Russia/Ukraine: What are asset managers saying and doing?

When it comes to the Ukraine invasion and its impact on markets, what are the views of asset managers around the world?

Because of our unique relationships with independent money managers globally, Russell Investments has unique access into these views. Our manager research analysts and portfolio managers were in close contact with external managers and subadvisors as tensions increased along the Ukrainian border and finally boiled over into the full Russian invasion of Ukraine. The invasion was not part of the typical manager’s base-case scenario. And the first day of the invasion forced managers to update their beliefs and to consider how to manage direct and indirect exposures to Russian assets.

For those managers who maintained cautious optimism about buying cheap assets that had suddenly grown much cheaper—literally overnight—that optimism vanished when the G7 took the extraordinary decision to freeze Russian central bank assets, representing about one-half of the country’s reserves. This action was clearly a game changer that led most managers to deem Russian assets essentially un-investable. Most managers didn’t pivot into a generally risk-off posture post-invasion, though it has led them to consider a wider range of future economic states, as they ponder optimal portfolio construction.

Pre-invasion manager views

In discussions with managers, it appears that most thought that a full invasion was highly unlikely. A common view is encapsulated in this following manager quote from the end of January: “The probability of a full-scale Russian invasion and subsequent occupation of the majority of Ukraine is less than the media reports and what’s priced in the market.”

On the other hand, managers did not necessarily expect a fully peaceful situation in Ukraine. Another manager stated shortly before the invasion: “The situation in Russia and Ukraine is rapidly evolving and recent developments are an escalation beyond our initial expectations.”

Even for managers that were explicitly considering the risks of the invasion, this stance did not preclude them from still holding positions, especially in energy or materials companies that were viewed to be world-class in quality, supported by dollar earnings and strong commodity prices and already reflecting geopolitical risks in their valuations. Overall, most managers held underweight positions to Russia in benchmark-relative products, and most absolute-return products had limited direct exposure to Russia.

As the military build-up continued and President Biden announced on Feb. 18 that he was convinced that Russia’s President Putin had made the decision to invade, Russian equities traded lower and credit spreads widened. The following chart shows the normalized price trend of the main Russian stock index MOEX through Feb. 23, the day before the invasion. It shows a clear deterioration through mid-February, followed by a sharp drop after the Biden announcement.

Market participants bid up the price of Russian stocks on Feb. 25, following the first set of sanctions announced that were within expectations, and some took the opportunity to add selectively to Russian holdings. As one emerging-markets-focused manager stated, “We believe a significant amount of bad news is already priced in the market, with valuations near or below 2014 lows. We are mindful of the strong rallies Russia witnessed in previous experiences.” But then the situation changed dramatically over the weekend, leading to more of a crisis-management mode with respect to Russian investments.

The impact of the first weekend’s events on markets

Heading into the weekend of Feb. 26 and 27, many market participants appeared to expect a repeat of prior events, whereby limited sanctions would eventually be lifted after a return to relative normalcy (at least for non-Ukrainians). Instead of following the prior playbook, though, major economies aligned with the United States and Europe, opting to ratchet up pressure unexpectedly and very significantly by:

- Removing some key Russian banks from the SWIFT communications network, which is an integral part of normal global payment operations.

- Freezing Russian central bank reserves in major countries. Based on data released by the Russian Central Bank in 2021, it appears that about one-half of its $600+ billion in reserves are now inaccessible. Of non-frozen reserves, a significant percentage is in the form of gold that can no longer be easily converted into major currencies.

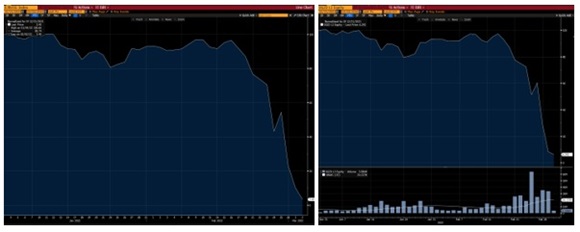

While the Russian MOEX has been closed since Feb. 25, Russian companies that have global depositary receipts (GDRs) listed in London traded actively until March 3, when the London Stock Exchange suspended trading in 27 companies with Russian ties. Prior to the suspension, many GDRs collapsed in price. Looking at the charts below, the chart on the left shows the performance of the Dow Jones GDR Index (measuring performance of Russian GDRs listed on the London Stock Exchange). It looks similar to the prior MOEX chart through Feb. 25, but then shows the extremely negative price action the week of Feb. 28 until March 3, while MOEX was closed. The GDR index is now showing an astonishing 97% decline since year-end. The chart on the right shows the price action of the largest constituent of the GDR index, Gazprom, which has shown a catastrophic downward move in price. The bar chart at the bottom also shows Gazprom’s severe tapering of trading activity.

For money managers that hold positions in Russian assets, these charts reflect the challenging environment they find themselves in. The price declines experienced in GDRs were dramatic, but so far are not being reflected in local prices due to the MOEX being closed. This created a wide disconnect between the prices reflected by local markets and the London-listed GDRs when trading was suspended. Current lack of tradability in Russian shares has left managers holding positions that represent nearly free call options on some Russian businesses, but shares in those companies are not currently tradable on major exchanges. Managers and asset owners who would like to divest of a wide range of Russian equities cannot currently do so, and they are now continually reassessing their investment views ahead of the eventual resumption of trading.

The path forward

It should be noted that the situation has been evolving by the hour as market participants digest the escalation in violence and sanctions in real time. Our managers have certainly become more bearish on Russia, but their views on the rest of the world are not necessarily much different than they were a couple of weeks ago. As one manager put it, “In the short run, the escalation of the situation is difficult to predict. However, history shows that despite near-term volatility, these types of events are generally not a detriment to longer-term equity market performance.” Outside of Russia, managers have not significantly adjusted positioning, and have not broadly de-risked their portfolios. Everyone is, however, assessing contagion risk and keeping a close eye on other potential geopolitical hotspots. It is also important to remember that, even prior to the volatility and fall in the prices of Russian assets, direct exposure to Russia was a relatively small part of the indices (3.3% of the MSCI Emerging Market Index and 0.4% of the MSCI All Country World Index as of Jan. 31, 2022). Therefore, the impact of the market price action on a diversified emerging-markets portfolio, let alone a global portfolio, is fairly limited at this time.

One can reasonably argue that recent events have no recent parallel, but the broader point is that fundamentals outside of Russia and Ukraine still appear to be good in a number of major economies. That said, several managers have indicated that there is a real risk of a commodity spike that could lead to further inflationary pressure that could, in turn, lead to a higher probability of a hard economic landing.

While the base forecasts for many managers may not have changed much, we do get the sense that managers are less certain about their forecasts. This may not impact positioning at a high level, but it might lead to adjustments to the types of investments held in portfolios. As always at Russell Investments, we are committed to dynamically managing both risks and opportunities on behalf of our clients. And to keeping you informed as well.