australian Fixed Income ETFs as investors look to position portfolios more defensively.

Due to their simplicity and transparency, Fixed Income ETFs have been the tool of choice for portfolio rebalancing and risk management at the onset of COVID-19 helping investors navigate periods of low liquidity and high volatility.

In addition, there are a multitude of reason why investors are increasing exposure to Fixed Income ETFs. Firstly, for strategic asset allocation they can serve as a core component of a fixed income allocation providing attractive income and diversification benefits to investment portfolios. Secondly, on the tactical side they can play the role of a satellite exposure that also can be blended with traditional fixed interest strategies to produce a more balanced set of investment outcomes.

We are also seeing Fixed Income ETFs employed more frequently as part of liquidity management, being a complement to cash allowing an investor to vary the duration exposure, credit exposure and income levels in portfolios.

Other drivers of success are well known. Large denominations of up to $500,000 for some bonds create hurdles for retail investors seeking direct exposure to bond investments. Fixed Income ETFs overcome these by allowing investors opportunities to implement their ideas quickly and efficiently.

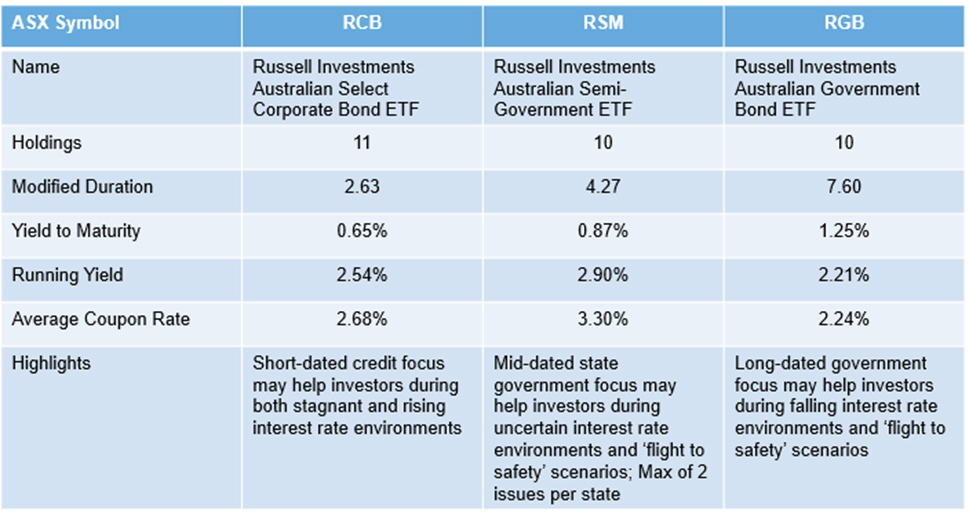

Click image to enlarge

Source: Russell Investments, 30 Jun 2021

Our outlook for rates and inflation

The key thematic that has played through markets over the last three months has been inflation, and the argument over whether the recent rise is temporary or not. The other question that many market participants are grappling with is the rise in government debt over the last twelve months – is this sustainable over the medium-term, and what are the implications for fixed income investors?

Starting with our outlook for inflation and future Reserve Bank of Australia (RBA) policy. We expect that the global spike in inflation is transitory, driven by base effects (i.e. very weak inflation last year leading to higher inflation this year) and some supply chain bottlenecks. We are starting to see some of the products that saw significant price rises earlier in the year come back, including lumber and chip prices. In Australia, we are due to get the inflation reading for Q2 2021 in the coming weeks which will show a significant jump for the reasons mentioned above.

There have been a growing number of anecdotes about wage increases, both here and abroad. However, we do not expect that this will lead to broad-based wage pressures over the next twelve months. Firstly, despite the very strong improvement in the labour market, there is still some spare capacity to be absorbed. Without getting into too much economic jargon, for broad-based wage pressures we think the unemployment rate has to be in the low 4% range – the current estimate of the natural rate of unemployment. Given the unemployment rate is currently at 5.1%, we still have some way to go before reaching that level. There is also the re-opening of the borders sometime next year, which will add to the capacity of the domestic labour market as foreign workers return.

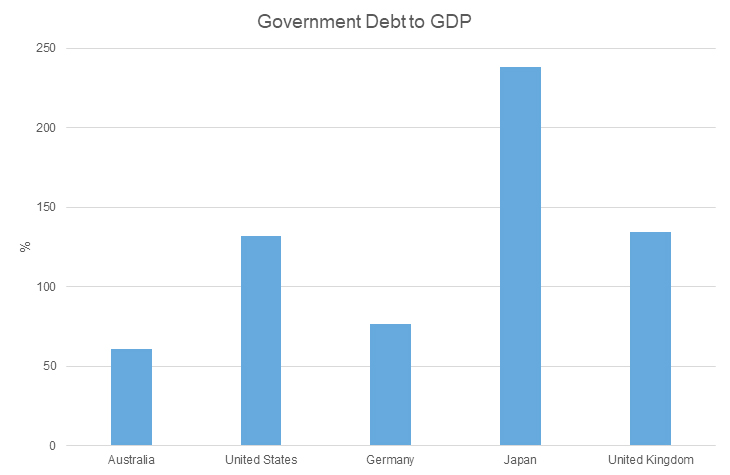

Click image to enlarge

Source: Russell Investments, Refinitiv Datastream, 30 Jun 2021

What does this mean for the RBA? We think that the RBA are unlikely to raise the cash rate until the second half of 2023. The RBA are very focused on providing support to the labour market and would like to see wage growth sustainably above 3% - which would be consistent with inflation sustainably within their target range of 2-3%. We think this hurdle is going to be difficult to achieve before the end of 2022. We do, however, expect that the RBA will continue to taper their bond purchase program through next year.

Finally, the increase in government debt. Federal net debt is expected to peak at 40.9% of GDP1 in a couple of years – which is quite low compared to other developed economies. The recent State government budgets have shown similar increases, while corporates have also seen an increase in their debt loads over the past year. As noted above, both State government and corporate debt have a lower duration than Federal debt, and so are relatively less sensitive to increases in interest rates compared to Federal debt. We don’t think that this increase in debt should concern investors in the nearer term, given how low interest rates are and the strong outlook for economic growth over the next 1-2 years. On a related note, we don’t expect that the Federal or State governments will become overly concerned with the increase in government debt and implement forms of budget repair, given their focus on ensuring the economy was supported through COVID and the Federal governments focus on getting the unemployment rate below 4.5%.

Click image to enlarge

Source: Russell Investments, Refinitiv Datastream, 30 Jun 2021

ETF Innovation

Investors are starting to demand more specific exposures through ETFs such as different maturity buckets across the yield curve or different types of credit. This desire for more precise exposures has led to an increase in Bond ETF launches.

This ability to reflect an investment view by taking a position on credit or duration is an interesting dynamic and it is becoming more apparent that one ETF cannot provide everything an investor needs. As investors become more focused on fixed income buckets more specific solutions and products can help.

Russell Investments’ suite of ETFs fit well into this new landscape with the duration of our Corporate Bond ETF RCB being 2.6 years moving to Semi Government ETF RSM at 4.2 years and then Government Bond ETF RGB at 7.5 years. Our ETFs can be blended so that Government bonds with the least credit risk provide the longer duration exposure and as you increase the level of credit risk you shorten the duration of the strategy as is the case with RCB.

Moving forward we see scope for significant further innovation in the Fixed Income ETF landscape particularly in areas like Environmental Social and Governance (ESG) and factor investing.