Is China coming back with a bang?

Executive summary:

- Chinese equities are extremely cheap and priced for bad news. We believe this environment may present opportunities for active managers.

- Valuation-focused and contrarian, opportunistic managers are rotating into China, focusing on beaten-down internet platforms and domestic consumer-oriented plays within travel, tourism and premium domestic brands linked to discretionary spending.

- Some active managers believe that the political leadership's focus on the economy and stock market could be the catalyst for a potential turnaround.

Is China coming back with a bang?

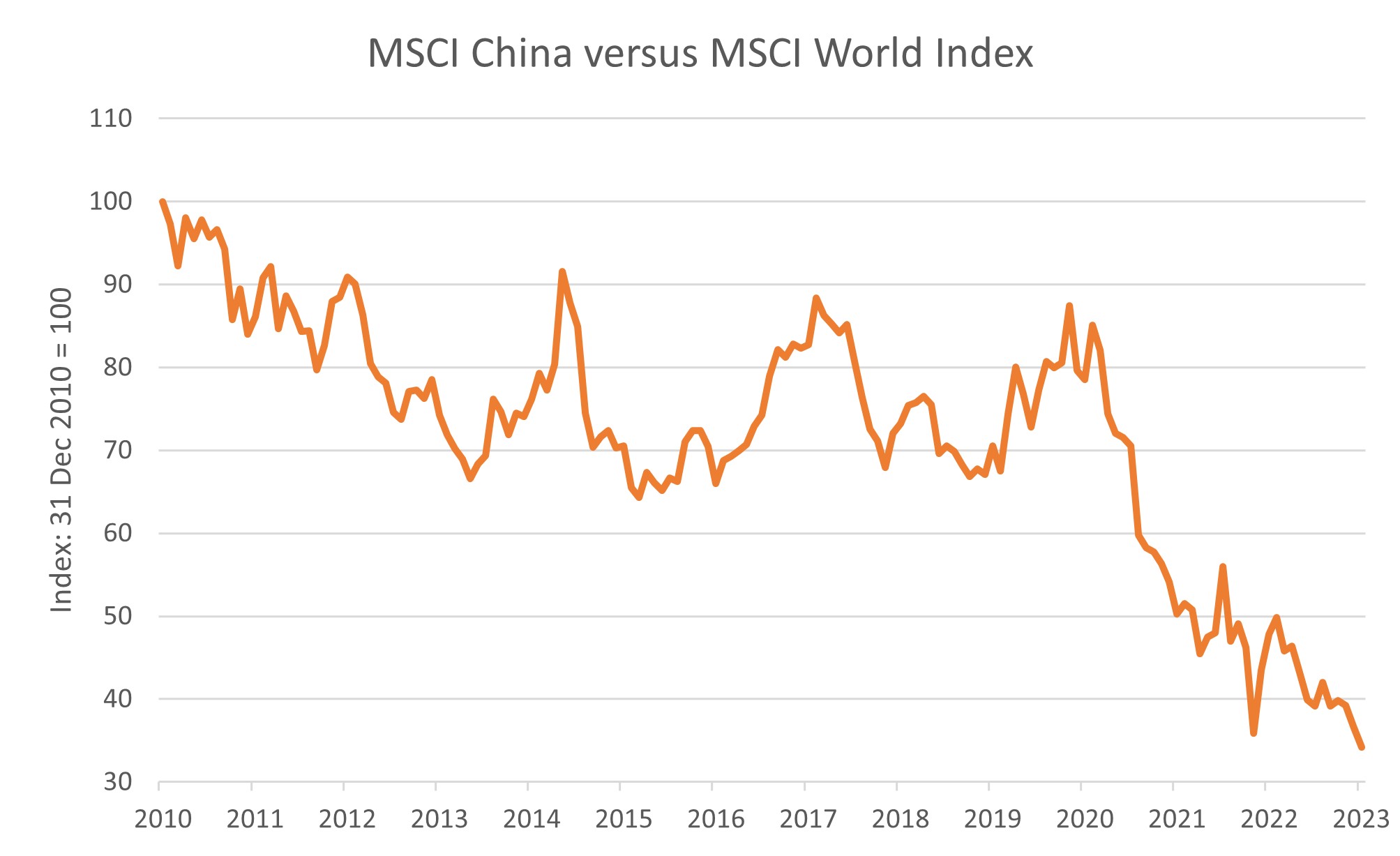

Chinese equities were one of the bigger laggards of 2023, with the MSCI China Index down 11% while the MSCI All Country World Index was up 23%. Taking a longer time horizon, Chinese equities (using the MSCI China Index) have underperformed developed market equities (using the MSCI World Index) by 65% since the end of 2010.

The Chinese economy limped through the second half of 2023, after a brisk reopening in the first quarter. The headwinds of a struggling property market and cautious consumer remain in place, but in the last three months, we have seen the Chinese government respond with an increased focus on fiscal stimulus.

Currently, Chinese equities are extremely cheap and are priced for a lot of bad news. Amid this backdrop, we think that active management in China could be a key beneficiary this year.

Source: MSCI World Index, MSCI China Index

Cycle, valuation and sentiment: Assessing the outlook for Chinese equities

At Russell Investments, we analyze markets through our investment framework of cycle, valuation and sentiment. Let's kick off with a look at the business cycle.

We expect the Chinese economy will achieve reasonable economic growth of around 4.5-5.0% in 2024. This growth will likely be powered by government spending (led by further stimulus measures) and a stronger credit impulse, with some gradual improvement in consumer confidence and consumer spending. We believe that recession risks remain elevated in the Northern Hemisphere, which limits the ability of exports to provide a great deal of support. This should mean that corporate earnings will be decent, although margins may come under some pressure if inflation remains very muted and producer prices accelerate. Additionally, consensus earnings estimates are currently at 18% for 2024, which does seem a bit optimistic.

The key watchpoints over the coming months will be the Two Sessions meeting in March, where the government will likely announce its official growth target, and the potential for more stimulus measures for the real economy. The other big watchpoint as we go through the year will be the U.S. election in November, and any potential changes in U.S. policy toward China.

Next, let's shift our attention to valuation.

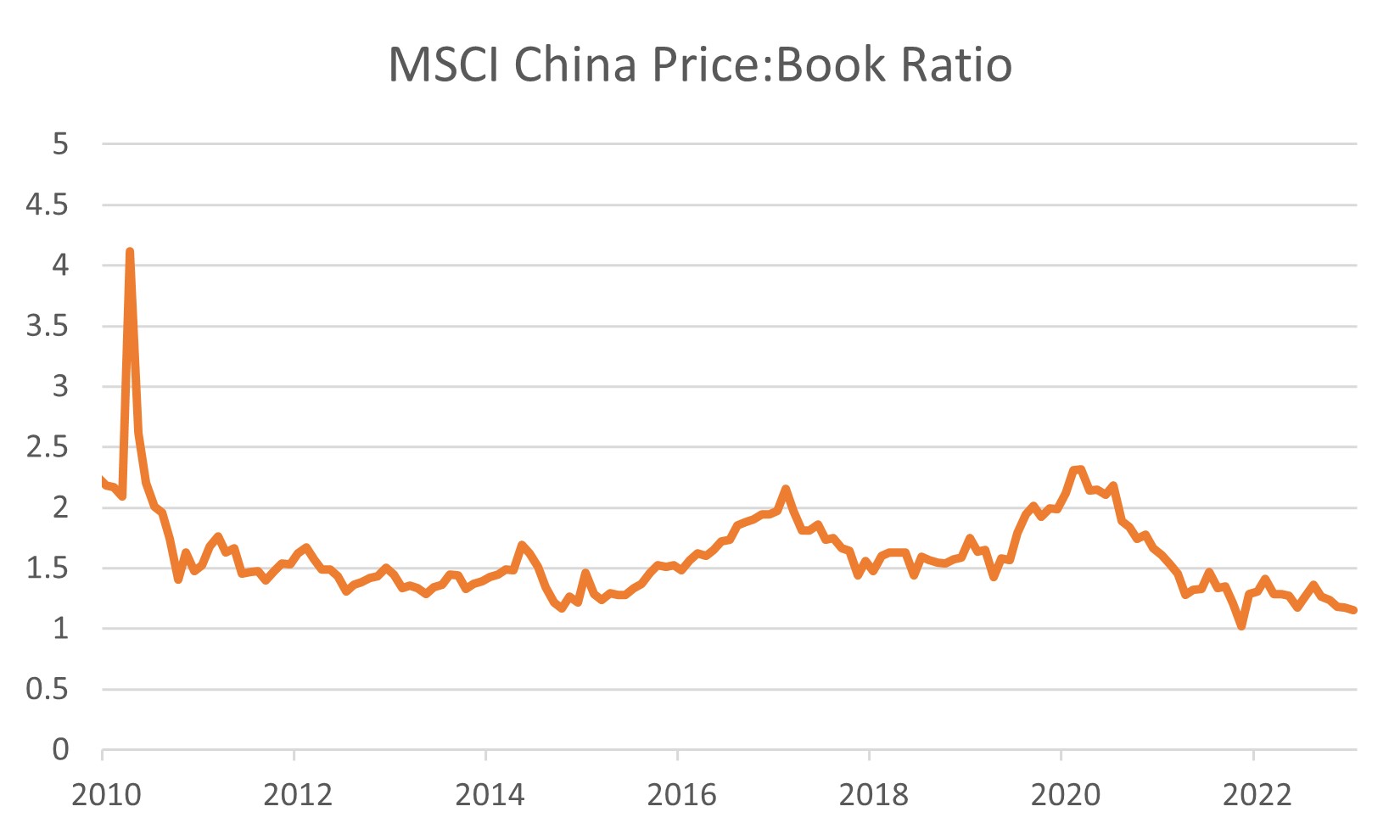

Chinese equities are extremely cheap right now, with the MSCI China Index trading at a price-to-book ratio only marginally above 1. Forward price-to-earnings multiples are currently less than 10 times, compared to developed world equities at 18 times. Because of this, we believe Chinese equities offer attractive valuations.

Source: MSCI Index

Finally, let's wrap up with sentiment. At Russell Investments, we've created a proprietary measure that looks at Chinese equities relative to global equities on a panic/euphoria spectrum. This model incorporates technical and positioning measures, including margin debt, implied volatility and relative strength indices. We have seen some indications of panic in recent months, suggesting that the market is increasingly cautious and underweight. Anecdotally, this characterization of the sentiment toward China seems appropriate. We have seen several articles this year with comments from asset managers highlighting the opportunities in Chinese equities, so we have not fully reached the level of capitulation.

Where do managers see opportunities in China?

Across active management, we've seen managers that have been previously underweight China (in 2021 and most of 2022) rotating into China as the market continues to sell off. We are now seeing valuation-focused managers, as well as contrarian, opportunistic managers buying into China on the back of what managers refer to as "historically attractive, GFC-like valuations." Managers are focusing on beaten-down internet platforms, which have seen strong compression of multiples over the past three years, as well as domestic consumer-oriented plays within travel, tourism and premium domestic brands linked to discretionary spending. These names have been widely ignored altogether on the back of the slower-than-expected economic recovery.

The bottom line

So far this year, we've seen more measures introduced by the Chinese government with the aim of stimulating the economy and instilling confidence in the broader market –developments which have been welcomed by some investors. While the measures are still being fleshed out, what probably matters more to investors is that the economy and the stock market are now top-of-mind for the political leadership in China. Ultimately, this is seen by some active managers as a clear shift in the political agenda and a positive catalyst for a potential turnaround.