Value of an advisor: T is for tax-smart planning and investing

Executive summary:

- Taxes – on dividends, capital gains and so on – are an inevitable part of the investing process. But we believe that advisors can help their clients minimize those taxes and keep more of what they earn.

- Tax-smart advisors who consider taxes throughout the investment process can add value to their clients’ portfolios. Fewer taxes mean more money remains invested to compound and grow.

- Tax-smart advisors can stand out from their peers which may help build their business.

Earlier this year I was at a large family gathering chatting with some cousins I hadn’t seen in a long time. During our conversation the normal questions were asked: “Got kids? What do you do?” Once I explained what I do, I got the usual response. “So honestly, do you think working with a financial advisor is worth it?” I told them about the value that advisors provide by helping investors remain in the market through difficult times, by actively rebalancing their portfolios, diversifying their investments, and how they can help reduce the bite that taxes take. Once taxes came into the conversation my uncle chimed in and said, “Ah, I hate paying taxes, but it’s the name of the game. You have to pay when you’re making money.”

I had to agree with him, to a point. Paying taxes isn’t an enjoyable part of the investment process. But it doesn’t have to be a necessary part of the investment process.

A tax-smart advisor can help investors by considering the impact of taxes throughout the investing process, so that the investors don’t pay more taxes than they need to every April. These advisors keep in mind that there is a myriad of taxes that can be triggered by our investments: taxes on dividends, on capital gains, or on the sale of shares, for example. These taxes can create a tax “drag” on the portfolio that impede its growth.

That’s why we at Russell Investments believe that tax-aware advisors who structure a portfolio to help minimize investment taxes can provide significant value. Indeed, our annual Value of an Advisor study finds that tax-aware planning and investing is an integral part of the value that advisors provide.

Value of an Advisor = A+B+C+T

This is the fourth and last blog in our 2023 series, discussing why Russell Investments believes in the value of advisors, based on this easy-to-remember formula:

Click image to enlarge

In earlier blogs, we discussed the value of active rebalancing, the importance of behavioral coaching and the customized wealth planning that many advisors are now providing for their clients and often, their families.

In this blog, we’re going to talk about the T in our formula – the value of tax-efficient planning and investing. Because it’s not about what the investors make. It’s about what they keep.

Investment taxes more noticeable in a low return year

Earlier this year, you probably had clients who were shocked that they had to pay taxes when their 2022 investment statement was negative. They may have asked you: “You mean I have to pay taxes even though my account was down?”

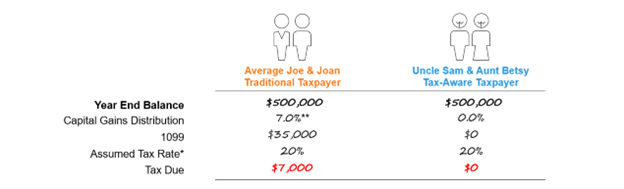

Based on the average 7% capital gain distribution reported in 2022, an investor with a portfolio worth $500,000 at the end of 2022 would have received a Form 1099-DIV in April, showing $35,000 in capital gains distributions, assuming a 20% tax rate (the top long-term capital gains tax rate at the federal level excluding the 3.8% net investment income tax surcharge). That translates into a tax bill of $7,000. Meanwhile, U.S. stocks, represented by the Russell 3000 Index, fell 19%.

But as I told my uncle, there are ways to minimize that tax bite. For example, an investor with a similar portfolio in tax-managed mutual funds could have entirely skirted capital gains distributions in 2022.

Tax-managed mutual funds are designed to reduce or eliminate capital gains distributions. Investors who hold these funds have control over the tax year in which capital gains are reported. For example, they can choose to sell their shares of the fund in a year when they may have less income from other sources.

How much are yearly capital gain taxes costing your clients?

Click image to enlarge

A Hypothetical Illustration.

*20%: Represents top long term cap gains rate, excluding 3.8% Net Investment Income Tax

**7%: Represents 2022 average capital gain distribution % of Morningstar broad category ‘US Equity’ which includes mutual funds and ETFs.

We believe that taking an active tax-managed investing approach can lead to a much better after-tax outcome. The cost of taxes – or tax drag – can weigh on investment returns over time, which could leave the investor with less than they had anticipated for their retirement, or future investing goal.

At Russell Investments, we have beaten the drum on how important tax-managed investing can be, because of its potential to help investors keep more of what they make. We believe this allows advisors to better serve their clients and may help advisors to set their practices apart.

When my uncle asked me if a financial advisor was worth the cost, I pointed out that a savvy and tax-aware advisor can help him save more in taxes than he would pay in the advisor’s fee. I could see him doing the math in his head. And then he asked me if I knew any tax-smart advisors.

Understanding your client’s tax-sensitivity level

Are you a tax-smart advisor? To help you decide if you have a robust tax-smart investment approach, ask yourself these five questions:

- Do you know each client's marginal tax rate?

- Do you deliberatively offer distinct investment solutions for taxable and non-taxable assets?

- Do you explain to clients the benefits of managing taxes?

- Do you collaborate with local CPAs to minimize tax implications?

- Do you regularly review your clients' 1099 and 1040 tax forms

Communicating your value all year long

More importantly – do you talk about taxes with your clients all year, not just in April? At Russell Investments, we believe every season is tax season. For example, investors traditionally receive their 1099-DIV form early in the year, while it’s still winter. Tax Day falls in the spring, and we believe that after the filing deadline has passed, it’s a great time for advisors to conduct a review of the tax form with their clients. This could offer the opportunity to structure their investments in a more optimal way to hopefully pay fewer taxes next year. In the summer, advisors have the opportunity to build relationships with CPAs and review their clients’ portfolios for taxable assets that could benefit from tax management. And in the fall, advisors can discuss the potential impact of capital gain distributions on their clients’ investment returns and look for ways to address that impact.

Bottom Line

I think I was able to convince my uncle that a financial advisor is worth the cost, even if all the advisor does is help the investor pay fewer taxes on their investments.

And there’s another thing to bear in mind. Using a tax-managed approach can help you stand out from advisors who don’t. We believe helping clients improve their after-tax wealth can be a great way for those tax-smart advisors to reinforce their value while potentially gaining new business. I’m pretty sure my uncle is going to mention our conversation to his friends, who in turn will likely want to find a tax-smart advisor.

To learn more about the 2023 Value of an Advisor Study, click here.