Are your clients prepared for a potential recession?

Let’s face it, the last three years have been challenging for investors. The global pandemic has had a domino effect on so many aspects of our lives. In one way or another, we have all faced:

- Health risks – the ongoing possibility of contracting the COVID-19 virus

- Inflation risks – prices of goods and services are rising globally

- Struggles in the bond market – the traditional anchor to a balanced portfolio, bonds have fared poorly this year due to inflation and rising interest rates

- Repricing of growth assets – declining liquidity, slower economic growth and persistent inflation hurting equities and other growth assets

- Geopolitical risks – the war in the Ukraine, a deepening political divide in both the U.S. and Canada, and growing food and supply shortages

Meanwhile, we all face our own personal struggles. Life happens, whether we are prepared or not.

Add to this list of ongoing concerns the increasing risk of a global recession and you can see the challenges investors are facing on their path towards financial security. Inflationary pressures and the aggressive pace of tightening by many central banks—including the Bank of Canada and the U.S. Federal Reserve (Fed)—is raising the risk of a global economic downturn. We believe recession risks are rising but are more concerned about Canada and non-U.S. regions. Unlike the U.S., Canada has overleveraged households and inflated home values. Internationally, extremely elevated natural gas prices are constricting growth. It's likely your clients are worried.

But while many of the risks outlined above are outside of your control, preparing clients for the potential impacts of a recession is something that you can help with.

Remember—you can’t control what the markets are doing, but you can control your reaction to what the markets are doing. Here are some key considerations to keep in mind while helping your clients prepare mentally, emotionally, and financially for a potential recession.

What does their emergency fund look like?

- General guidance suggests it should cover three to six months of essential expenses

What is their employment situation?

- Are they a dual-income household working in an essential service?

- Or are they a single-income household dependent on an industry likely to feel recessionary pressures?

What does their investment portfolio look like?

- Is it a broadly diversified portfolio encompassing stocks, bonds, and alternatives globally?

- Or is it a highly concentrated portfolio focused on a particular asset class sector, style, or security?

How does their portfolio line up with their risk tolerance?

- Is their portfolio 80% stocks when they describe themselves as conservative investors?

- Or is their portfolio a 60/40 balanced allocation in line with their risk profile as balanced investors?

What is the state of their financial plan?

- Do they have a plan of record?

- Do they know where they stand in relation to meeting their long-term goals?

- Is their plan built with the understanding that there will be both growth and recessionary periods over its lifetime?

Based on these considerations you can assess your clients’ recession readiness and can offer advice and guidance according to their personal situations.

For clients who are less prepared, you can work with them in the coming weeks and months on items such as adding to their emergency funds, aligning their portfolios with an up-to-date risk profile and creating a financial plan if one doesn’t exist.

For clients who are more prepared, you can use their financial plan to share with them the strength of their current position, to make small adjustments if needed (think rebalancing an investment account) and even explore opportunities that a recession may bring. A few examples could include the heightened impact of charitable donations or the opportunity to purchase a desired piece of real estate at a lower price.

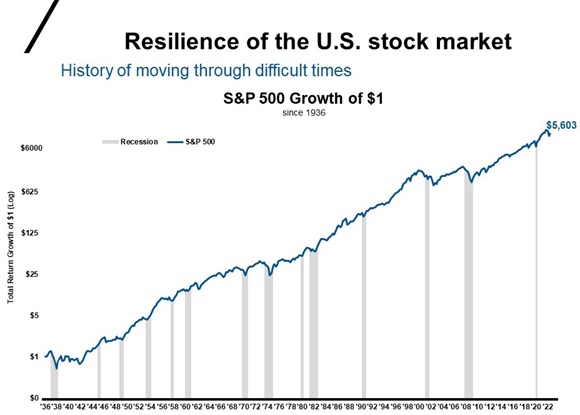

Source: St. Louis Federal Reserve & Morningstar Direct. S&P 500 Index as of 3/31/2022. Log: Lognormal scale. Total Return: Includes dividend reinvestments.

Indexes are unmanaged and cannot be invested in directly. Past performance is not indicative of future results.

While having these conversations with your clients, consider showing them this chart. It highlights that when taking the long view, recessions play a relatively small role in the history of markets, with most time being in recovery and expansion. It's for this reason that you are stressing the value of being a long-term investor and maintaining investments in alignment with their financial plan.

You can't help your clients reduce their fretting about the unknowable. Rather, you can engage in a productive dialogue about how proactive planning can help navigate the risks and opportunities of a recession when one inevitably comes around. In doing so you will be positioning yourself as the valued advisor while putting your clients at ease on their journey to financial security.