What steps should DB plan sponsors consider taking ahead of a potential recession?

Is a recession lurking around the corner in 2023? If so, how might it impact defined benefit (DB) plan sponsors—and what steps, if any, should they consider taking?

To shed some light on these burning questions, we recently sat down with Chief Investment Strategist for North America, Paul Eitelman, and Senior Consultant Mike Sylvanus. Below are their answers, edited for length and clarity.

Q: Do we think a U.S. recession is likely in 2023?

Paul Eitelman: Economists are notoriously bad at forecasting recessions, but the combination of an overheating labor market, elevated sticky inflation and a Federal Reserve (Fed) that appears committed to restoring price stability at any cost suggests recession risks are much higher than normal right now. We assign a 55% probability of an economic recession in the United States over the next 12 months.

The speed of the hiking cycle—the fastest since the Paul Volcker (former Fed chair) era in the early 1980s—and the associated sharp tightening of financial conditions amplifies these concerns. Current economic data is mixed. Leading indicators—like manufacturing orders—are already contracting. But more coincident and lagging data like nonfarm payrolls are still demonstrating resilience. This is normal for a late-cycle slowdown, and the Fed’s obsession with delivering a slowdown in labor markets and wage inflation risks the central bank overtightening into a policy mistake.

Q: What’s our central scenario for the next economic downturn?

Paul Eitelman: The median peak-to-trough real GDP (gross domestic product) decline in post-war U.S. recessions has been around 2.5%. Our assessment is that the next U.S. recession is likely to be more moderate (i.e., a real GDP decline of 2% or less) rather than a crisis. Full-blown crises tend to be driven either by large shocks (e.g., COVID-19) or large imbalances. While the U.S. labor market is overheating and imbalanced, the picture more broadly across the U.S. economy looks relatively benign. Banks are well capitalized, household debt levels are not excessive and business investment is not excessive relative to cash flows. Additionally, corporate debt levels—while elevated—are unlikely to pose an immediate systemic threat, given interest expenses are low relative to profitability and companies, generally, termed out their maturities in the low-yield environment from 2020 and 2021.

We are, however, more concerned about the vigorousness of the recovery out of the next recession. This is because there is a tendency for U.S. policymakers to fight the last war. In 2020, for instance, policy stimulus was extremely aggressive—given the nature of the pandemic and the lessons learned from the Global Financial Crisis (i.e., that fiscal policy could have done more to support the recovery). A headwind to consider, particularly if the midterm elections result in a divided government, is that policymakers might be more reluctant to stimulate—both in terms of speed and magnitude—given that one of the lessons learned in the post-COVID period was that government support contributed to the current high-inflation problem.

Q: How might this moderate recession affect markets?

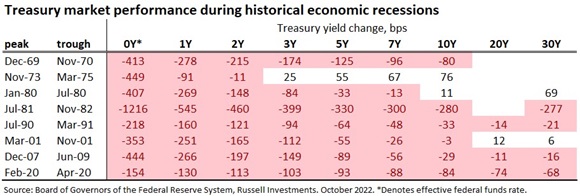

Paul Eitelman: We expect the Fed to keep hiking policy rates up to a level of around 4.5% by early 2023. Longer-term interest rates are forward-looking and already embed much of this expected tightening. While the Fed is warning investors that it might remain restrictive for some time, history suggests that both the central bank and longer-term interest rates could fall from the start to the end of the recession. If the recession is somewhat more severe or if inflation falls quickly in response to economic weakness, it would not be too surprising to see the Fed cut its policy rate all the way back down to zero again in time.

In equity markets, clearly a decent amount of the damage has already been priced in. The S&P 500® Index is down roughly 25% from its peak in early 2022. And our aggregation of different measures of investor psychology shows a significant degree of pessimism already. Nevertheless, the crystallization of a recession from a probability to a reality would likely inject more downside volatility into equity markets. While it is hard to be precise on exactly how low equities can go, a further 10% decline in equity markets would bring this episode more closely into line with historical recessionary drawdowns and would likely push equity valuation multiples closer to levels that we would consider to be cheap.

It is useful to remember, however, that the market isn’t the economy. Recessions are often a great time to get invested—if you aren’t already. Equity-market bottoms normally form three months before the recession is over. Put differently, markets typically anticipate the bottom in the economy before it actually happens.

Q: When do we see the next downturn occurring?

Paul Eitelman: I wish I knew. It is easier to say we are late-cycle than to say exactly when the downturn will occur. In gauging where we are in the business cycle, the state of the labor market (i.e., is it overheating or not) and the stance of monetary policy (i.e., is it accommodative or restrictive) are useful signposts. Both suggest we are late-cycle now. Inversions on the Treasury yield curve send a similar message. But the lead times from these warning signs onto an economic recession can be long and variable. My suspicion is that the transparency and speed of the transition to a restrictive Fed stance will speed up those historical relationships. So as a best guess, a recession starting in the first quarter of 2023 might be a reasonable starting point to consider.

The resiliency of U.S. labor markets is the biggest challenge to this view right now. Some of that likely reflects the scarcity of qualified workers and labor hoarding. However, if the economy slows further and corporate profits start to contract, that should impose some tough discipline on hiring and firing decisions. CEOs are very pessimistic already—they just haven’t acted on it in a meaningful way (yet).

Q: How might a recession impact DB plans?

Mike Sylvanus: Our experience this year is that while all asset values have dropped dramatically, so has the value of the liability due to the dramatic increase in interest rates. While the impact depends on the details of each plan, the funded status for most plans has either remained stable or improved. For the mild-to-moderate recession scenario outlined above, a decline in asset values would likely result in a drop in the funded status of pension plans. If the Fed succeeds in its goal to temper inflation (via a mild-to-moderate recession), then it would mean it raised rates just enough, and a subsequent adjustment downward might not be needed. Of course, any downward adjustment in yields to address a recession would further impact the funded status.

Q: If it’s a deep recession, and equities sell off further, this would harm the value of assets, right?

Mike Sylvanus: Yes, and a deep recession might lead the Fed to easing, in which case yields would drop and liabilities would also increase—leading to a steeper drop in funded status.

Q: U.S. equities are now solidly in a bear market—going by either the S&P 500 or the Dow Jones Industrial Average. What, if any, steps should DB plan sponsors be considering?

Mike Sylvanus: We generally recommend changes to a DB plan’s asset allocation only if there’s a change in the parameters of the plan itself (e.g., the plan is closing, freezing or a pension risk transfer is occurring) or if there’s a dramatic change in funded status.

For plans which have experienced a large INCREASE in funded status this year (due to a low hedge ratio and rising rates), we would suggest it’s time to seriously consider increasing the hedge ratio, by either shifting assets from return-seeking to hedging and/or increasing the duration of the fixed income portfolio.

A second consideration for a few plans is what to do with the illiquid assets which haven’t (yet) experienced the level of declines seen in the rest of the portfolio—meaning their allocation has drifted upward, often above policy ranges. For these plans, we see a few options, none of which are very satisfying.

- Adopt wider ranges on the policy allocations for illiquid assets—either temporarily or permanently. This might require adjustments to the investment policy as a whole to segregate the liquid assets from the illiquid assets.

- Many plans have been considering a higher allocation to illiquid assets. This provides an opportunity to adopt such a change immediately—although we believe it should be accompanied by the appropriate asset/liability analysis that would be used to support any policy change.

- Reduce the allocation by accessing the secondary market. A challenge with this approach is finding secondary buyers who will pay the desired price—in a market where everything else being actively traded has declined. Accessing the secondary market in this environment might produce bids which are a preview to markdowns for the illiquid portfolio as a whole.