Personalized Managed Accounts: A tax-managed transition

Investors who have accumulated substantial wealth by successfully investing in a handful of stocks or those who have stock from an employer that becomes fully vested may feel they can’t diversify without taking on a significant tax burden. While they may understand the perils of concentration risk and acknowledge the benefits of diversification, once a portfolio has significant unrealized gains, investors can often feel stuck. This can be a great opportunity to provide valuable guidance.

Give your clients a structured and well-developed plan to reposition a portfolio by running a transition analysis. This can be a powerful tool to help your clients understand how to migrate a concentrated or unmanaged portfolio to a customized and diversified investment strategy such as a separately managed account (SMA) while managing the related tax burden. Since an investor who holds a personalized SMA owns the individual securities, instead of needing to sell all of them to buy a complete portfolio—as you would if purchasing a mutual fund or exchange-traded fund (ETF)—securities can be transferred in-kind and maintained in the portfolio, avoiding realized gains that would trigger capital gains taxes.

Personalizing the transition: The timeline transition versus the tax-budget transition

This raises the question of what’s more important: Prioritize risk management and transition a portfolio in a timely manner, or prioritize tax management and transition a portfolio in a tax-conscious manner?

- The first approach, the timeline transition, allows investors to control the length of time over which the transition to the desired portfolio occurs. However, they will have less control over the tax consequences. In this approach, the tax-sensitivity of the transition will be dictated by the number of years allotted for the transition and the market environment. The taxes are spread out, but depending on the market, could result in a higher tax bill than with the tax-budget approach.

- The second approach, the tax-budget transition, allows an investor to provide an annual budget for capital gains taxes that must not be exceeded. With this approach, the timeline of the transition will depend on the size of the annual tax budget and the embedded gains in the portfolio. Lower embedded gains with larger tax budgets will have shorter transition horizons. Portfolios with higher embedded gains and low annual tax budgets typically require longer horizons. The budget can be specified either in terms of capital gains to be realized (for example, $10,000 in capital gains per year) or an estimated tax from capital gains (for example, $2,500 in taxes from capital gains per year).

The choice between using a timeline transition or tax-budget transition will depend on the client’s preference: If the client has a stronger desire to control the amount of taxes generated each year, then they may want to consider a tax-budget transition; If the client prefers to control the time it takes to transition to the target portfolio but also wants to spread taxes across multiple years, then they may want to consider the timeline approach.

Transition scenarios

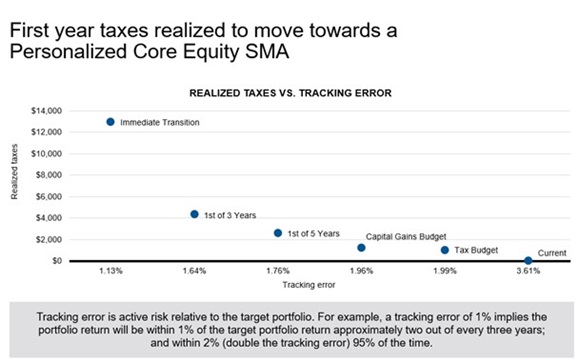

Once the new investment strategy is identified based on a client’s investment goals, objectives and risk tolerance, we can do an analysis into the process of transitioning the existing portfolio. Providing the client with the different options available can give them a greater sense of ownership over the decision and may help them be comfortable moving forward with a plan. As their advisor, your role is to provide guidance, and performing a transition analysis can help them choose how they want the transition to be made. When laid out on one page, a transition analysis can show the first-year implications of the various transition options. This can be of tremendous value.

The amount of taxes paid can vary greatly depending on the chosen path of transition. Intuitively, executing an immediate transition and repositioning an existing portfolio to a new strategy could generate a large tax liability. But when a little more precision is employed and a tax-aware approach is taken, that tax liability can be reduced. And if the transition is spread out over three or five years, the tax liability can be easier to digest over time.

If the tax budget and limiting capital gains in any given year is a priority, it may take longer to complete the transition plan. The tradeoff for that control over taxes is that the portfolio may not perform perfectly in-line with the newly targeted investment strategy.

Assessing potential taxes from changing strategies

Let’s say the client’s goal is to obtain S&P 500® Index-like performance. We then need to examine how closely the portfolio tracks the S&P 500 during the transitional phase. Tracking error is a useful measure to assess the potential performance deviation between the return an investor receives and that of the targeted benchmark. A sample portfolio in the exhibit below has a tracking error of 3.01%, which is quite high given the objective of tracking the S&P 500. To meet the objective, the portfolio should be repositioned to a lower tracking error target, while considering potential tax consequences. Each point on the curve below shows the lowest tax-cost solution for each tracking error level.

For illustrative purposes only. The simulations are hypothetical in nature and implemented using a tax minimization algorithm. Actual client experience may be different from the data presented. Assumes a portfolio of $662,096 with a federal income tax rate of 40.8% and a long-term capital gains rate of 23.8%.

The pattern in this exhibit is typical of an appreciated portfolio: the cost to move the portfolio closer to the target (in this case, the S&P 500 Index) increases inversely with tracking error. When the different paths of timeline transitions and tax-budget transitions are clearly presented and compared, it can enhance the decision-making process. In the example above, an immediate transition will significantly reduce the tracking error of the portfolio but also comes with the highest tax cost. Here the timeline approach appears to help reduce tracking error while spreading the tax liability over a three- or five-year period. However, if controlling taxes is a priority, then the client’s portfolio performance will have greater deviation relative to its target (again, the S&P 500 Index) and could potentially take longer to fully transition.

Know what you’ll own

Severing ties with long-held stocks can be an emotional decision for a client. Most difficult decisions can be made with a little bit of compromise. Moving to a diversified portfolio does not mean eliminating all positions in an existing portfolio. There may be some overlap in underlying stocks, which may result in reducing some of the concentrated positions or even preserving a portion of existing stocks while repositioning the remainder. Knowing that a portfolio is not going to be completely cleaned out and replaced with all new securities can encourage a client to move forward as they’ll continue to own some of their favorite names. Seeing how those existing stocks fit into the new strategy and help create an integrated portfolio solution can often put things into perspective.

Conclusion

Before repositioning a portfolio it’s important to understand the options available, assess the tax implications and establish an objective transition plan. There are generally two approaches to help clients tax-efficiently reorient their portfolios. The timeline approach moves the existing portfolio to the new strategy over a set number of years. The tax-budget approach moves the existing portfolio to a new strategy while limiting taxes or capital gains per year. Having a tool that presents the actual tax consequences and tracking error values derived by each transition method can help guide investors toward a choice that aligns with their personal preferences regarding risk and tax implications. Advisors can play a valuable role in guiding investors in these decisions.