Credit now, credit into the future

When last I wrote, corporate credit was trading at extreme levels only seen during two or three brief periods in the last 30 years. At the time, we were extolling the opportunity to buy credit assets at historically cheap levels, and while we could not predict where the market would bottom out, we could be highly confident that the result would be positive for performance over a horizon of a year or more.

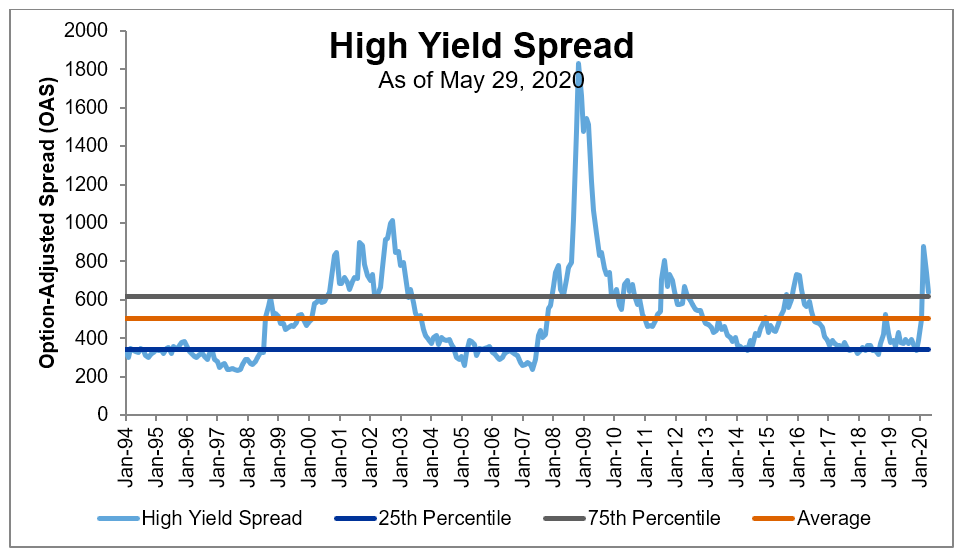

In the last couple months, the market has come storming back faster than any of us could have predicted. Today, high-yield corporate spreads sit at nearly the same level as when the U.S. had its first known COVID-19 death on Feb. 28.1 That level is essentially the same as the historical average for the sector over the past 20 years, which begs a rather obvious question. Credit was the place to invest for right now … two months ago. But, is that still true today and into the future?

The short answer is yes. Eye-popping double-digit bond returns may no longer be an offer, but credit remains an attractive investment for the foreseeable future. Why? Well, there are a few reasons credit can be attractive at only average spread levels normally—and particularly so in the current market.

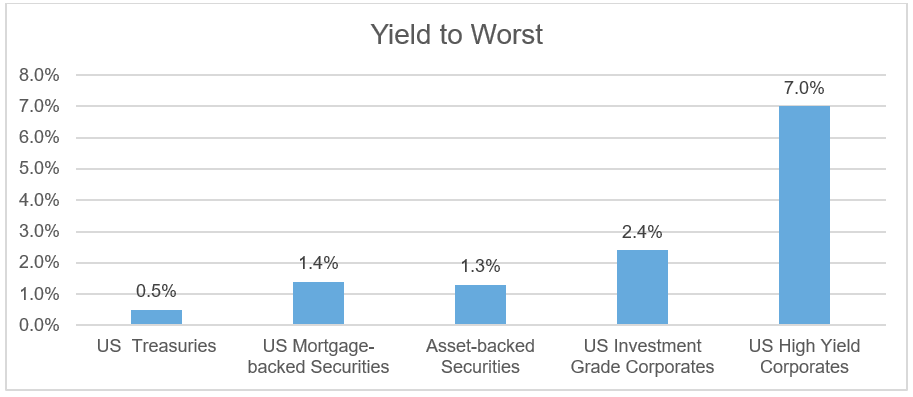

With Treasuries near all-time lows, there’s no alternative

First, is the classic TINA argument. Investors, especially retirees, love income. And with U.S. Treasuries still at or near record lows, there is no alternative (TINA) to credit for generating meaningful income. Sure, we can quibble over the various flavors of credit and which is slightly more or less attractive, but the U.S. corporate market remains the most liquid and first stop for most investors reaching for yield in their portfolios. Until more juice is squeezed out of that market, many investors are going to see little reason to venture into more esoteric sectors with less policy support from the Fed.

Click image to enlarge

Source: Based on Bloomberg index data as of 5/29/2020

Favorable cyclical outlook

Next, we should think about why the credit cycle is called a cycle in the first place. It ebbs and flows like the tides. Typically, when it goes through the average heading up, it keeps right on going to a peak, as we saw in March. When it comes back through the average on the way down, it grinds lower for quite some time, clipping a coupon and additional excess returns over Treasuries along the way. So, while the valuation may be the same, the cyclical outlook for credit risk is very different depending on whether the average is being approached from below or, as is the case today, from above.

The latter would tend to imply more room to run ahead. Of course, we can’t fully discount the possibility of a double dip in markets—as happened in the late 1990s and early 2000s—so it would only be prudent to hold less credit risk than a month or two ago. Still, the cycle favors continuing to ride some additional credit risk even at an average valuation.Click image to enlarge

Source: Based on Bloomberg index data from 12/31/1993 to 5/29/2020

Compensation for defaults

Lastly, at average spreads investors are more than compensated for most plausible future levels of defaults. The nature of a risk premium like the credit spread is that it not only compensates you for the risk that bad things will happen (defaults), but also for the uncertainty about which companies that bad thing will happen to. That latter component is rather big for each individual bond. Thankfully, we have that most magical of forces known as diversification to help us out!

How? When you buy a broad and diversified portfolio, the uncertainty about who is going to default gets diversified away, yet you are still able to get all that yield in your portfolio. With skillful active management, you can perhaps even have fewer defaults than the broad market.

Using a back-of-the-envelope calculation, at a spread of roughly 500 basis points, or 5%, and an average recovery of 40 cents, defaults would need to be ~12.5% to eat up all that 5% cushion in a given year. That’s a high default rate versus history, though not implausible in a major recession. But, for anyone with an investment horizon longer than one year, the math starts to get more favorable the longer you look out. That 5% spread is annual, so recessionary default rates have to keep happening, which is far less plausible.

All of this lends further support to continuing to hold a diversified exposure to corporate credit in bond portfolios—for now and into the foreseeable future.1 The spread of the Bloomberg U.S. High Yield Index on that date was 500 basis points versus 536 basis points on 6/8/2020. Note also that subsequent post-mortem analysis has found earlier deaths in the U.S. due to COVID-19 that were not known at the time.