UK Spring Budget statement: Play it again, Jeremy

Executive summary:

- In a move aimed at offering voters a pre-election giveaway, UK Chancellor Jeremy Hunt cut national insurance contributions by 2 percentage points in his spring budget.

- He had previously cut national insurance contributions by 2 percentage points in the autumn budget less than four months ago.

- A squeeze in spending and tax increases likely loom after the next general election, expected sometime later this year.

- The market’s indifferent reaction is a good sign for bond investors and mortgage borrowers.

After having cut the national insurance contributions by 2 percentage points in November’s budget statement, UK Chancellor Jeremy Hunt used the same playbook in the Spring Budget, announced March 6, to try to bolster his party’s slim chances of winning the general election.

The fiscal straitjacket imposed by an economy in recession and higher interest rate payments means that the fiscal giveaways were offset by previously announced tax hikes and spending cuts after the election.

The market reaction was benign, and our outlook for Bank of England rate cuts and modestly lower bond yields remains intact.

- National insurance contributions are cut by 2 percentage points (pp) from 10% to 8%, saving someone on an average salary £450 per year. This comes after a 2-pp cut as recently as November 2023, as part of the autumn budget.

- Fuel duty increase dropped: Having the budget early in March allows the Treasury to scrap the 5p increase to fuel duty planned for 23rd.

- Property capital gains tax: In a surprise move, the higher rate of property capital gains tax is cut from 28% to 24%.

- Spending: Contrary to speculation that day-to-day government spending would be cut further, the chancellor kept it at 1% p.a. in real terms over the next parliament. As larger inflation-adjusted increases are penciled in for health, defense, and childcare, other public services will need to be cut steeply by £18bn per year through 2028/29, according to calculations by the Institute for Fiscal Studies.

- Tax increases: Mr. Hunt also announced a slew of measures to raise additional revenues, such as a tax on vapes, increased air passenger duty for business class travelers and the abolishment of the non-domiciled tax status, which allowed some residents who are not permanently settled in the UK to keep their foreign income out of the UK authorities’ reach. The windfall tax on the profits of oil and gas companies was extended until 2029.

- In good news for savers, the chancellor announced the introduction of a new “UK ISA” (Investment Savings Account). The additional allowance of £5,000 (on top of the existing £20,000) would allow savers to invest in UK-focused businesses, but details of the scheme are yet to be determined after a consultation.

Delayed fiscal squeeze

The Resolution Foundation points out that tax cuts announced at today’s budget should be seen in the context of previously announced tax hikes of around £20 billion in 2023/24. These include the freezing of personal tax thresholds and increases in corporation tax, affecting households and businesses, plus some £17 billion of tax rises set to come into effect in the next Parliament. After the chastening experience of Liz Truss’ mini-budget in October 2022 and the turbulence in UK gilt markets, the Treasury is focused on avoiding another upset for bond investors.

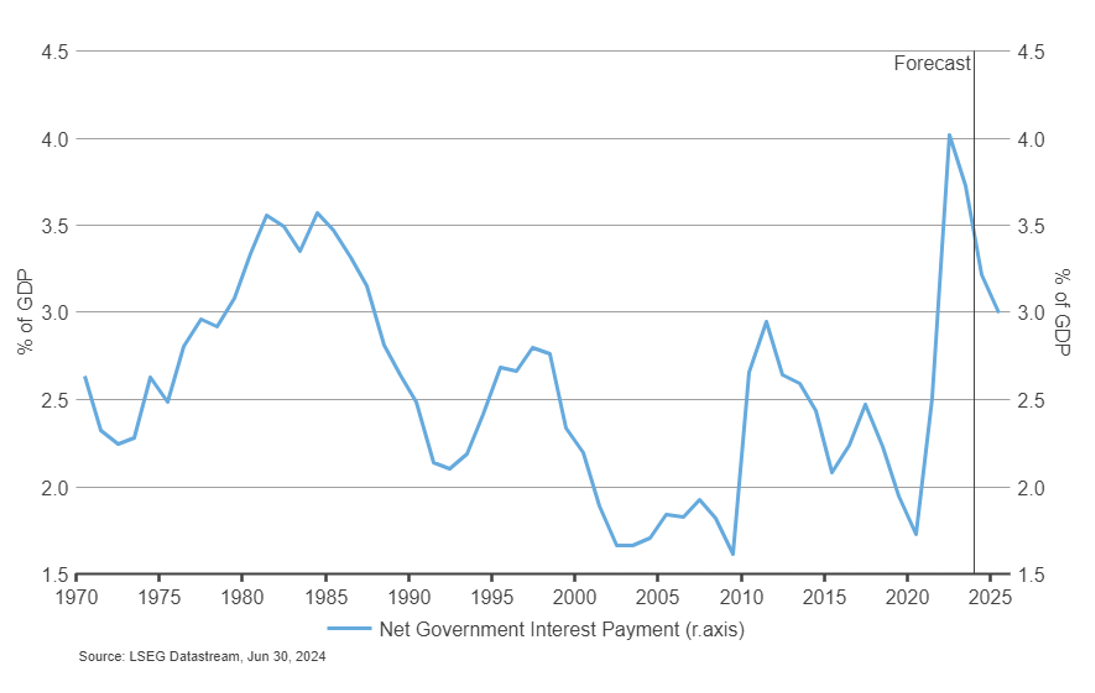

The effects of the Covid pandemic, a stagnating economy and higher interest rates are reflected in record-high interest payments the UK government needs to make. As shown in the chart below, net interest payments as a percentage of GDP reached a record-high of 4% in 2022. They are forecast to drop back to 3%, but only if the fiscal discipline is maintained.

Government Interest Payments % of GDP

Implications for the Bank of England, gilts, and sterling

Today’s budget does not change our outlook for the Bank of England, UK bond markets and the pound sterling exchange rate.

Market observers had been worried about the risks the budget poses to UK gilt markets. The UK's recession, coupled with the Conservative Party’s intent to implement tax cuts to stimulate the economy before an upcoming election, could push long-term bond yields higher. Tax cuts could also make it harder for the Bank of England to reduce interest rates later in the year. However, robust growth in the United States and revisions to the path for U.S. key interest rates had already spilled over to what money markets discount for the Bank of England. The first cut in the bank rate has been pushed back to August and the total magnitude of priced rate cuts reduced to about 60 basis points for 2024.

Financial markets greeted the Budget with a shrug, mostly because most details were as expected after leaks to the press in recent days. The yield on 10-year UK gilts initially rose by a few basis points during the budget speech but retraced back to 4.01% later in the day on March 6. As we wrote in our previous article, we expect the Bank of England to start a rate cutting cycle in the second half of the year, and for gilt yields to decline modestly across the curve. The pound is the strongest developed-market currency in 2024, supported by comparatively high interest rates and attractive valuations , but its appeal could wane somewhat later in the year.

The bottom line

Overall, the financial market impact of the Spring Budget was muted. While Mr. Hunt had saved up fiscal leeway to deliver a pre-election morale boost for the Tories in the form of a tax cut, as we suspected after the Autumn Budget, his options were limited by the constraints of fiscal arithmetic and the challenging economic backdrop. For bond market stability and mortgage borrowers, today’s indifferent market reaction is a good sign.

Whether the Spring Budget has materially altered the Tories’ re-election chances is doubtful.