The value of an advisor: What we have learned in the past 10 years

Executive summary:

- An advisor’s value to the investors who work with them has evolved over the years as their roles have changed

- As investor demands have increased, advisors have responded by expanding their services

- The biggest lesson we have learned is that advisors need to communicate their value to investors so that they are aware of the benefits

We have always believed in the value of an advisor. That’s why we launched our annual study 10 years ago and have updated it every year since then. Through good markets and bad markets, through the rise of robo-advisors, increased regulation, fee pressures, new technology and so on, we’ve never doubted that investors who work with a financial advisor have benefited.

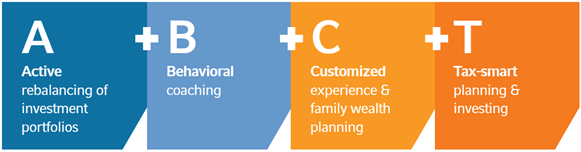

Our 2023 Value of an Advisor formula consists of four key elements in an advisor’s total value proposition: their active rebalancing of a portfolio to keep an investor’s risk profile on track, their role as a behavior coach to keep clients invested through thick and thin, their customized wealth planning to guide their client and their family through the many stages of their financial life, and their tax-smart planning and investing to help investors keep more of what they earn.

The formula has been refined over the past decade as the role of an advisor has evolved. When we launched our Value of an Advisor study, an advisor was essentially a stockbroker. Now, they can spearhead a network of experts to provide customized wealth planning for entire families. We believe the value of an advisor has increased as the services they offer have broadened and deepened.

A lot has happened in the 10 years since our study began.

The financial markets have had their ups and downs: through presidential elections, Brexit, the demise of well-known brands such as Toys R’ Us and Sears, the rise of meme stocks, a crypto scandal, the emergence of COVID-19, the Chinese market crash, oil cuts, the Russia/Ukraine conflict and so on. Last year was one of the most volatile, with soaring inflation leading to a sharp rise in interest rates, sparking a decline in both equities and fixed income.

The decade also saw the dominance of technology stocks, which drove equity markets higher for most of the period, until declining sharply last year. U.S. stocks outperformed all other regions for most of the period but have now begin to underperform. The U.S. dollar has risen and fallen in tandem.

The way we work has evolved over this time as well. Many of us started working from home when the pandemic started and a lot of us are still there. Others are slowly transitioning to a hybrid office model. Many of us changed jobs and others started their own businesses. We rely a lot more on technology. We may now place greater value on a work/life balance, and we may also have a different view about commuting than we did before.

We’ve seen major demographic changes as well. Generation Z has begun to enter the workforce and Baby Boomers are leaving it. We’ve seen huge strides by women in the workforce and they’ve grown to control a larger share of wealth. It’s been a tumultuous decade!

10 lessons learned in 10 years

Not only have we been through a lot in the past 10 years, but we’ve learned a lot too. These are the main lessons we’ve taken away from the past decade:

- An advisor’s role is constantly changing. In our first study, an advisor was essentially a broker—selecting investments for clients. Now, most advisors are expected to provide family wealth planning for entire families. That advice can encompass everything from insurance needs, custom requests, as well as legacy and charitable planning.

- Portfolio rebalancing is important: Active rebalancing is a vital part of the value advisors provide investors because it’s designed to help them avoid unnecessary risk exposure.

- Investors are ruled by their emotions. There’s a reason behavioral finance has gained popularity: investors tend to buy high and sell low—unless they are guided by an advisor.

- Everyone wants to feel special. We all enjoy getting things our way. There is a growing demand from investors for a more personalized client experience and an investment portfolio that reflects their unique goals, circumstances, and preferences.

- Planning is an ongoing process. Planning, done correctly, is not a one-time step. Advisors are continuously adjusting plans to align with the client’s changing needs.

- Teamwork makes the dream work. As the expectations for personalized service grows amid the increased complexity of client needs, advisors are building a network of experts to help create comprehensive long-term plans for their clients.

- Time is of the essence. By this we mean time is an advisor’s scarcest resource. Advisors have adopted new service models to ensure their time is spent on the highest-value task—building deeper relationships with their clients.

- Model portfolios increase efficiency. All these extra services take time and energy. As advisor roles change, the use of model portfolios is rising.

- No one likes paying taxes. We introduced tax-smart planning and investing into our formula in 2016. Why? Because taxes can take a big bite out of a portfolio.

- Communication is key. Unless advisors communicate the value they provide, their clients may not be fully aware of all the benefits they receive by working with their advisor.

We know that much of the work an advisor does is complex and happens behind the scenes, making it more difficult for clients to appreciate. Our Value of an Advisor study is designed to help you bring the results of that work to the forefront so you can demonstrate the full value of the services you provide to your clients.

At Russell Investments, we believe in the value of advisors. Our annual study confirms that belief. We see the potential advantages you create for your clients. We know the commitment you bring to your relationships. Our decade of producing the annual Value of an Advisor study quantifies that dedication.