How has COVID-19 affected trading capabilities?

Global financial markets have been severely impacted since the spread of COVID-19, most notably since the crisis began in China and exploded in Italy on Feb. 23. Unprecedented pandemonium has followed in recent weeks as the spread of the coronavirus continues.

But how have market structures fared during this period of exceptional stress? And what has been the impact on liquidity and trading costs? In this post we outline our observations of the market dynamics over recent weeks, as well as how we, at Russell Investments, are positioned to manage these, with a specific focus on equities, fixed income and foreign exchange.

Quantifying the impact COVID-19 is having on trading capabilities

Trading set up - The uncertainty of COVID-19 has driven global financial markets into extreme levels of volatility. The high level of volatility and increased illness among individuals has resulted in trading operating systems becoming stressed. The majority of trading firms have pushed to trading all, or some, from home or from their business continuity planning sites. At Russell Investments, we are operating a split-shift model, with roughly 50% working from home and 50% in the office. We are ensuring regional and asset class coverage is split, and are accounting for periods of extremely high volumes, such as expiry or rolls.

We have been set up for some time to accommodate these changes, with traders having complete at-home workstations, which have been regularly tested and verified. While some firms have struggled to cope with large portions of their workforce being able to work effectively from home, this has been incorporated into our business continuity planning for many years now. If required, we are ready and prepared to move to 100% remote working. Our infrastructure, across all our regional offices, is set to handle these stressed conditions, and we are currently using only about 20% of our VPN capacity.

Structural impact - Despite a stabilized infrastructure, there are still challenges being faced during this time. A large number of brokers and investment banks outsource their middle and back-office operations to other countries, such as India, which is now on lockdown as the pandemic spreads across the country. We have already seen an increase in the number of operational issues, such as trades failing, and so are monitoring this closely. And we are limiting our operations with those brokerage dealers who do not have a plan B, to avoid difficulties in settling trades efficiently.

Adjusting trading strategies to accommodate market conditions

The dramatic turn of events has had a profound effect on capital markets, but has impacted asset classes in different ways:

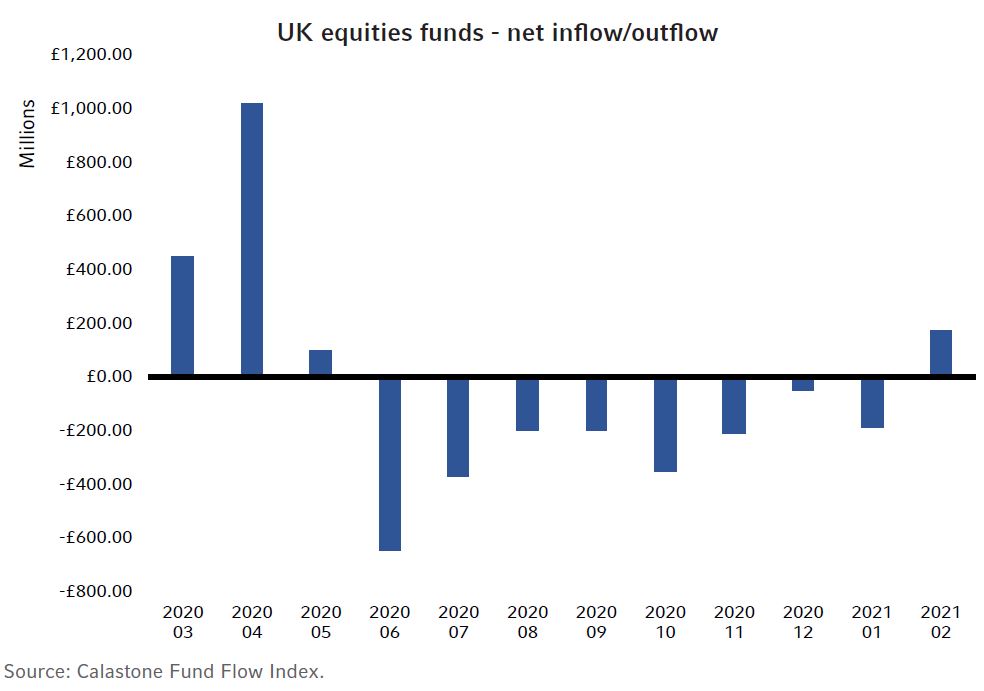

Equities - In global equity markets, we have seen volatility recently spike to all-time highs. Additionally, there have been material increases in spreads, upward of two to three times in some cases, perhaps surprisingly most extreme in the U.S., but also in other developed and emerging markets. However, with this volatility and widening of spreads, there has also come a similar increase in volumes, also two to three times higher. In this environment, how you manage your trading is even more important, especially when it comes to real-time cash management, sector exposure and other risk factors.

Furthermore, although we have seen an increase in overall volumes, we also observed a drop in volumes in dark pools and crossing networks, making it more imperative in the current market conditions to have access to primary exchanges. The following chart shows the total execution costs (including spread and market impact) of a slice of global equities. You can see how the spread component (light blue bar) has materially increased in February, and this continued in March.

[Click the chart to enlarge]

Source: MSCI World, data as of 31 March 2020.

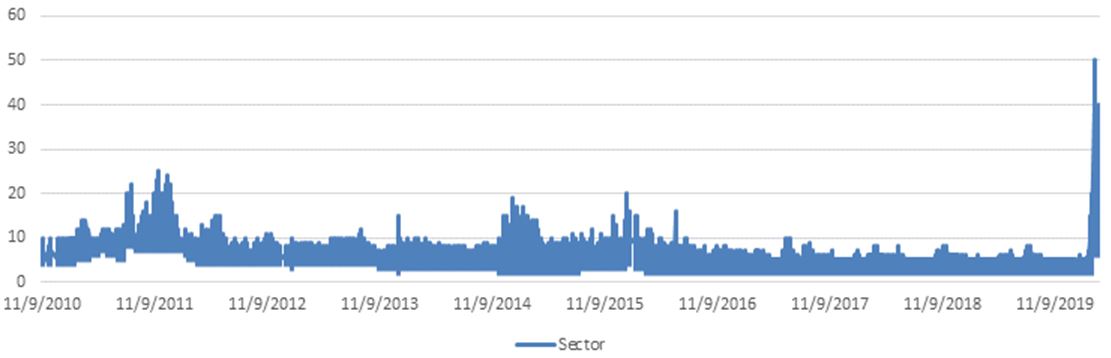

Fixed income - As with equities, there have been considerable increases in spreads in fixed income, in some cases during the early stages of COVID-19 up to ten times the normal levels. Volumes have been up in higher-quality asset classes, such as sovereigns and investment grade, however, lower-quality high yield has been devastated, with volumes down 20-30% lower. New-issue, both in sovereigns and credit, continues to put downward pressure on the market and with little demand, it has been hard to absorb supply.

There has also been a significant flattening of the curve in credit, with most of the selling in the shorter two-to-five-year range and less selling further out the curve, due to duration risk. Not surprisingly, emerging markets (EM) have seen some of the wider increases in spreads, with little liquidity at all in EM credit. With the reduction in dealer capital, one-sided trading is difficult, and switches/swaps can dramatically reduce spread impact and limit duration risk for dealers.

Additionally, stressed markets require broad trading capabilities, and have highlighted the benefits of dark pools and buy- side- to- buy- side liquidity platforms that have been evolving the past few years. The below is a historical chart showing all spreads for investment grade.

[Click the chart to enlarge]

Source: Russell Investments, dealer quotes received from Nov 2010. Data as at 1 April 2020.

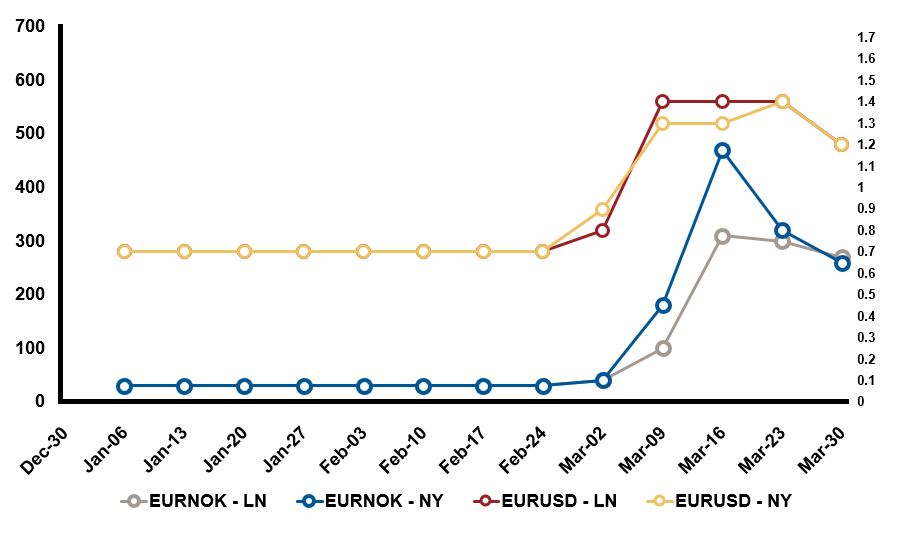

Currency - The increased market volatility has had a profound impact on currencies. There has been a spike in overall volume, as risk traders are unable to warehouse positions as they would in normal circumstances, and the spread in all, including G10 currencies, remains wide, as the market remains risk averse.

Liquidity in euro/yen and Swiss franc is down by some 20%, but other currencies are faring worse. Additionally, the AUD, NZD, CAD and GBP are each down around 30%, with the Scandinavian currency liquidity down over 50%. The NOK was particularly hit by the fall in oil.

Spreads have consequently been anywhere from two to five times wider, but have started to come in more recently. We have seen dealers getting more defensive in their fixing standards and moving forward their cut-off times. We’ve also seen increased volatility in the price movement leading up to and entering the fixing window. Recently, it is taking longer to complete even what would have previously been considered small trades, as there has been less provision of liquidity in the inter-dealer markets by electronic providers.

The following chart shows the spreads in pips across EURNOK and EURUSD from 30 December 2020 to 3 April 2020.

[Click the chart to enlarge]

Source: EURUSD Source: EBS, data as at 3 April 2020. EURNOK Source: Reuters, data as at 3 April 2020.

The bottom line

The month of March 2020 is a period we will never forget, with the steepest draw-down in the equity market in history and record levels of volatility. While we do not believe the high levels of volatility will reduce anytime soon, we do believe we are prepared and equipped to manage our portfolios during these times of uncertainty and disruption, even moving to 100% remote working, if required to do so.