With the passage of the

Tax Cuts & Jobs Act and April 15 deadline in the rearview mirror, many advisors have moved on from thinking about taxes. But taxes have not gone away and helping clients invest smartly around taxes is an

excellent way for advisors to differentiate themselves from their peers. And while most focus on the impact to individuals and families and their tax situation, taxable trusts are an

additional area where advisors may be able to find new clients.

Why spend the time to understand tax-smart investing and taxable trusts?

- Of the $18.7 trillion in open ended mutual funds, $8.6 trillion reside in taxable accounts.1

- In 2016, there were more taxable trust tax returns filed (3.2+ million) with the IRS than C-corporation tax returns.2

Parts of a taxable trust

Trusts are often established to assist families to reduce the gift or estate taxes while

passing wealth to children, grandchildren or other beneficiaries. But not all trusts are taxable at the trust level.

Form 1041: The federal tax return used to report income for the trust. Similar to the Form 1040, but for trusts – not individuals.

Grantor Trust: A grantor trust typically means that the grantor (creator) of the trust still enjoys certain discretion over the assets. The grantor

retains control of the assets. In a grantor trust, any investment income is generally included in the grantor’s tax return – not a separate tax return.

Irrevocable Trust: An irrevocable trust represents the grantor (creator) placing the assets in a trust and losing direct control or rights to the assets. As labeled, the decision is irrevocable – it can’t be reversed. This type of trust will typically have a separate tax return (Form 1041) and any income/gains not distributed to beneficiaries will be taxable to the trust.

Form 1040/1041: Why does it matter?

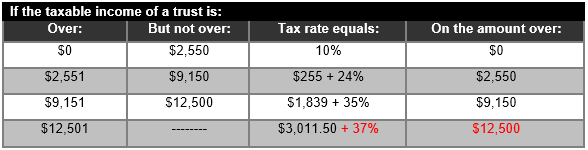

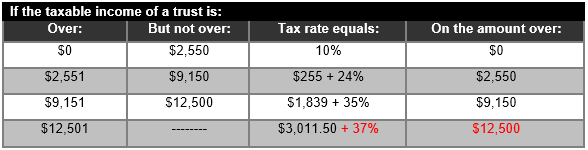

The tax rates are vastly different between trusts and

individuals with the rates for taxable trusts (Form 1041) causing the taxpayer to fear the reaper.

Uncle Sam takes a sizable chunk for trusts.

Under the new tax regulations from the Tax Cut and Jobs Act, both individuals and trusts have the same top marginal tax rate, but

trusts cross the top rate with taxable income above only $12,500. A married couple (tax status Married Filing Joint) will not cross the top rate of 37% until their taxable income crosses $600,000 - $587,500 difference!

And a married couple would cross the 24% marginal tax rate at taxable income above $165,000 while

the taxable trust hits 24% with taxable income above only $2,550. It does not take much of a portfolio size to cross $2,550 is taxable income. Consider a trust with assets under management of $55,000 that had a 5% capital gain distribution. If short term in nature, the taxable income would be $2,750 and crossing into the 24% marginal tax rate.

Source: Internal Revenue Service

Net Investment Income Tax

The

Net Investment Income Tax is the 3.8% additional tax tied to income that is earned passively to include the interest, dividends and capital gains – the type of income recognized from investments. A married couple (MFJ) would get the honor to pay this tax when Modified Adjusted Gross Income (MAGI) exceeds $250,000. But

taxable trusts get this honor with MAGI above $12,500. Another material difference impacting trusts.

How to address

With progressive tax rates such as these, the investment approach clearly should be tax-smart and not be the same as used for qualified (IRA, 401k) assets. Successful tax-smart investing will be very aware of both the source and character of investment returns. In discussions with trustees and those responsible for taxable trusts, there are certain characteristics that help achieve leverage/scale and be more successful with taxable trusts:

- All assets to be in one account

- Consolidated performance reporting

- Consolidated 1099

- No K-1's. The timely receipt and tracking of K-1’s often is the cause of filing an extension to push off the filing date (Remember the filing date is extended, but not the taxes due)

- A focused, proven tax-smart investment strategy

- Diversified fiduciary approach

The bottom line

Tax-smart investing should be a key consideration for the creation and ongoing management of taxable trusts. It’s likely that you know someone who is already part of a trust or considering the creation of a trust. You probably also know a fiduciary, beneficiary or tax-preparer of trusts. A little bit of knowledge in this area may help you identify taxable trust opportunities in conversations with your clients and prospects.

Source: Internal Revenue Service

Source: Internal Revenue Service