1099 Season – An opportunity for tax-aware advisors

2022 was a banner year, and not in a good way. It was only the third time in 100 years that both stocks and bonds ended the year lower. (The previous times were in 1931 and 1969!). Needless to say, this made for a challenging year for investors, no matter what equity-to-fixed-income ratio they had in their portfolios.

To add insult to injury, many taxable investors also saw significant capital gain distributions from their equity and bond mutual funds, which will mean a tax bill in April in addition to the uncomfortable market performance many experienced.

Some investors are discovering the not-so-good news when they receive their 1099-DIV forms. But in every problem lies an opportunity, so here’s how advisors can take this negative news and potentially make it advantageous for clients and prospects.

Three steps to help you uncover and win assets during 1099 season

Step 1. Compile a list of clients and prospects you know who might have non-qualified assets. If you need help, think of clients who may have mentioned any of the following to you in past meetings and conversations:

- The sale of real estate

- The sale of a business

- Deferred compensation

- Inheritance (i.e., Stretch IRAs)

- Insurance proceeds

- Trusts

- Receiving RMDs

- Current taxable assets in mutual funds

For more ideas, check out our blog post Top 7 sources of taxable assets.

These clients could potentially have assets in investments that are paying capital gains, dividends, interest, etc., causing an unwanted or unnecessary tax bill, and may be good candidates for a 1099 conversation.

Step 2. Once you have a list, reach out to those clients, and ask them to bring their 1099-DIV forms to the next client meeting. In this meeting, help investors connect the dots between the 1099-DIV form and their investments. It will help to explain what the different boxes on the form mean, the tax liabilities associated with them, why it matters, and what can be done about it.

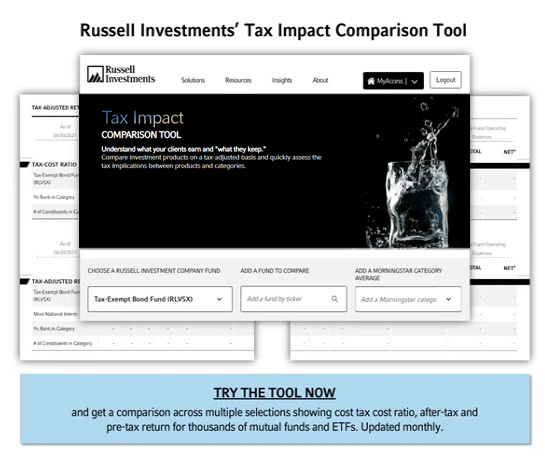

Use our 1099 Tax Form Guide to perfect your language as you study the documents. I recommend that you calculate the tax bill for your client in dollars and cents so that it will be easier to understand the impact taxes are having on their investment returns. Furthermore, having visuals and examples ready to present may make the concept of capital gain distributions and taxes easier to understand. Check out our Tax Season Essentials flyer, which provides effective diagrams and pictures further explaining these concepts.

The bottom line

Taxes can limit returns in the good years and magnify losses in the bad years, but many clients are unaware of this issue because the industry does not communicate it well. Showcasing that you are a tax-aware advisor and bringing tax drag to light for clients and prospects may be a way to differentiate yourself from your competition and find yourself adding a new client.

With 1099-DIV forms distributed at the end of this month, there is no better time to start these conversations, educate clients on the impact of investment taxes, and demonstrate why you are the best financial advisor to help reduce their tax exposure. If you have questions or want to dive into these ideas further, reach out to your local Russell Investments representative.