What are the key changes in our recent ETF reconstitution?

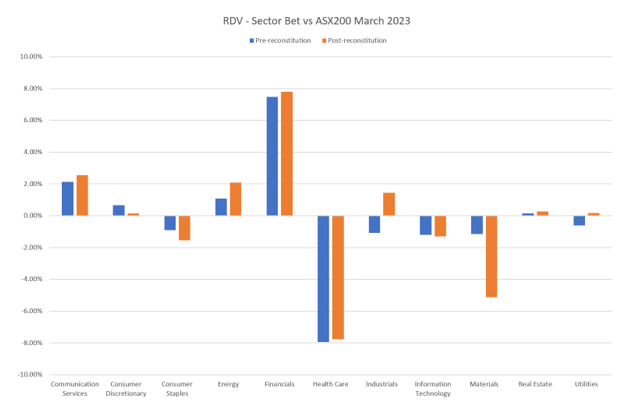

RDV: Reducing exposure in the materials sector

The major theme in RDV’s rebalance was a reduction in exposure in the materials sector. BHP and Rio Tinto were the two significant sells in the sector, having their weights reduced by approximately 1% and 2% respectively. Relative to last year the outlook for dividends from both companies has reduced, and as such the dividend growth outlook has weakened. Further, heightened earnings volatility has reduced the overall attractiveness for both companies from a future dividend perspective.

Exposure to the industrials sector was increased, via Downer EDI. Downer EDI is attractive from a future dividend growth perspective, whilst having relatively low earnings volatility. Both of these metrics are a key input to RDV’s methodology, which focuses on future dividends and potential volatility in future dividends rather than backward looking dividend yield metrics in isolation.

Source: Russell Investments

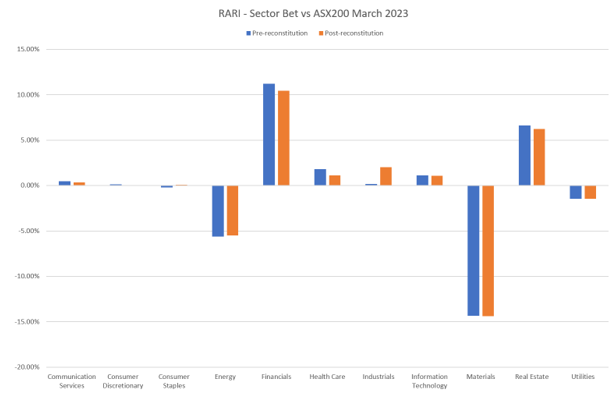

RARI sees modest reductions

RARI’s rebalance was lower turnover relative to RDV (approximately 8.5% vs RDV’s 10%), with modest changes to sector allocations. Exposure to the industrials sector was increased, mostly due to stock specifics rather than a sector-wide theme, through buys in Computershare and Worley. Based on our proprietary Material ESG score1, which is an input to RARI’s methodology, both stocks have better than average ESG characteristics2.

The Real Estate sector saw a modest reduction, as both Charter Hall Retail REIT and Growthpoint Properties Australia were reduced; both stocks having below average Material ESG scores.

Post rebalance, RARI has a Material ESG score approximately 15% higher than that of the ASX200 index, indicating a tilt to those companies which have a better than average ESG characteristics.

Source: Russell Investments

1 Further details of our Material ESG scoring approach and methodology is contained in our research paper Materiality Matters: Targeting the ESG issues that impact performance – the Material ESG Score.

2 For detailed information on RARI's methodology and investment exclusions refer to the PDS, available at https://russellinvestments.com.au/disclosures.