Will high inflation hurt defined benefit plans? Probably not.

Inflation is all bad news, right? Gas prices increase, the price of a Big Mac goes up, and housing—don’t get me started on the price of housing. But how might rising inflation impact defined benefit (DB) plans. Will our current 40-year-high inflation numbers hurt a plan’s ability to close its funding gap? The answer is, probably not. In fact, if our focus is limited to a plan’s funded status, higher inflation could actually be good news.

Background on inflation, asset value, liability value and funded status

In markets, it is usually true that what is bad news for one investor is good news for another. And in the same way it is vital to manage a portfolio holistically, it is equally vital to view markets holistically. It is also vital to step back from the noise of today and look at how the current news compares to both the market cycles of the past and outlooks for the future.

Let’s examine today’s admittedly nerve-wracking inflation from the perspective of historical experience and from Russell Investments’ strategic capital markets forecasts. Setting aside the distinction between whether the currently high inflation is transitory or entrenched, what might high inflation mean to asset class returns and what impact might it have on the funded status of defined benefit plans?

While higher inflation presents immediate challenges to retirees in the form of reduced purchasing power—for basic needs such as gasoline, Big Macs, and housing—we’ve observed that during extended periods of high inflation, asset class returns eventually catch up to and surpass inflation. In addition, from the perspective of most U.S. DB plans (assuming they do not have cost-of-living adjustments for retiree benefits), higher inflation is associated with higher yield. Higher yield reduces the discounted present value of payments to retirees (the liability value) and results in higher funded status. Measured in nominal dollars, the present value of the amount owed falls, while the amount earned on assets goes up. In other words, higher inflation can mean higher funded status and lower funding gaps.

Now, let’s take a look at different ranges of cumulative inflation over a 10-year horizon and the associated return to different asset classes, to the value of the DB liability and to the relevant funded status for each of those ranges.

Historical Perspective (using Shiller CAPE data, 1910 through 2021)

Click image to enlarge

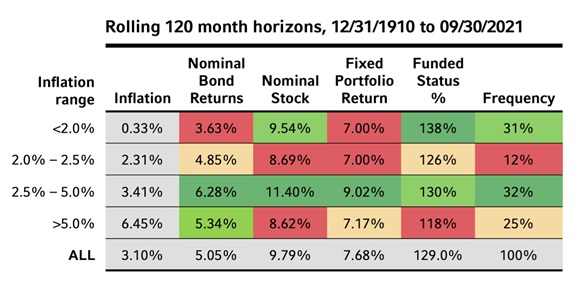

For the table above, we used over 100 years of inflation data. We measured cumulative inflation over rolling 10-year horizons for the period from 12/31/1910 through 9/30/2021. We then grouped those periods into four ranges of inflation shown in the first column. Within each inflation range, we then calculated the conditional average values of annualized cumulative returns to stocks, bonds, and to a 60/40 portfolio. Funded status is roughly estimated as the initial value (100%) times (1+CompoundPortfolioReturn)/(1+CompoundBondReturn).

The average inflation (for rolling 10-year horizons) was 3.10%, with average stock returns of 9.79%. The average bond return was 5.05% and the average funded status grew from 100% to 129%. Inflation was between 2.5% and 5.0% about 32% of the time. Within that range, the average stock return was 11.4%, bond return 6.28% (both higher than the overall average, and funded status 130% (slightly higher than the overall average). About 25% of the time, inflation was in the highest range (> 5%), stock return was still 8.62% and bond return 5.34%. With the lower stock return and higher bond return, the funded status is notably lower (118%) than the overall average.

Next, let’s examine the range of future possibilities using Russell’s strategic capital markets forecasts.

Russell Investments’ forecasts as of 12/31/2021

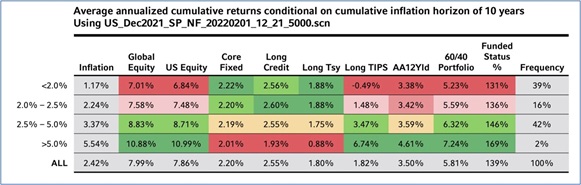

Click image to enlarge

The table above shows statistics based on 5,000 random paths drawn using Russell Investments’ most recent strategic capital markets forecast. Looking forward, the higher inflation ranges are associated with higher equity return, but lower bond return.

That combination of higher equity return and lower bond return is the reason inflation can be good news for a DB plan’s funded status. Bond returns are depressed because yields are currently low, and as they rise (with higher inflation) the price decline depresses total return. At higher levels of inflation, the higher stock return, lower bond (and liability) return results in higher funded status.

The bottom line

While there’s no dismissing the immediate pain to consumers and retirees associated with high inflation, there is a potential silver lining for DB plans. That said, inflation increases, rate increases and geopolitics simply add complexity to the already challenging job of institutional investing. In the midst of this complexity, make sure you choose a strategic partner who has the historic perspective, a holistic approach and the right set of capabilities to help you reach your desired outcome.