What the pandemic has taught me

Everything changed for me, my family and everyone I know in March last year. We were plunged into working from home, remote learning and lockdown life for the first time.

Fast forward to today. As I reflect on those early days, I want to make sure that I have learned from these experiences and bring the best bits into my ‘new normal’.

I made a promise to myself during that period when we were all essentially confined to our homes, that when I returned to seeing clients, I was not going to do the same stuff as before the pandemic. When I speak to financial advisers, they feel the same way. I want to share some insights from my 430+ days working from home that I think every adviser needs to keep in mind during the great “reopening.”

Have a process

The advisers who thrived in 2020 were the ones who had a process. What do I mean by that? They had a morning ritual. They set up their day. They were intentional about what they did and not just reactive. The best advisers know what activities are most important to their business and prioritise them. Do you as an adviser take 10 minutes every morning to figure out what you are going to do for the day? Think about it. If you took just 5 percent of your workday or roughly 4.8 minutes and planned your next moves, what would change?

If you struggle with this kind of planning, there are many great tools available. I personally use the "Daily Manifest" by Jack Butcher, but I am sure you can find others with a quick search on the internet. If you are struggling to identify which activities you need to be doing, may I recommend “The Index Card Business Plan” by Brian Margolis. You can also reach out to someone at Russell Investments and we can help you with planning your day and discussing what activities elite advisers spend their time doing.

Be more empathetic

I think we have all changed over the past year. A lot of people have struggled both mentally and physically with the restrictions imposed due to the pandemic. Advisers who have done well have been in constant contact with clients. I recently reread “Supernova Adviser” and they suggest an adviser should have at least 12 “touches” with clients every year. I agree and believe these should be soft touches. What do I mean by that? I mean the phone call shouldn’t start out with the phrase “let’s talk about performance”, but rather ““How are you doing?” Calling clients on birthdays or just calling them because you care, can make a world of difference. Clients do not often leave advisers they like. Everyone needs someone to lean on. Be that person for your client and their family.

Be more efficient

My biggest takeaway from last year was how inefficient I was. For example, I realised I had been driving to appointments with clients when a call would have sufficed. I was scheduling one-hour calls instead of 30-minute calls. People don’t want to be on a call for an hour – if they say they do, they are lying. I also realised I was spending time doing “busy work” instead of making time for myself. How many times have we all thought “I am too busy to take five minutes for myself”? Ask yourself: Are you too busy or are you “wasting” your time? Could that conference call be done in 30 minutes instead of one hour? Could I do six calls today and have some time tomorrow to exercise? If you are able to streamline your day, everything becomes easier. Zoom, Teams or Skype are all useful tools to leverage your time. Be an expert on that technology. If you need help, reach out to your Russell Investments representative.

Spend time with the right clients

This time off the road has also allowed me to spend more time with my best clients. Since I was not stuck in traffic, I was able to do more case consultation with them. That allowed my clients to be better prepared and to close more business. I was also able to spend more time with my Centers of Influence (COIs) and with more available time I was also able to develop more COIs.

How many times before the pandemic hit did you take an unscheduled call from clients? When you took that call what happened? I know what happened: your day went sideways and you did not complete the tasks you had intended to complete.

If you are able to spend more time with your best clients, you will get to know them better, you will get more referrals and finally you will just have a better relationship with them. If you have not segmented your client base let us help. Remember the 12 touches I mentioned earlier? While you can’t do that for every client, you can for your best clients. But how can you if you don’t know who your best clients are? If you don’t know who your best clients are or what your 50/5 is (the half of your book of business that represents 5% of your revenue) let us help you out. We could do a Custom Business Analysis for you.

It is all about behaviour management

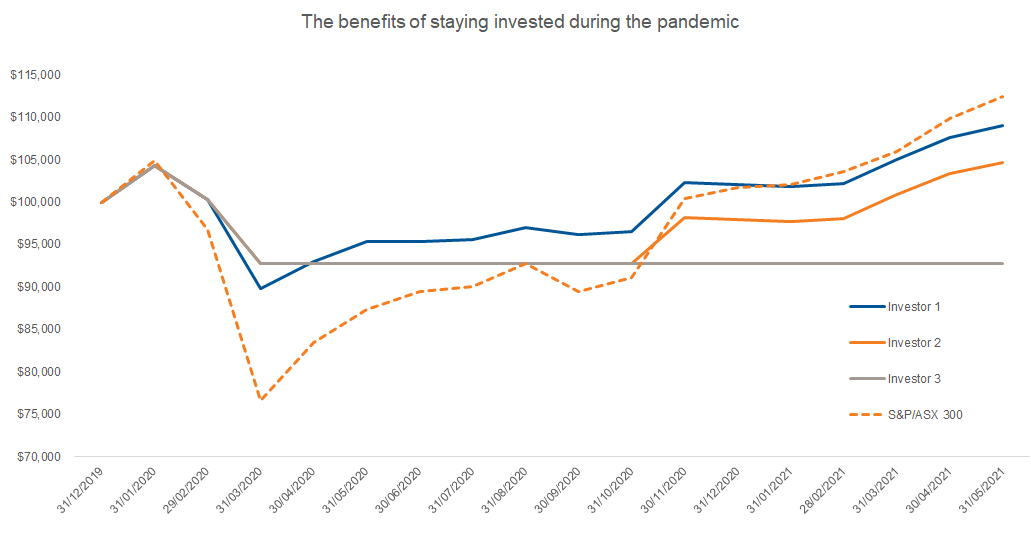

I have always believed the biggest detriment to a client’s return has been themselves, but the past year has just reinforced that belief even more. The month of March 2020 was definitely one of the hardest months in the business I have ever had. Not only was I trying to help my clients stay the course, I was trying to help my family stay the course. Was I scared? Yes. Anyone who tells you they weren’t scared during the first few weeks of the pandemic is lying. In the early days of COVID most of us did not even want to go outside. I remember going into a store on 21 March and seeing most of the shelves empty. I had never seen that before. I was scared and the questions I was getting from my kids were even scarier, but I knew we would get through it. Did I think the recovery would be this quick? Never, but I did understand that if you get out of the market you better have a plan to get back in. If you look at the graph below you can see what happened if you go out of the market or if you waited to invest when things felt “better”. I am not sure what better even means.

Click image to enlarge

| Comparison of 3 investors with starting portfolio of $100,000 1 January 2020 to 31 May 2021 | Portfolio value (31 May) | Portfolio return |

|---|---|---|

| Investor 1 - Stayed invested in Balanced Portfolio | $108,986 | 9% |

| Investor 2 - Switched from a Balanced Portfolio to cash in 15 Mar 2020, re-invested into a Balanced Portfolio 1 Nov 2021 | $104,617 | 5% |

| Investor 3 - Switched from a Balanced Portfolio to cash in 15 Mar 2020 and stayed there | $92,706 | -7% |

Source: Morningstar Rebalance monthly Balanced Portfolio: 30% MSCI World NR AUD, 30% S&P/ ASX 200, 12.5% BBgBarc Global Aggregate TR Hdg AUD, 12.5% BBg AusBond Bank 0+Y AUD, 5% FTSE EPRA NAREIT Dev TR AUD, 5% S&P Global Infrastructure NR AUD, 5% Cash. For illustrative purposes only.

If as an adviser you were able to keep clients invested for all of last year, you should be proud of yourself. We saw that some of our most experienced advisers had done such a great job of educating and preparing clients for periods of volatility, that when markets fell – their clients remained calm, confident and importantly – remained invested. Indeed, our annual Value of Adviser Report has shown every year that the adviser’s role as a behaviour coach provides value over and above the typical adviser fee. For details into our report, please request a copy of the report.

Reading and investing in yourself and your family

I have always been a big reader, but I read more books last year than ever before. Some of my favorites include: “Thinking in bets”, “Never split the difference”, “Around the year with Nick Murray”, “ Think twice” “The little book of behavioural investing”. All of that education allowed me to turn off the TV and reenergise.

A silver lining from COVID was that I was able to spend a lot more time with my family. Those of us in the investment industry sometimes forget why we do what we do. COVID made me slow down and appreciate the people around me. All of that allowed me to be energised for my next morning. Even as I return to in-person meetings and a more normal work environment, I plan to make sure I continue to block off time for myself and my family. When the end is near, I doubt anyone regrets not working more.

I know none of these ideas are revolutionary, but good ideas never are. Pick one or two and really embrace them and try not to waste what we have learned from the past year and a half.