Is it time to reset your investment clock?

While the COVID-19 recession is not officially over yet, we’re quite confident that April marked the bottom of the global business cycle—and that we have therefore transitioned into the early innings of a new recovery. This has important implications for how we think about our investment strategy, which is based on the three pillars of cycle, value and sentiment.

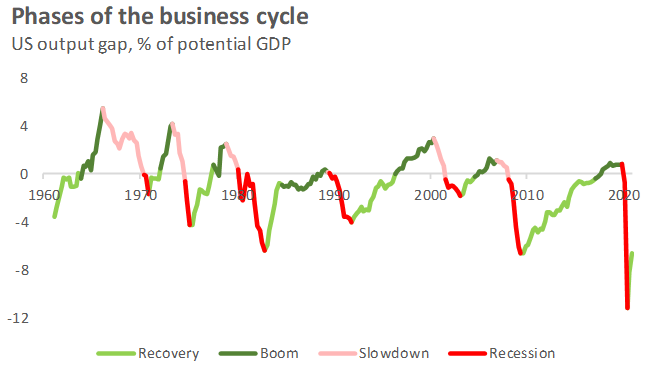

To expand on this, let’s define the four phases of the cycle that we think about:

- Recovery

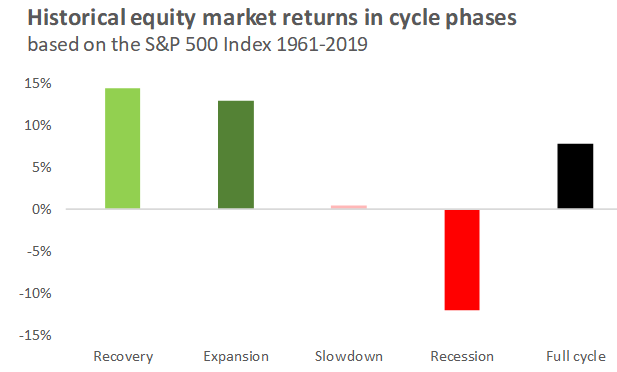

Following a recession, the economy has significant spare capacity and an ability to deliver above-trend, non-inflationary growth. Monetary and fiscal policy are also typically very accommodative and supportive of equity and credit outperformance over government bonds. Cyclical areas of the equity market like value, small cap, and industrials are likely to outperform passive benchmarks. Cash is trash. The lack of inflationary pressures means government bonds will deliver a return similar to their current yield. This is one of the longest phases of the business cycle. Recession risks are at their lowest. We are here.

- Boom

Years of above-trend growth in the recovery phase gradually exhaust spare capacity to the point at which the economy starts overheating (e.g. excessive investment, excessive hiring, excessive leverage). Inflationary pressures start to rise. Equities and real assets generally do well. Government bonds may re-price and return less than their current yield. Given recessions are exceptionally difficult to forecast, having a convicted tactical asset allocation can become very challenging in this phase of the cycle as both upside and downside risks are significant.

- Slowdown

There’s a saying on Wall Street that stocks take the staircase up and the elevator down. That’s true for the economy as well. Defensiveness is rewarded. However, this is the shortest phase of the cycle and very difficult to time. For example, the shock from the pandemic onto the global economy was so abrupt that we transitioned from strong growth in February to the steepest recession ever in March and April, totally skipping the slowdown phase.

- Recession

Households, businesses and banks retrench, pushing the economy well below its productive potential. Government bonds shine in multi-asset portfolios, showcasing their diversification benefits as safe-haven flows and disinflationary dynamics drive strong performance. Remember, financial markets are forward-looking and typically bottom a few months before the recession ends. Buying equities in the middle of a recession when other investors are panicked can reap handsome rewards over the medium-term.

Click images to enlarge

Source: Board of Governors of the Federal Reserve System, Congressional Budget Office, Thomson Reuters Datastream, Russell Investments. July 2020.

Considerations during the recovery phase

In the recovery phase, we generally target equity and credit allocations at/beyond long-term strategic levels. Of course, we also want to make sure the price we are paying for those securities isn’t excessive.

Today, with the strong rally from March 23, we see global equities as slightly expensive, while our proprietary measures of investor sentiment look slightly optimistic. That’s led us to edge allocations back down toward our long-term strategic targets.

However, being early in the cycle, our underlying bias is toward the positive side of the ledger. With this in mind, we plan on being aggressive around any dislocations that may arise in markets in the months or years ahead.