A closer look at the (mis)behavior in markets

The virus and associated government containment efforts have turned off entire industries and driven an unprecedentedly sharp slowdown in the U.S. and global economy. Financial markets have been very volatile as investors (unsuccessfully) try to think through the likely contours of the virus—as we’ve written about before, these epidemiological models aren’t very accurate. The situation in New York appears worse than models previously anticipated. But Italy and Germany may be within days of hitting a peak in new confirmed cases. And Erik Ristuben wrote yesterday about how China is carefully trying to come back online again.

Which areas of the market are seeing signs of recovery?

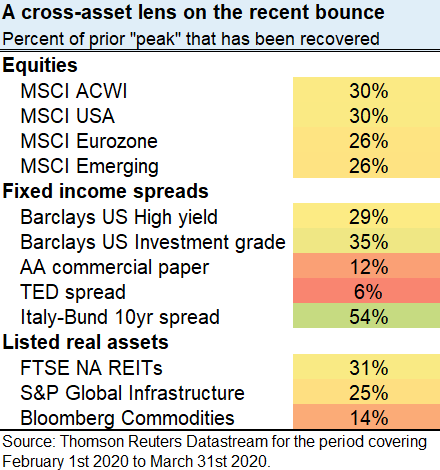

What has definitely changed globally is the policy response to this pandemic. The combined support from fiscal and monetary authorities around the world has helped drive a partial compression in risk premia. Below is a quick snapshot of the percentage of peak-trough losses various areas of the market had recovered by the end of March (yesterday’s close).1

Click image to expand

Italian government bonds, U.S. corporate bonds experiencing stronger recovery

Two of the stronger recoveries have occurred in Italian government bond spreads and United States investment-grade corporate bond spreads. I’ll briefly discuss each of those.

Italy was initially one of the hardest-hit developed market economies by COVID-19. Its older population profile made the virus much more dangerous in the aggregate. And Italy came into this episode with one of the more unsustainable long-term debt trajectories in the developed world.

But the good news for Italy has been twofold. First, a protracted and painful containment effort appears to have gained some traction. The number of new confirmed coronavirus cases in Italy has been edging down slightly for the last four days. It’s far too early to declare victory, but definitely an incremental improvement. Second, the European Central Bank launched its 750 billion euro Pandemic Emergency Purchase Program (PEPP) in mid-March, which ramped up the buying of Italian (and other) government bonds. Central bankers committing to buy at almost any price can serve as an effective backstop in volatile markets.

On the other side of the Atlantic, investment-grade corporate bond spreads compressed by roughly 100 basis points in the United States from March 23 to March 31. What happened on March 23? Well, the Federal Reserve (the Fed) announced a number of new emergency facilities, including the so-called Primary and Secondary Market Corporate Credit Facilities. With a combined $20 billion in equity capital from the U.S. Treasury department, these facilities are scheduled to buy $200 billion in investment-grade corporate bonds. Again, a non-economic buyer stepping in to backstop the cost of financing.

A wide range of U.S. corporate securities have benefited further from the $2 trillion fiscal stimulus package that was passed last Friday. Airlines will receive a bailout. Small businesses will have access to $350 billion in forgivable loans if they keep their workforce employed. And roughly 50% of the high-yield market looks likely to be able to access a soon-to-be-unveiled mid-sized business program at the Fed, where companies that satisfy certain lending conditions will be able to borrow from banks at a below-market, 2% interest rate. The support has been strongest for the investment-grade market where the Fed is buying the securities directly, but the benefits have rippled out more broadly as well.

The bottom line

Big picture: we don’t know what is going to happen with the coronavirus tomorrow, or next week or next month. But areas of the global market that have demonstrated some success from their containment efforts and/or areas that have very strong policy support have showed some incremental improvement here. Today’s selloff makes it clear that we are by no measure out of the woods yet. But we’re encouraged that some of the preconditions for an eventual recovery are falling into place.

1 This table is just one of many ways that an investor can quantify the extent of recovery following a market selloff. Using investment grade as an example, spreads have compressed nearly 100 basis points from March 23 to March 31. That represents a 35% recovery of the peak-trough 283 basis point spread widening from February 19 to March 23. 100 divided by 283 gives us the 35% shown in the table.