Harmonizing DB and DC: Part two - Investments

It’s time to face the music: The investment approaches driving your organization’s DB and DC plans should be harmonized.

In part one, we detailed the benefits of a unified governance approach to both plans. In part two, we make the case why it’s equally important to harmonize the types of investment in both plans.

DC plans and the perils of a single-manager structure

Virtually every DB plan uses multiple investment managers. It’s widely accepted that no single organization offers proprietary solutions that are best-in-class across all asset categories—and that such a bundled approach would significantly increase manager risk should anything happen to that manager. Even within asset classes, there’s typically a meaningful benefit to manager diversification: Managers have different styles (e.g., value, growth), their individual approaches may go in and out of favor with the markets and sometimes, managers just don't meet expectations.

When it comes to DC plans, however, this often isn’t the case. Instead, DC plan menus are typically populated with many products offered by their recordkeepers, or with asset class options comprised of solo managers.

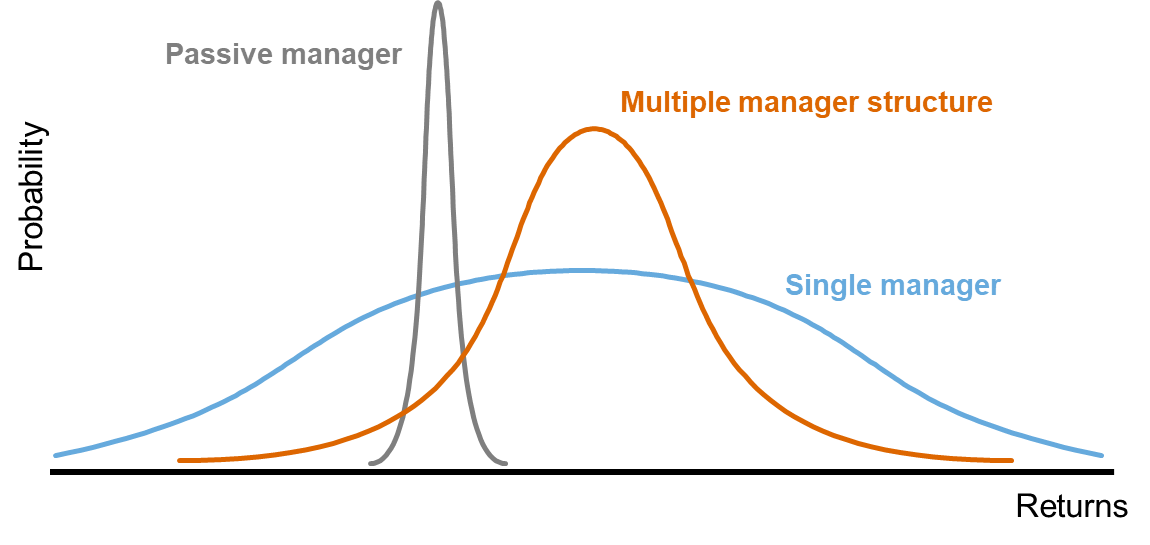

The chart below provides an illustration of potential manager outcomes when using a passive manager, a single manager or a multiple-manager structure. For example, a single active manager and a combination of multiple managers may be expected to have the same average outcome. However, the multiple-manager structure has a narrower distribution of results, and is typically viewed as more favorable, with less uncertainty and tail risk.

Chart 1: Investment approaches matter - Expected distribution of returns. Click to enlarge.

Image shown for illustrative purposes only and is not meant to represent any actual results.

With this in mind, we believe that DC plans that fit the single-manager profile should be clear about why they are using this approach. Specifically, plans should be able to address why they are exposing DC plan participants to idiosyncratic single-manager risks—particularly if the plan sponsor is diversifying across multiple managers in its DB plan.

Choice of investment vehicles

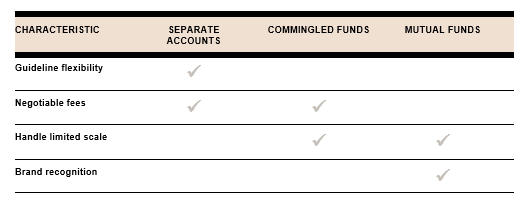

Plan sponsors also have choice in how to implement investment exposures within their DB and DC plans. They may take an institutional approach using separate accounts and certain commingled funds (e.g., collective investment trusts), or they can adopt a more retail approach using mutual funds. As highlighted in the graph below, each investment vehicle has unique characteristics.

Chart 2: Consider investment vehicle characteristics. Click to enlarge.

Plans with the scale and resources to negotiate fees might want to avoid mutual funds. In contrast, those with lower levels of assets might find it difficult to use separate accounts.

In practice, we see that many plan sponsors favor separate accounts or equivalent institutional commingled funds in their DB plans, yet they continue to use mutual funds in their DC plans. Mutual funds may have wide appeal for brand recognition, but does this characteristic really provide a greater chance of meeting the plan's ultimate goal of providing retirement income for participants?

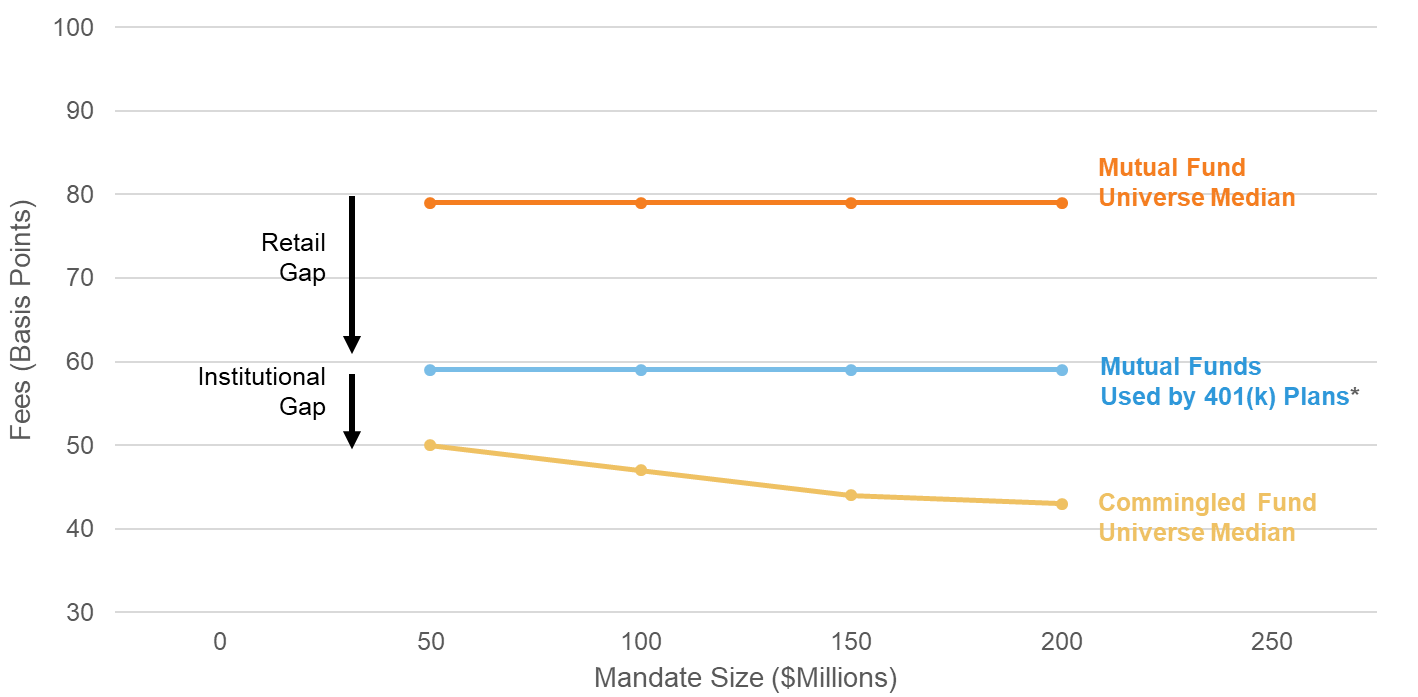

These decisions are important. They can have a material impact on fees, as demonstrated in chart 3, which illustrates typical U.S. equity fees. Mutual funds usually entail higher fees, even for DC plans, where fees tend to be a little more cost-effective than in the mutual fund universe as a whole. Note that the management fee line is flat across all mandate sizes, because mutual funds must charge the same fee for all investors in the fund, or at least those in the same share class.

Chart 3: Product structure and fees matter – U.S. equity fees. Click to enlarge

Source: Investment Company Institute, 2018 Fact Book (Domestic Stock, Asset-Weighted Average).

eVestment, LLC, March 2019 (US Large Cap Core Equity) unless otherwise noted

Separate accounts and institutional commingled funds typically offer plan sponsors a way to reduce costs. Aside from general negotiability, tiered pricing schedules also offer the potential for even lower fees as assets with a provider grow. This may be achieved via the aggregation of equivalent mandates across DB and DC plans with common providers, or simply through the organic growth of the assets over time.

The importance of fees

Remember: Fees matter. The prospects of outperforming on a net-of-fee basis in, say, U.S. equities, are not as appealing if the fee is 90 basis points a year—especially relative to a scenario where the fee may be half that.

At the end of the day, plan sponsors should consider their approaches to choosing investment vehicles for both their DB and their DC plans and seek alignment between them, unless they have a defensible reason to do otherwise. We realize that plan sponsors may have taken different approaches in their DC plans because of the historical prevalence of the bundled fee model, even though it’s a model that is increasingly unwinding in the current drive toward increased transparency and fee disclosures.

Nevertheless, if we look at the largest DC target date fund providers in terms of assets, it's not surprising to see that most of them are also recordkeepers. Plan sponsors using such solutions should assure themselves that they are exposing their participants to best-in-class investment options, and not simply assuming that strong administrative skills translate to equivalent investment capabilities. Furthermore, no single organization's proprietary products are best at everything. In fact, a 2013 Department of Labor tip sheet explicitly suggested that plan sponsors should evaluate non-proprietary and custom target date options.[i]

A harmonized perspective

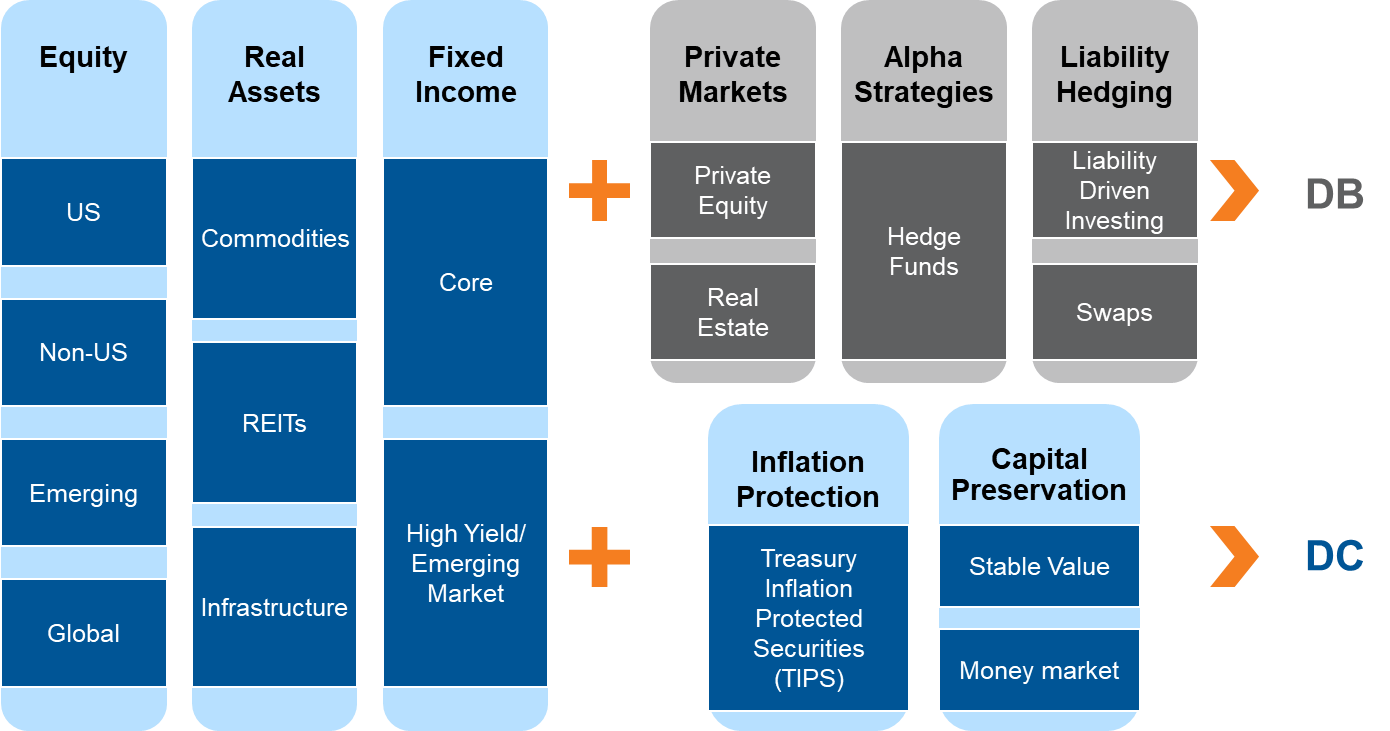

While DB and DC plans may have separate and distinct objectives that necessitate certain structural differences and requirements, they can and should be guided by consistent investment beliefs and principles. In addition, there is potential to leverage common asset class exposures across plan types, while allowing unique exposures to persist.

The asset classes grouped at left in chart 4 often play a similar role in both DB and DC plans, where the approaches could be similar, if not the same, across plans.

Chart 4: A harmonized perspective to DB and DC plan investing. Click to enlarge

For example, the U.S. equity option offered to participants within a DC plan could be broadly consistent with the U.S. equity asset-class structure embedded within a DB plan—and potentially even use the same investment vehicles, bundled and offered as a single multiple-manager option to DC plan participants. At the least, it’s critical to identify the overlapping needs and do what’s necessary to harmonize investment approaches in those areas. Such harmonization would include seeking more consistency across plans regarding the use of multiple managers, the blend of active and passive and the type of investment vehicles used.

Again, the approaches taken across DB and DC plans do not need to be in unison. But what is the basis for doing something completely different?

Bottom line

When it comes to DB and DC plans, it’s imperative to apply your best thinking across both plans in accordance with your investment beliefs. Harmonizing your investment approach may lead to improved outcomes and a more defensible fiduciary position. And that’s music to everyone’s ears.

1 U.S. Department of Labor (2013), “Target Date Retirement Funds – Tips for ERISA Plan Fiduciaries.”

Available at https://www.dol.gov/sites/dolgov/files/ebsa/about-ebsa/our-activities/resource-center/fact-sheets/target-date-retirement-funds.pdf