2023 active management outlook: Why we believe active is attractive

Executive summary:

- We believe fixed income markets present fundamental advantages that enable active managers to outperform benchmarks. These include market inefficiencies, index rules and reconstitutions, participant motivation, and trading inefficiencies.

- In fixed income, we believe the environment of higher rates volatility, an unclear rates regime, and recent market dislocations is ripe for fixed income active management.

- In equities, we think global small cap and emerging markets managers unlock additional opportunities in a multi-manager approach by operating in markets with favorable dynamics and diverse opportunity sets.

As 2023 hits its stride, is active attractive?

Midway through last year, we highlighted our optimism around the active management environment, the ability of a skilled manager to outperform peers, and the potential benefits investors receive from using a multi-manager approach. As 2022 came to an end, we took a deep dive into excess returns from our extensive universe of active managers—in both equity and fixed income—to establish forward-looking expectations based on active management indicators and results from active managers1 dating back to 2003. Here's what we uncovered.

Equity recap: Understanding recent headwinds

Our excess return analysis covers four-year periods dating back to 2003. The glaring takeaway from the most recent four-year period is that it was a difficult environment for active global large cap managers,2 with the average manager underperforming by 30 basis points (bps) per annum.

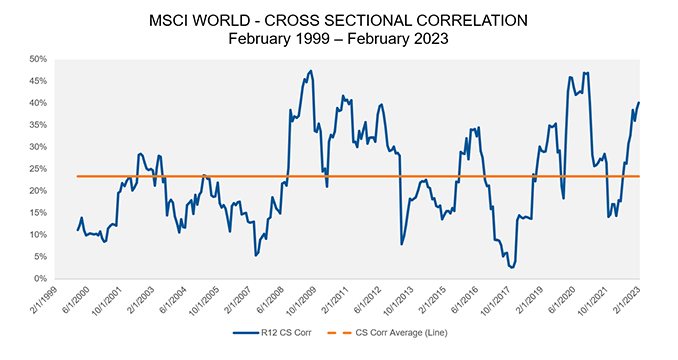

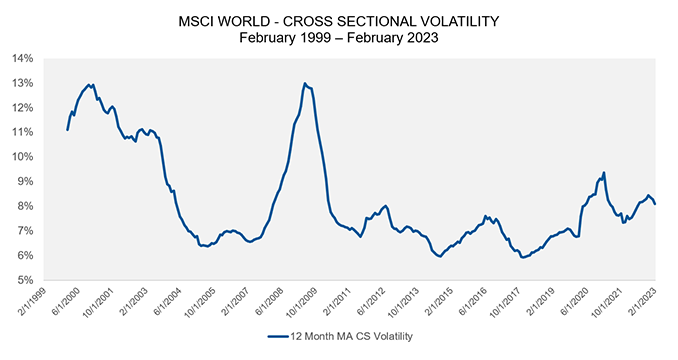

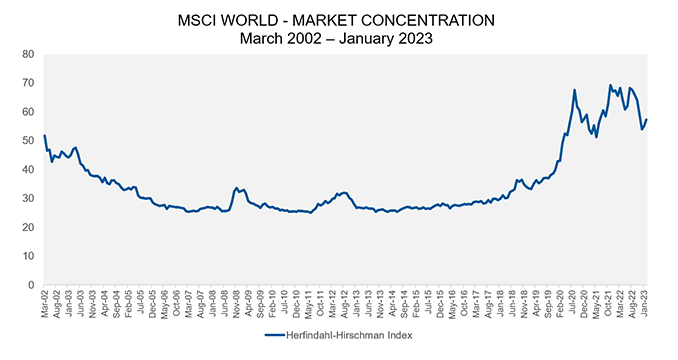

As highlighted in previous blogs, active managers tend to benefit from periods with heightened cross-sectional volatility, relatively low stock level cross-sectional correlations, and low market concentration. The most recent four-year period saw extreme dynamics among these indicators.

For instance:

- Cross-sectional correlation of the MSCI World Index was above the long-term average3 79% of the time.

- Market concentration (Herfindahl-Hirschman index) spent almost the entire period at levels higher than we'd seen dating back to 2003.

- Cross-sectional volatility of the MSCI World Index was in-line with historical values.

In sum, zero of our three active management indicators exhibited favorable dynamics for active management.

Not only did these market dynamics cause structural headwinds for active managers, but they exposed the structural preferences of active managers. Managers in the global large cap universe tend to consistently prefer smaller cap and non-U.S. stocks, driven by beliefs around market inefficiencies and breadth of opportunities. With narrow market leadership generally coming from expensive U.S. large cap stocks from 2019-2021, the broad universe faced more pronounced headwinds throughout the period because of the elevated cross-sectional correlations and extreme market concentration we highlighted.

Additionally, market volatility from 2020-2022 was driven by macroeconomic uncertainty, such as earnings impacts from COVID-19 and the Russia/Ukraine war, which de-emphasized the importance of bottom-up fundamentals, creating an additional headwind for active managers. Even with a change in market drivers benefitting performance in 2022, the adverse conditions of the prior three years drove modest underperformance relative to the broad index from 2019-2022.

Finding opportunities in different places

The question this leads us to is, where do we go when market dynamics make it historically difficult for active managers to generate alpha? We can attempt to avoid these market dynamics altogether, or we need to find skilled managers who have shown an ability to generate excess returns during these periods. As it turns out, you can find both within the global small cap and emerging markets universes.

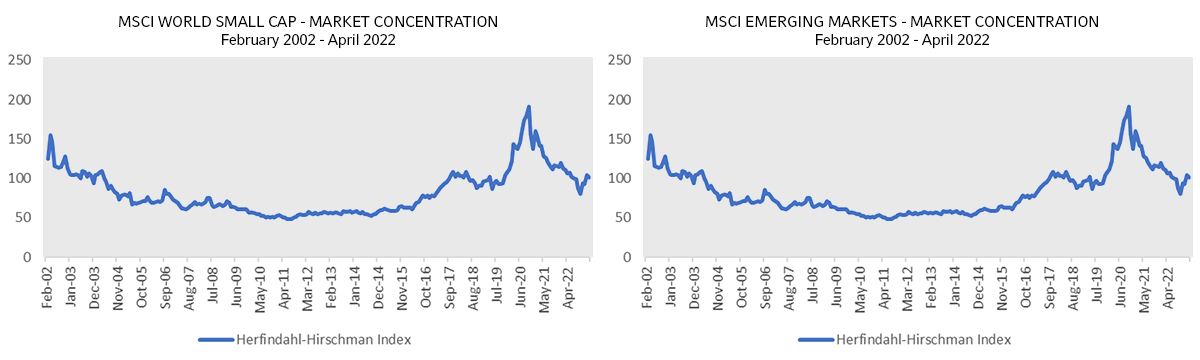

The below charts show the differences in market concentration within the respective indexes. As the first chart illustrates, even though we saw a brief period of elevated market concentration in emerging markets in 2021, concentration reverted toward the mean in a short period of time. This starkly contrasts the MSCI World Index, where concentration remained at historic highs for a full four years.

Small cap, on the other hand, is almost immune to elevated market concentration, as the second chart shows. This is due to regular rebalancing that removes stocks with market caps that exceed the upper limit.

Both of these markets, with distinct dynamics, have strong support from our internal analysis[iv] that shows emerging markets and global small cap universes5 outperformed their respective benchmarks in a period (2019-2022) that proved to be historically difficult for global large cap managers. These market areas highlight the additional opportunities presented to active managers in markets with informational and trading inefficiencies, a lack of sell-side coverage, and a broad and dynamic universe of companies. Furthermore, according to our results, over the last 20 years, managers in global small cap and emerging markets have proven they can generate excess returns, even in times when active management appears out of favor.

The multi-manager approach: Have your cake and eat it too

When it comes to past performance, investors tend to justify decisions in one of two ways: mean reversion or momentum. Whether you're a believer in mean reversion, like we're anticipating for global large cap managers, or you prefer a track record with recent momentum, like we've seen with active managers in global small cap and emerging markets, both options exist. Better yet, through a multi-manager approach, you can take advantage of both simultaneously, enjoying the benefits of capital markets fundamentals via broad equity exposure and alpha generation together, in addition to the myriad of risk benefits offered in a multi-manager approach. With market dynamics trending in the right direction and the ability to add value by picking skilled managers, we believe you can have your cake and eat it too.

Four key reasons why we believe in active management for fixed income

We believe that fixed income markets present fundamental advantages that enable active managers to outperform (or beat) benchmarks. Common sources of outperformance are not dissimilar to the benefits we highlighted in our equity comments and include the following:

- Market inefficiencies: The sheer number of fixed income securities, which dwarfs that of equity securities (e.g., tens of thousands of securities in the Bloomberg U.S. Aggregate Bond Index versus 500 stocks in the S&P500), and the differentiation of fixed income securities across many dimensions such as capital stack (or priority of payment), maturity, coupon, covenants, and contingent claims allow skilled active managers to uncover value amid complexity.

- Index rules and reconstitutions also play a significant role as they lead to security inclusions and exclusions, often driven by considerations such as rating changes, new issues, and maturities.

- Participant motivation: Market participants in fixed income are not always driven by profit. Central banks (which actively buy and sell in the bond market) and associated monetary policy decisions are the most prominent examples of this behavior.

- Trading inefficiencies: Fixed income securities are typically traded over the counter (literally doing deals on the phone versus on an electronic exchange), meaning active managers can add value through trading abilities and leveraging a broad network of dealer contacts.

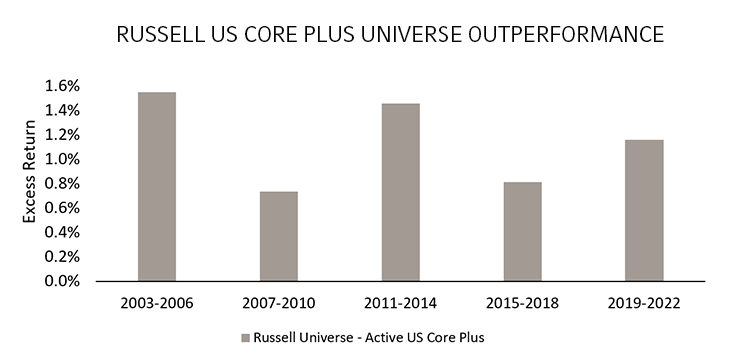

Our excess return analysis shows that Russell Investments' U.S. Core Plus (representative of the broad U.S. bond market) managers6 capitalize on these fundamental advantages in fixed income markets. Over the four-year period of 2003, active U.S. Core Plus managers6 provided substantial outperformance versus the benchmark index (typically the Bloomberg US Aggregate Bond Index).

How active fixed income managers generate value

Our research has shown that active fixed income managers generate excess returns largely through credit exposure. Active managers have a number of levers they can pull, including security selection, sector rotation within the benchmark, and out-of-benchmark allocation. We have seen that tactical sector rotation tends to play the most pronounced role in performance value-add. In a multi-sector U.S. Core Plus portfolio, there are typically hundreds of holdings, leading to greater diversification. This means that adding value through individual security picks is a less consistent source of alpha than tactical sector allocations.

Conversely, active security selection is extremely important for downside protection during periods of volatility. Recent cases, such as the Russia-Ukraine conflict, the selloff in the U.K. gilts market, and banking turmoil led by Silicon Valley Bank, Signature Bank, and Credit Suisse, have demonstrated the importance of astute managers who avoid distressed securities or act quickly to remove or add positions during turbulent times.

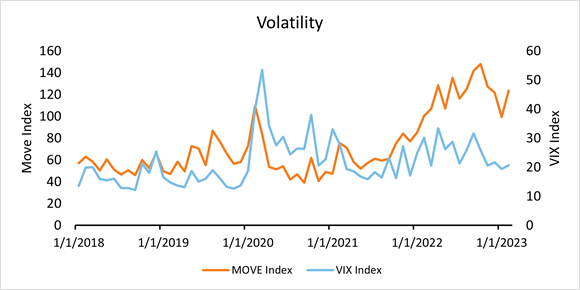

Over the past few years, the MOVE Index—a proxy for bond market volatility in the U.S.—and the VIX Index—a proxy for equity volatility in the U.S.—moved in tandem (below). In 2022, bond market volatility outpaced equity volatility. Importantly, an increase in bond market volatility is a positive factor for active managers because it increases the number of opportunities to capture market imbalances.

The value of interest rate strategies in fixed income

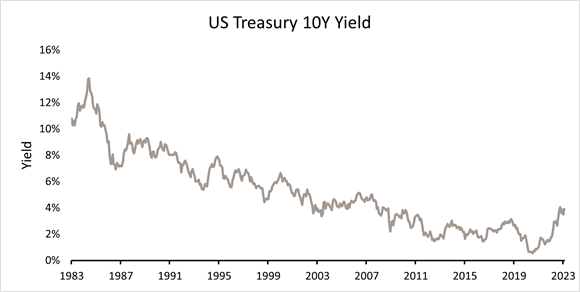

Beyond credit exposure, active managers also add value through interest rate strategies. Over the past 40 years, U.S. Treasury yields have steadily declined on the back of reductions in long-run inflation expectations, lower growth expectations, and accommodative monetary policy. The playbook for managers was to be long duration and benefit from price appreciation.

Then came 2022, which shattered this trend as rates increased rapidly, causing Treasuries to have their worst year on record. Where do interest rates go from here? Up, sideways, back to zero? As we enter a new rate regime, we believe strong managers will differentiate themselves from the crowd through informed rates calls.

The bottom line: We believe a multi-manager approach is beneficial for equities and fixed income in 2023

The upheaval in rates markets in 2022 led to challenged total returns for fixed income. However, despite negative rates performance, fixed income managers were able to produce excess returns through credit exposure and security selection.

We anticipate that employing a multi-manager approach in fixed income in 2023 will have similar benefits, allowing investors to capture exposures to different markets and possibly coupling the benefits of credit specialist managers with the decorrelating returns of tactical rates managers.

Ultimately, we believe the confluence of higher volatility, an unclear rates regime, and skilled fixed income managers are ripe for continued success. Likewise, on the equities side, we think favorable market dynamics and the opportunity set for stock pickers in small cap and emerging markets could unlock additional opportunities.

1 Russell Investments' proprietary equity and fixed income universes, defined by region and style.

2 Russell Investments' proprietary Global Large Cap universe.

3 12-month rolling average of MSCI World cross-sectional correlations since 1999.

4 Based on the median Emerging markets manager in the Russell defined Emerging Markets universe vs. the MSCI Emerging Markets index.

5 Russell Investments defined universes.

6 Russell Investments defined fixed income universe.