Principles to navigate volatility – for advisors

Periods of crisis—such as the one we are arguably living through now—can provide the greatest opportunity to deliver valuable guidance to your clients. When markets are volatile and investors are nervous, your ability to help them weather the turmoil is key. This is the time to solidify in their minds that you are the person to steward their family’s legacy for the generations to come.

But you too might have concerns as markets zigzag, interest rates climb, commodity prices soar and inflation spikes. So, to help you keep your wits, here are six principles that advisors must never forget during times of extreme market volatility.

Principle 1 – Volatility is opportunity in disguise

The best time to be opportunistic is when markets are volatile.

Put your cash to work

The same businesses that were trading for ultra-high multiples last year are now trading at incredible discounts. Cash generally creates a drag on your overall investment return. But cash also allows you to remain opportunistic in bad times. However, that only works if you are actually opportunistic when bad times occur. If you continue to linger on the sidelines while bonds, stocks, currencies and assets trade at great discounts then why were you holding cash in the first place? This is the moment your cash has been waiting for!

Don’t let emotion shove logic to the side and ruin the potential of your cash reserves.

Take advantage of Mr. Market

Let’s consider what famed value investor Benjamin Graham said about how you should interact with the market:

Think of Mr. Market as your business partner. Everyday Mr. Market knocks on your door to offer you shares in his business. Somedays Mr. Market is overly enthusiastic, and he offers you an outrageous price for shares in his business. Other days he is a complete depressive and gives you a great bargain. Somedays he’s even-keeled and gives you a fair, rational price.

How should you interact with your business partner Mr. Market?

You have three options:

- If Mr. Market is depressed and offers you a ridiculously low price, you buy more shares of his company, increasing your ownership in his business.

- If Mr. Market is excited and offers you a ridiculously high price, you sell your shares back to him and cash out.

- If Mr. Market offers you a fair and reasonable price, you do nothing. Continue owning what you own. Sooner or later Mr. Market will change his mind, and you’ll be able to take advantage of the situation.

Advisors, you know this. Help your clients understand that market downturns are an opportunity to deploy capital.

“Be fearful when others are greedy and greedy when others are fearful”

~Warren Buffett

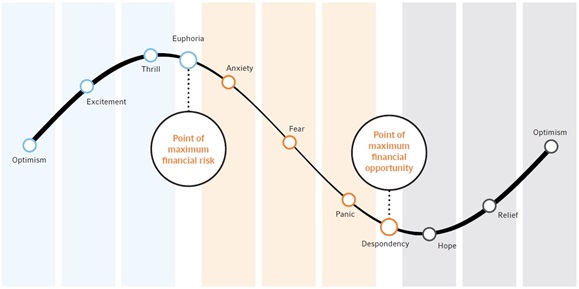

Click image to enlarge

Principle 2 – Reposition, don’t abandon

I’m amazed at how many advisors have called me asking if they should move to cash to redeploy later when the markets calm. Many clients have been asking their advisors recently if they should try to time the market this way. In turn, those advisors have called their wholesalers with the same question.

Here’s my advice as a wholesaler: use this volatility as a gift to reposition your assets, but please for the love of all things don’t abandon the game.

Stay in the game – rebalance

Rebalancing is slightly counterintuitive. Essentially you are saying, let me sell the things that have done great in my portfolio, to buy more of the things that have performed terribly in my portfolio.

This is a tough one for clients to understand. But that is why it is so important, because the counterintuitive nature of rebalancing makes it a behavior few engage in. Therein lies the opportunity for you as an advisor.

When we rebalance, we bring our portfolio back into alignment with the strategic allocation that we’ve targeted for the long term. By doing this, we maintain the risk profile of the portfolio, and potentially increase its long-term performance.

Instead of moving to cash, explain to your clients how you’re going to strategically adjust their portfolio weights, right when Mr. Market is depressed. Show them there’s a game plan for volatility. Rebalancing is where it starts.

Passive exposures have costs

When you are a passive investor, you are the majority investor. While this can be additive during bull markets, bear markets tend to punish the majority investor more than they do the investor focused on fundamentals. In a bear market, the excess gets sucked out and you are left with what the market believes the true value of each security to be.

Market-cap weighted portfolios can become wildly skewed away from underlying fundamentals, for quite long periods of time. During Fed-fueled monetary expansions such as we have seen in recent years, passive exposures can be more attractive than active exposures based on fundamental analysis.

But valuations do matter in the long-term. Mean reversion is real. It is in moments like this we remember why owning active portfolios can be advantageous for long-term capital.

Active managers will never be irrelevant

Over the last decade there’s been a lot of talk suggesting that someday the entire market will be made of passive benchmark-hugging funds. As a species we will ascend above the evils of active management and arrive in the land of perfectly passive, cap-weighted portfolios.

Okay, let me burst your bubble.

Who sets asset prices? Answer: active managers. The only people doing the job of researching assets are active managers utilizing fundamental analysis to determine what the price of an asset should be, in a reasonable, rational world.

Passive investors need active investors to determine the base, fundamental prices of the securities they’re buying. Though monetary expansions can (massively) distort the prices of our businesses and assets, underlying fundamentals remain true long-term, through booms and busts, and through all monetary environments.

This volatility is an incredible chance to consider repositioning your assets away from an all passive, cap-weighted exposure into active managers. During monetary contractions valuations will matter more.

Principle 3 – Losses have value. Harvest them.

Downturns in the market provide the opportunity to pick up free tax credits that can be enjoyed for years and years to come, making them worth multiples of what they’re worth when you harvest them. But many advisors aren’t fully taking advantage of this.

Tax-managed is best

Ask yourself, how many of your non-qualified portfolios are engaging in tax-loss harvesting right now? Most advisors typically scratch their head and say, tax-loss harvesting should be done in December, right?

Wrong. You want to harvest losses whenever the market gives you the opportunity to do so. If your portfolios aren’t doing this, the time to reposition could be now. Let me tell you why.

Loss harvesting pays dividends

With tax-loss harvesting, you continue participating in all the market’s movements. But along the way you pick up a tax credit that you can use whenever it suits you. This has tremendous power.

If you stick to a disciplined rebalancing strategy, this means you will harvest gains regularly. It’s in the very nature of the action (buying low, selling high). Rebalancing triggers gains and this could increase a client’s tax liability, unless you harvested losses previously somewhere else, at another time. If you did, then the gains triggered by rebalancing can be neutralized.

Proactively harvesting tax losses means you have tax credits you can use to offset gains later on. This means you can harvest gains right at the exact moment when your top investments are trading at their all-time highs.

Selling high has consequences if you haven’t previously taken tax losses and banked the credits. Tax-loss harvesting doesn’t just reduce your tax liability, it also allows your rebalancing strategy to work more effectively, and without tax consequence.

Transition costs have lowered

Volatility can be a great opportunity to reposition non-qualified accounts into tax-managed portfolios.

The cost of transitioning a taxable portfolio has fallen as the market coming off its highs means embedded capital gains have come down. Thus, you can transition the portfolio at a lower tax cost.

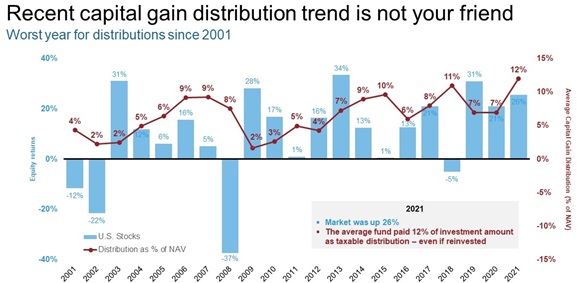

Many of your clients may be open to the idea of transitioning to tax-managed funds now, since capital gain distributions in 2021—and in turn, capital gain taxes—were the highest in 20 years.

Click image to enlarge

Source: Morningstar

U.S. Stocks: Russell 3000® Index. U.S. equity funds: Morningstar broad category ‘US Equity’ which includes mutual funds and ETFs (and multiple share classes). For years 2001 through 2020 % = calendar year cap gain distribution ÷ year-end NAV, 2021 % = cap gain distribution ÷ respective pre-distribution NAV. For years 2001 through 2013, used oldest share class. 2014 forward includes all share classes. Indexes are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

Your clients likely paid an ugly tax bill last year if their investments weren’t managed for taxes. Volatile markets give you a chance to reposition assets so you can solve that problem going forward.

Why would you not take it?

Principle 4 – The market is a weighing machine long-term

“In the short run the market is a voting machine, but in the long run the market is a weighing machine.”

-Benjamin Graham, father of value Investing

Valuations matter

In the short term, markets can behave irrationally, but over full market cycles the valuations of companies do tend to matter. The portfolios that are experiencing the worst swings currently are those that became furthest detached from valuations during the past few years of monetary expansion.

Popularity fades

“Only when the tide goes out do you discover who’s been swimming naked.”

-Warren Buffett

The companies that were darlings of the market a few months ago have been brutally punished. NFTs have crashed. Cryptocurrencies have crashed. Stablecoins like Terra and Luna have lost 99% of their value (something that shouldn’t have happened). Speculative investments move against you quickly, and they can bite hard. Many do-it-yourself investors have felt the sting of improper money management.

Advisors, this is an incredible opportunity to gather assets. Popular investments garner attention, news headlines and euphoric, cult-like followings. But long-term professional money managers keep their eyes on fundamentals.

The magnitude of recent swings likely has caused some self-directed investors to wonder if they’re properly positioned. They may now be more receptive to the idea of utilizing professional money management for their hard-earned capital, and their family’s legacy.

Let the ashes of their recent misfortune be the embers from which new relationships form. Go back and knock on the doors of all the DIY investors who turned you down and said they knew better. Offer your help again. I think you’ll find that for many, their tune has changed.

Principle 5 – Defense is offense in asset management

When you speak with professional money managers, their mindset often centers more around risk management than return generation.

Adopt an institutional mindset

Structure your investment strategy like an institutional manager. CIOs of institutional capital, such as sovereign wealth funds, endowments and pensions think about their investments very differently from how many retail advisors invest.

Institutional managers think more in terms of the relationship between their assets and their liabilities.

“How should I allocate my existing assets to give me the greatest chance of successfully funding all of my future bills forever?"

There are many ways to fund your future liabilities. The question is which one gives you the greatest chance of success? Answer: it will be the one that gives you the necessary rate of growth, with the least amount of risk.

Risk management then is truly the key. Managing purely for growth and ignoring risks might give you higher investment returns, but it could lead to extreme drama such that you are more likely to make an emotional decision that is precisely the wrong one, at the wrong time.

Alternatively, a portfolio that is managed for risk first attempts to avoid the worst traps that could lead to permanent destruction of capital. It narrows the range of possibilities (both good and bad) and by doing so gives you a greater chance of hitting the target over the long term.

“Nowhere does it say that investors should strive to make every last dollar of potential profit; consideration of risk must never take a backseat to return.” -Seth Klarman

Advisors, I implore you, build portfolios that are properly diversified. Pay attention to valuations. Give your clients the highest probability of success at funding all their future bills.

Don’t be a return chaser or performance junkie. Think like a sovereign wealth fund manager. Think like a pension fund manager. Build investment portfolios for long-term, full market cycles.

Principle 6 – There’s no such thing as too much communication

Finally, let’s discuss the most important principle to remember in times of extreme volatility. You can never overcommunicate.

Get out in front – lead

If you are an advisor, you need to get in front of the issues and be a leader to your clients during this volatile time. They’re counting on you to take the reins and tell them what’s going on.

A lot of data right now suggests that clients are actively searching for terms like inflation, rising interest rates, recession and so on more than they have in the last few years. Your clients are wondering about what’s going on in the markets, even if they’re not actively calling you on the phone.

The secret weapon for advisors

One of the easiest ways to capitalize on this opportunity is to host frequent virtual client webinars. Most advisors I talk to day-to-day aren’t doing this at all. They react to in-bound calls from nervous clients. But they don’t proactively schedule webinars to give answers.

I am doing many client webinars for my advisors right now. And guess what? They’re working. Clients dial in and in 20 minutes get a market update from me and the advisor. They can type questions into a chat box and get live answers from a professional money management company. It’s valuable. They appreciate it. It makes you look great, and it will lead to investment conversations with your clients.

Reach out to your Russell Investments regional team today and ask them to host an Economic & Market Review client webinar for you. We are all well-trained to deliver high-quality, client-friendly information that will make you look like a rock star!

One-on-one client meetings

By far the most effective tool in your arsenal is and always will be a scheduled conversation. Scheduled discussions (not random check-ins) that have a purpose and an agenda are the most effective tool you can use to be a better advisor, and to be a better businessperson.

This is where advisors can learn a thing or two about the wholesaler’s business. The wholesaler and the advisor have very similar businesses, with slight differences. Wholesalers typically have 15-25 scheduled meetings per week—in person or virtually. This is just their normal state of play. Sometimes we can have weeks with more than 30 meetings. We are engaging in conversations all day long.

Volatile times are a perfect opportunity for advisors to think like wholesalers and schedule as many 1:1 virtual or in-person meetings with their clients as possible. Tell them about all the great work you’re doing behind the scenes (rebalancing, tax-loss harvesting, etc.). Make suggestions on how you think you can take advantage of the volatility (transition to tax management, reduce cap-weighted exposures, etc.).

Be active during volatile times. Stack your calendar with meetings and watch your client satisfaction rise, and, hopefully, your AUM accelerate.

The bottom line

Times of crisis are the greatest opportunities to create positive, lasting value for your clients. This is when you earn your money. Here is a quick summary of the principles of volatility management.

- Volatility is an opportunity in disguise. Take advantage of Mr. Market while he is depressed and put your cash to work.

- Reposition, don’t abandon. Use volatility to prune successful investments and buy more of the investments that are trading at discounts. Rebalance.

- Losses have value. Harvest them. Reposition your taxable assets into portfolios that are actively tax managed. Take advantage of lower transition costs to migrate client capital out of tax-egregious investments.

- The market is a weighing machine long-term. Over the long term the market reverts to the mean. Utilize active portfolios that stay closer to underlying fundamentals to dampen the drama of the client’s investment experience.

- Defense is offense in asset management. Think like an institutional money manager and reassess the way you manage for risk. Adopt portfolios that give your clients better chances of success over full market cycles.

- You can never overcommunicate. Schedule webinars and personal meetings with clients to discuss your game plan for the volatility. Stack the calendar.

Stick to these principles and you will find that the most volatile moments in the markets have the potential to become your most profitable years as an advisor.