Fed highlights concerns over inflation as rate-hiking cycle begins

Well, that was fast. Just two years removed from the COVID-19 lockdowns and the sharpest economic recession in the history of the United States, the U.S. Federal Reserve (Fed) has now raised interest rates for the first time in this cycle. The quarter-point increase in the federal funds rate today was not, in itself, very interesting for markets, as Chair Jerome Powell already pre-committed this decision in his testimony to Congress a few weeks ago. Investors were more focused on the path forward and how the central bank was weighing the uncertainty from the war in Ukraine against mounting evidence of broadening inflationary pressures.

Fed sounds hawkish tone, with projections for at least 7 rate hikes in 2022

On that latter and more important note, the Fed meeting was hawkish today. The dot plot of Federal Open Market Committee (FOMC) participant views showed an expectation for seven total rate hikes this year. Taken literally, that would imply a 25-basis-point hike at every single meeting that remains on the calendar for 2022. Furthermore, a chunky minority on the FOMC—seven of the 16 participants—favored hiking rates even faster than that. Finally, the dot plot suggests the Fed will start to take the punchbowl away in 2023, with policy rates moving into restrictive territory by year end.

How did markets react?

Markets initially reacted negatively. Bonds sold off, with the 10-year U.S. Treasury yield rising to 2.25% in the minutes around the announcement. The S&P 500 Index—which was trading up almost 2% before the meeting—gave up ground before recovering again later in the afternoon.

How is the war in Ukraine impacting the economic outlook?

The war in Ukraine was flagged as a major source of uncertainty for the outlook, directionally adding to inflation and weighing on economic growth. We agree, with those headwinds likely to be smaller in the United States than in Europe. Thankfully, one of the main risk channels by which the conflict could challenge the global cycle—higher energy prices—has come down sharply in recent days. For context, West Texas Intermediate crude oil was trading at around $92 per barrel before the invasion began on Feb. 24. It peaked at almost $125 per barrel on March 8, and has subsequently come back down to $95 per barrel today.

The bottom line: While lots of volatility remains in energy markets, current price levels are unlikely to derail the U.S. consumer. In addition, tentative headlines that Ukraine and Russia have drawn up a neutrality plan to end the war are very encouraging as well, if substantiated.

Inflation worries mount as price pressures broaden

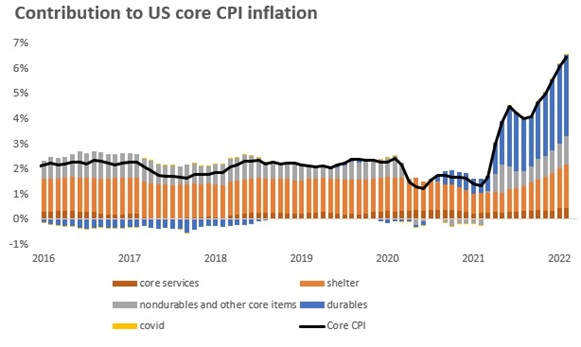

Meanwhile, inflation has become more concerning in recent months. Wage inflation has jumped, with the Atlanta Fed Wage Tracker shooting up to 6.5% in February. Wages are now running so far ahead of productivity growth that they are inconsistent with the Federal Reserve’s inflation target of 2% over the medium-term. Price pressures have broadened as well. Whereas in the summer of 2021 almost all of the core inflation spike was concentrated in transitory items like consumer durables (blue bars in the chart), inflation is now also increasing in cyclical and sticky categories like shelter, and wage-sensitive areas like core services (the orange bars at the bottom of the chart).

Click image to enlarge

Source: BLS, Russell Investments calculations. Data as of February 2022. Core services includes Recreation Services, Education and Communication Services and Other Personal Services. Shelter includes Rent of Primary Residence and Owners Equivalent Rent. Durables includes Household Equipment and Supplies, Transportation Commodities less Motor Fuel, Recreation Commodities and Information Technology Commodities, COVID includes Transportation Services and Lodging Away from Home. The grey area includes all other items.

The bottom line: Above-trend growth still likely in U.S.

It is perfectly normal for markets to have indigestion around major monetary policy shifts, and we judge that a significant amount of the year-to-date weakness in equities was precisely because of (and in anticipation of) today’s decision. Importantly, fixed income markets are already priced for the seven U.S. rate hikes the Fed showed in the dot plot for this year. Meanwhile, market psychology is quite pessimistic, which we assess to be a positive for the tactical outlook.

Fundamentally, we still expect 2022 to be a year of above-trend economic growth in the United States. Importantly, China also stepped up its commitment to economic growth and markets in comments this week. And while Europe faces considerable uncertainty from the war in Ukraine and volatility in commodity markets, those pressures have come off the boil a little bit in recent days.

We continue to focus primarily on strategic asset allocation and the security selection from our underlying money managers as the primary drivers of risk and return in portfolios. And we remain on the lookout for any extreme dislocations in markets tactically, should they present themselves in the current bout of market volatility.