3 reasons why investors shouldn’t bail on bonds

One of my associates, Keith Brakebill, recently wrote that many bond investors might be finding themselves in unfamiliar territory and wondering what lies ahead for this asset class. A rare year of negative returns from bonds (represented by the Bloomberg U.S. Aggregate Bond Index) in 2021 has carried over into 2022, with the asset class down -3.7% this year through the week ending Feb. 18, 2022.

To make matters worse, investors are worried what impact the Federal Reserve raising interest rates might have, given the inverse relationship between interest rates and bond prices (as interest rates go up, all else equal, bond prices go down). The combination of these factors may cause investors to question whether it makes sense to own bonds at all.

However, before bailing on bonds, here are a few things to keep in mind when considering portfolio allocations for the remainder of 2022 and beyond.

The market is already anticipating rate hikes from the Federal Reserve

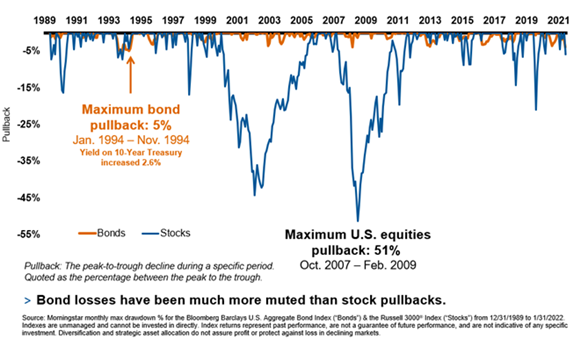

Though the Federal Reserve (Fed) has yet to actually raise rates, interest rates have already been increasing in anticipation of the Fed’s actions and future increases. The chart below shows the yield on various Treasury bonds of different maturities since the start of 2020. After initially falling to around 0.50%, the 10-year Treasury yield has generally been increasing since mid-2020 and is near 2% today. Perhaps more noticeably, after hovering near 0% since the start of the pandemic, the yield on 1-year and 2-year Treasuries started to increase in the later part of 2021 and has continued to rise in 2022.

The faster recent rise in these yields reflect that Fed actions influence short-term rates more than long-term rates. In each case, yields today are not far from 2020 pre-pandemic levels, despite no actions from the Fed. It is important to remember that financial markets are forward-looking and when it comes to rate increases, this is something the market has been anticipating. As Keith explained in his blog, the market is already pricing in rate hikes this year. Therefore, it is not necessarily rate hikes themselves that will drive fixed income returns going forward—but how those hikes compare to what the market is already expecting.

Click image to enlarge

Source: U.S. Department of the Treasury

Bonds remain the best way to offset to risk from stocks

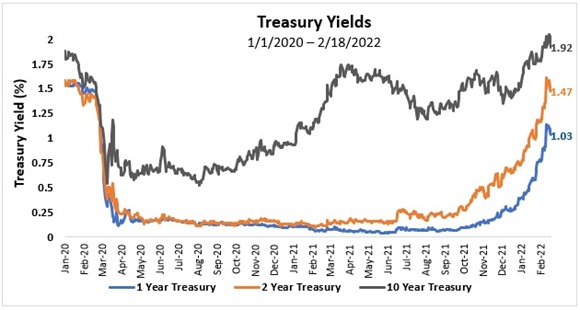

For many investors, bonds are owned as a component of a diversified portfolio alongside other asset classes such as stocks. When comparing relative risk and returns, though stocks historically have generated larger returns over the long run, in shorter time periods stock prices have been much less stable than what we have seen from bonds. In addition, the magnitude of declines from stocks has been significantly larger than for bonds.

Since 1996, the average yearly pullback (peak-to-trough decline) for U.S. stocks (as represented by the Russell 3000 Index) has been around -15%. In each of the last three U.S. recessions—marked by the dot-com bubble, the global financial crisis and the COVID-19 pandemic—U.S. stocks dropped by more than 30%. By comparison, bonds delivered positive total returns of 23% and 7% as stocks dropped amid the dot-com bubble and global financial crisis, respectively, while during the swift COVID-19 stock-market-selloff, bonds were down less than -1%. 1

As the chart below illustrates, negative bond returns have been much shorter lived and much less severe. Perhaps most importantly, bonds helped to act as a buffer during those instances where stocks experienced large losses. While negative returns from any asset may be difficult for investors to stomach, abandoning an allocation to bonds in favor of stocks due to fears of rising rates will significantly increase the portfolio’s risk and expose it to larger possible drawdowns. As the saying goes, a bad day for stocks can be a bad year for bonds.

Bonds have survived previous hiking cycles

Over the last 30 years, there have been four sustained periods when the Federal Reserve increased interest rates, which are highlighted below. Despite an average increase of more than 2.5%, bonds were still able to deliver positive returns in three of the four periods. It also is worth noting the starting point of the two most recent hiking cycles is similar to today’s low interest rate environment, yet bonds still produced positive returns of 6% in each of those periods. Even in the negative return environment of 1994-1995, the total return over that period was only slightly down at just -2%.

Part of the reason for these results is that total return from bonds consists not just of changes in prices, but also the income—or coupon payment—that comes with owning bonds. This coupon payment can be helpful in offsetting declining prices and help to reduce the negative impact of rising rates. Additionally, though rising rates have a negative initial impact on returns, the silver lining to investors is that higher yields translate to potentially higher levels of income and returns going forward.

| Dates | Start Rate | Ending Rate | Total Increase | # of Hikes | Total Bond Return |

| 2/4/1994 - 2/1/1995 | 3.00% | 6.00% | 3.00% | 7 | -2.0% |

| 6/30/1999 - 5/16/2000 | 4.75% | 6.50% | 1.75% | 6 | 2.0% |

| 6/30/2004 - 6/29/2006 | 1.00% | 5.25% | 4.25% | 17 | 6.1% |

| 12/17/2015 - 12/20/2018 | 0.00% | 2.25% | 2.25% | 9 | 6.0% |

Rate represented by target lower federal funds rate.

The bottom line

With low yields and rate increases likely coming, many investors may be wondering if it is still worth owning bonds. However, the Federal Reserve has signaled its intentions and interest rates have already been increasing in anticipation of the Fed’s actions before the first rate hike. In addition, bonds can continue to help offset stock-market volatility similar to what has been experienced to start the year. Although it has been a challenging environment for bonds since the start of 2021, investors shouldn’t lose sight of the important role they play in a diversified portfolio.

1 Dates of equity drawdowns: Dot-com bubble: 9/2/2000 – 10/9/2002; GFC: 10/10/2007 – 3/9/2009; COVID-19: 2/20/2020 – 3/23/2020. Source: Morningstar