Should you be “inflation-proofing” your portfolios?

As global vaccination rates continue to climb and the pandemic appears to wane, there’s seemingly a new worry in town—inflation. Developed countries around the world have seen significant spikes in inflationary data in recent months. Although we believe this increase is mostly transitory1, your clients might be wondering how this can affect their retirement nest egg. Since inflation has been relatively benign over the last decade, investors may have forgotten just how detrimental its impact can be on their investment returns, especially in the decumulation phase of retirement.

This begs the question—should you be “inflation-proofing” your clients’ portfolios?

Building all-weather portfolios is not what it used to be. Think about how a typical 60% equities/40% fixed income balanced portfolio has evolved over the last 20, or even 10 years. Gone are the days where diversification meant buying government bonds and North American equities. This alone was generally enough to achieve the level of return that most investors needed to outpace inflation and grow their portfolio. However, these days, meeting an adequate risk-adjusted return2—in the face of potentially higher inflation—requires stepping out of the box and considering alternative investment vehicles such as real assets.

Inflation can mean different things to different asset classes

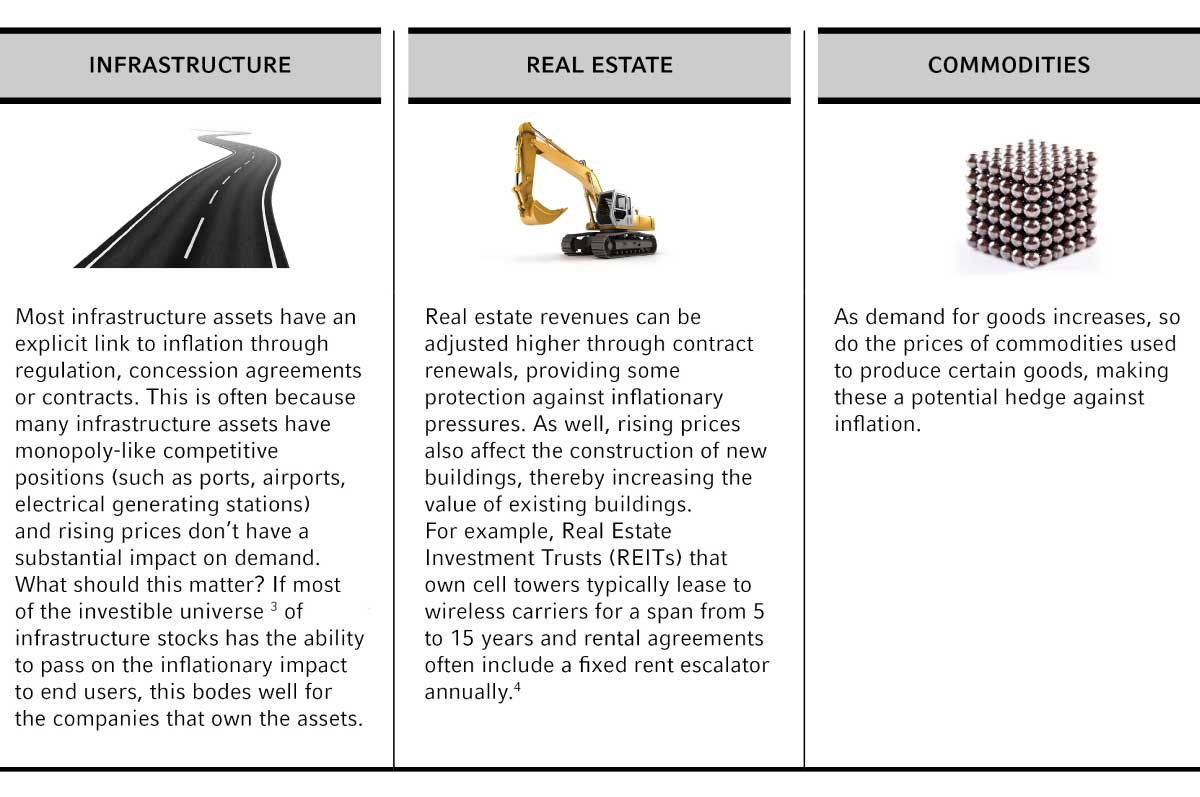

Non-traditional equities:

When it comes to equities, we know how the addition of certain non-traditional asset classes can not only enhance the potential for greater returns and help protect on the downside, but also act as an inflationary hedge. Let’s dig deeper into some of these categories:

Click image to enlarge

Traditional equities:

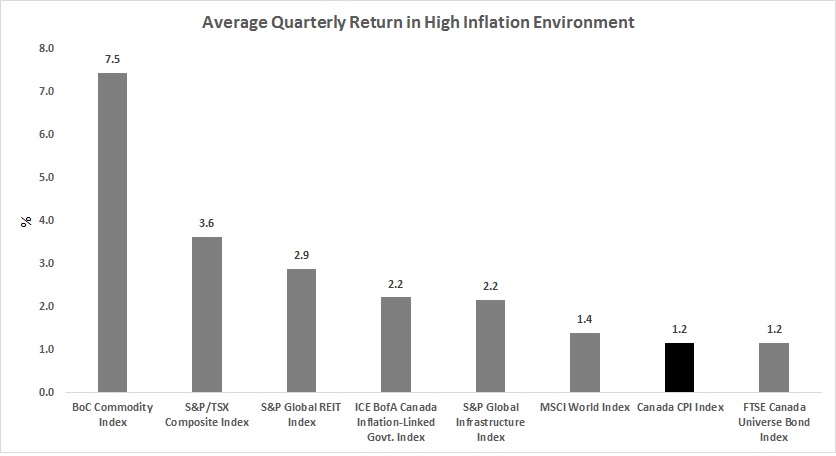

Now that we have highlighted how owning non-traditional stocks can help improve client outcomes in inflationary periods, how do traditional equities fare? The truth is investors have greatly benefited from owning stocks over the last decade and it can be hard to change a winning strategy. As Warren Buffett has famously said, when things perform well—remember inflation.

Click image to enlarge

Click image to enlarge

Source: Refinitiv DataStream, Russell Investments. All returns in CAD. High inflation defined as when CPI is greater than 0.7% for a given quarter. This analysis looked at the average quarterly returns and determined which quarters met the definition of high inflation environment from 12/31/1993 to 7/31/2021.

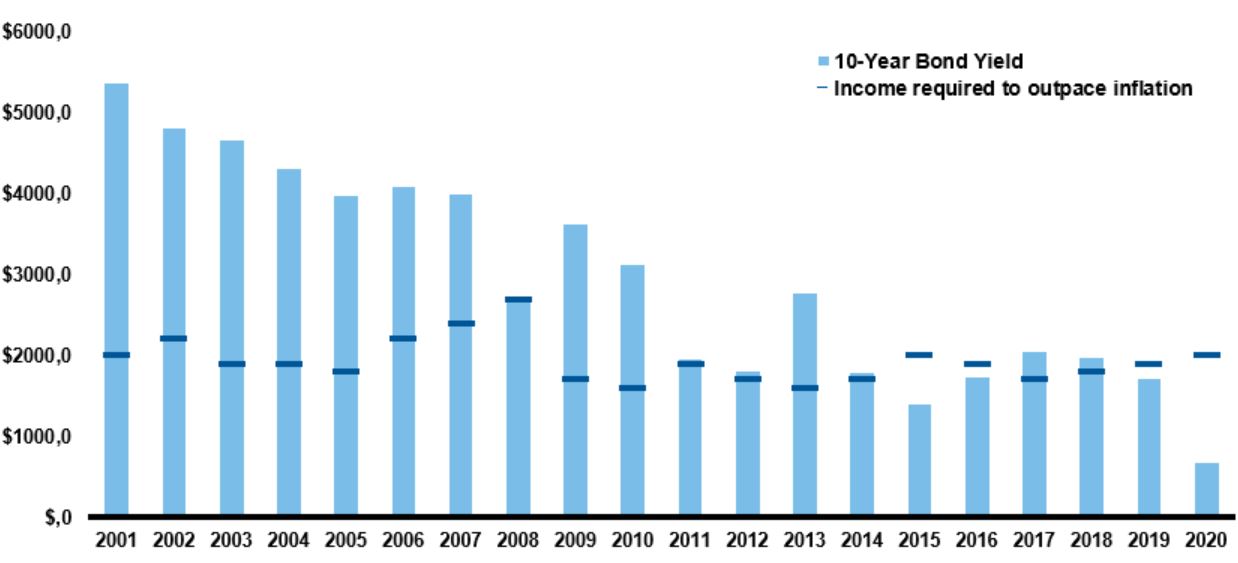

Fixed Income

With interest rates so low, it doesn’t take much for inflation to eat at any potential return that bonds may offer, and then some. And although it may be tempting to rush into inflation-linked bonds4 or chase some higher-yielding securities, or even abandon ship and flock to equities, it is also critical to keep in mind the diversifying role that bonds play in your client portfolios.

Income generated by $100,000 bond portfolio

Click image to enlarge

As of December 31, 2020. Source: Bloomberg, Bank of Canada. YIeld is based on Canada 10-Year Government Bond yield. Inflation is based on CPI median.

At Russell Investments, real assets are not new to the investment toolbox. In a world where interest rates have remained low, investors continue to clamor for yield, and we believe that real estate, infrastructure and commodities can potentially provide that yield.

Looking at institutional clients and some of the world’s largest pension plans can offer good insight into asset allocation trends. The Canada Pension Plan (CPP) for example, has slowly increased its allocation to real assets over time, and currently holds more than 21% in global infrastructure, real estate, and other real assets5. Hedging against inflation is just one of many benefits real assets can add to your client portfolios.

1 https://russellinvestments.com/ca/global-market-outlook

2 Risk-adjusted returns is a concept that is used to measure an investment’s return by examining how much risk is taken in obtaining the return.

4 Inflation-linked bonds are securities designed to help protect investors from inflation. Primarily issued by government entities, ILBs are indexed to inflation so that the principal and interest payments rise and fall with the rate of inflation.