3 reasons why value stocks may outperform soon

At Russell Investments, we believe in holding a strategic allocation to the value style, or factor within the equity market. Investing in stocks with depressed valuation multiples is widely understood by academics and fund managers to have outperformed passive equity benchmarks since the 1920s.1 But the value style has lagged significantly in recent years, with that underperformance becoming particularly acute in the first quarter of 2020. So where do we go from here?

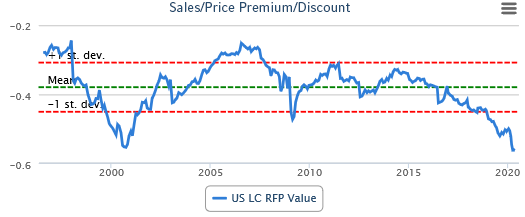

First, this stretch of underperformance means that the spread between valuation multiples on value stocks and passive equity benchmarks has become historically wide. For example, looking across large capitalization U.S. equities, our proprietary value factor portfolio is trading at a 56% discount to the market on a sales-price basis. This extreme of valuation spreads is only matched in the post-Depression period by what we saw in 2000—an environment most investors, describe as a technology bubble.

Click image to enlarge

Source: Russell Investments. As of March 2020. US LC RFP Value refers to Russell Investments' proprietary large-capitalization US Value factor portfolio. Standard Deviation is a statistical measure of the degree to which an individual value in a probability distribution tends to vary from the mean of the distribution. The greater the degree of dispersion, the greater the risk. The chart shows the sales/price ratio of th Value portfolio against the S&P 500 Index. When the line is higher than the mean, the Value portfolio trades at a premium to the index, and when it is below the mean, it trades at a discount.

The above discount tells us that the potential return opportunity in a value-oriented equity strategy might be much larger than normal today. But admittedly it tells us very little about the timing or potential catalysts for this expected payoff. Enter the business cycle …

3 fundamental characteristics of value stocks that are well suited for the current outlook

1. The long-term premium on value strategies compensates investors for the risk of rare disasters

COVID-19 has truly been a black swan for investors. On Dec. 31, 2019, the city of Wuhan in China reported 27 cases of an unknown pneumonia outbreak. Fast forward to today, and there are now in excess of 5 million confirmed cases of this novel coronavirus 2, marking the most severe global pandemic since the Spanish Flu of 1918.

Government efforts to contain the virus around the world effectively caused a staggered global shutdown of entire industries in February, March and April.

Put simply, COVID-19 had a serious impact. And while we don’t have a perfect crystal ball, the partial re-openings underway in China, Germany, Texas and California suggest the worst of the economic impact may be in the rear-view mirror. If we’re right on this, history would suggest the potential for a large payoff on value strategies. In the United States, value stocks have, on average, outperformed by 730 basis points in the 12 months following a trough in the business cycle.3

2. Value stocks have more balance sheet leverage than the broad equity market

The debt ratio for our value factor portfolio is roughly 5% higher than that on the MSCI All Country World Index. While this leverage gap is not as extreme as it was in the early 2000s or in 2008 (each around 40%), it does suggest that the relative performance of these businesses is still likely to hinge on movements in credit spreads.

With the U.S. Federal Reserve taking unprecedented steps to support the functioning of the U.S. corporate bond market, our fixed income research analysts expect investment grade and high-yield credit spreads to compress over the next 12 months. Our research suggests that value stocks, on average, have outperformed by 1,600 basis points in periods of falling credit spreads.4The support measures instituted by the U.S. federal government should also be supportive in backstopping against severe credit events.

3. Value stocks have a shorter duration profile to their cash flows than growth companies

Relative to growth companies, where analysts must discount large anticipated earnings streams far off in the future, value stocks tend to have a shorter duration profile to their cash flows. This leads to performance patterns in equity styles that are sensitive to movements in the U.S. Treasury yield curve.

With the prospect of a further normalization in investor risk appetite and a gradual recovery in the global economy, we think it’s more likely than not that the U.S. yield curve could bear-steepen, or widen, going forward (i.e., overnight interest rates remain at zero lower bound and 10-year yields rise modestly). We find that in 12-month periods in which yield curves are steepening, value stocks on average outperform by 330 basis points.5

The bottom line

While we don’t have a crystal ball on what exactly the future may hold, the extreme discount in valuation stocks today, coupled with the potential for positive cyclical catalysts, suggests that investors should hold the line on their strategic factor investments in value companies.

1Source: https://rady.ucsd.edu/

2Source: https://www.worldometers.info/coronavirus

3Source: NBER, Ken French. Data from 1927-present

4Source: Russell Investments research

5Source: Russell Investments research