Managing the risks ahead: From Darkness to Dawn

2022 proved to be a very challenging year for financial markets, including equities and bonds. In fact, 2022 was one of the worst years on record in terms of total returns for a traditional 60/40, equities/bonds multi-asset portfolio. Whilst the sell-off in equities and bonds has resulted in improved return assumptions moving forward, especially across fixed interest assets like bonds, we’re not out of the woods just yet. Investors continue to contend with slowing economic growth and rising interest rates globally. Importantly, declining inflation should allow central banks to pivot toward a looser monetary policy, i.e. interest rate cuts, in the second half of 2023. This should set the scene for the next economic upswing and help financial markets, as we move out of the darkness and into the dawn.

Recession risk

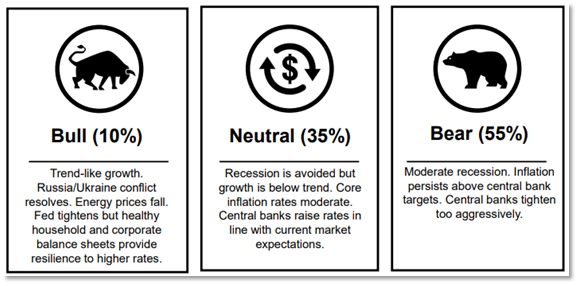

A global recession does seem likely. We consider the probability of a U.S. recession to be above 50% (see Figure 1 below). Supporting this view are a number of classic late-cycle economic indicators, including:

- the most aggressive tightening of financial conditions by the Federal Reserve (the Fed) since the 1980s;

- an overheated labour market;

- a deeply inverted yield curve, which reflects market expectations for a decline in longer-term bond yields as a result of weaker economic performance;

- softer manufacturing activity; and

- high corporate debt levels.

Figure 1: Market scenario probabilities

Source: Russell Investments

In saying that, we acknowledge the large divergence in U.S. economic growth expectations. These range from a ‘Goldilocks’ environment where disinflation, i.e. a slowing in the rate of inflation, is strong enough for the Fed to pause, pivot and stop the economy from entering a recession, to a more dire view, where profit margins decline due to strong disinflation headwinds, the economy enters a severe earnings recession and the bear market continues, i.e. economic data starts to disappoint, company profits begin to fall and stock prices begin to drop sharply.

Navigating through economic uncertainty

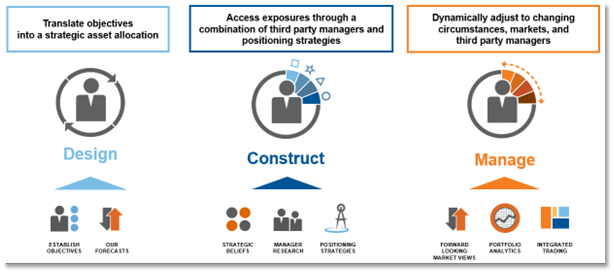

We believe relying on strategic asset allocation, i.e. the portfolio’s Design component, is the best way to navigate the current market environment. More broadly, our Design, Construct and Manage (DCM) framework ensures a robust and repeatable process for navigating uncertain markets.

The Design component is backed by the expertise of our asset allocation strategists and their long-term forecasting of various asset classes. The Construct component is supported by our manager research team, who source the best exposures to underlying asset classes. The Manage component focuses on shorter-term positioning based on identifying unsustainable extremes in markets, as researched by our global subject matter expert groups and the global investment strategy team. We outline this process in Figure 2 below.

Figure 2: Design, Construct and Manage framework

Source: Russell Investments

How the managed portfolios were positioning in 2022 to take advantage of market opportunities

During 2022, the managed portfolios held positions in alternative assets within the dynamic core. Exposures to alternative asset classes forms part of the 'Construct' within our DCM process and relies on our experienced manager research team. These strategies provided exposure with very low, or negative, correlations to bonds and equities. It also provided important diversification benefits.

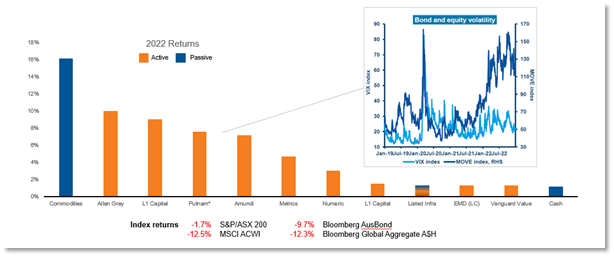

The dynamic core within the managed portfolios offers exposure to many alternative managers that are not accessible via retail platforms. In this way, the dynamic core serves as a vehicle through which retail investors can gain exposure to ‘non-traditional’ asset managers. Figure 3 below shows two such managers: Amundi, a global equity volatility manager, and Putnam, a global fixed interest volatility manager. Both managers provided strong returns over the period, significantly outperforming equity indices.

Figure 3: The benefit of using a diverse set of asset managers and strategies

Source: Russell Investments, Amundi and Bloomberg. Data as at 31 December 2022. Sold Putnam in August 2022.

Let’s take a closer look at global fixed interest volatility manager Putnam. Putnam achieved strong positive returns during 2022 by utilising a strategy that provides hedging (via swap-options) against major shocks in the market. Given the diversification benefits provided by this strategy when bonds sold off during the first eight months of 2022, we took the opportunity to remove the strategy and rotate the proceeds into traditional fixed interest assets. At the time (August), traditional fixed interest assets provided much higher and more predictable total returns as a result of U.S. Treasury yields being significantly higher and bonds trading relatively cheaply. Figure 4 below demonstrates the favourable asymmetric return profile currently offered on traditional fixed interest assets as at December 2022.

Figure 4: Impact of interest rate changes on bonds

Source: Barclays. Historical yield analysis includes monthly yield-to-worst (yield) and modified adjusted duration (duration) data for each fixed income sector from 1/1/2003 to 31/12/2022. Bloomberg Indices: U.S. Aggregate: U.S. Aggregate Bond Index, U.S. Treasuries: U.S. Treasury Index, U.S. Securitized: U.S. Securitized Index, U.S. High Yield: U.S. Corporate High Yield, Global High Yield: Global High Yield Index, Emg Mkt Debt: EM USD Aggregate Index, High Yield Muni: High Yield Municipal Index, Municipal Interm: 1-15 Yr. Municipal Index, Cash: U.S Treasury Bills 1-3 Mo. Duration: Modified Adjusted Duration. Indexes are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

Shown above is the impact on estimated forward returns of various fixed interest asset classes given a 1.0% increase in interest rates, no change in interest rates or a 1.0% decrease in interest rates. Given where interest rates currently are and where the peak, or ‘terminal’ rate is priced by markets, the forward returns are favourably asymmetric to the upside.

De-risking and planning ahead in 2023

As noted previously, the Manage component of our Design, Construct and Manage framework is backed by our global subject matter expert groups and the global investment strategy team. Our global investment strategy team uses Cycle, Valuation and Sentiment, or ‘CVS’, inputs to determine whether markets are exhibiting unstainable extremes and to guide the positioning of our portfolio strategies on a shorter-term, more tactical and dynamic basis.

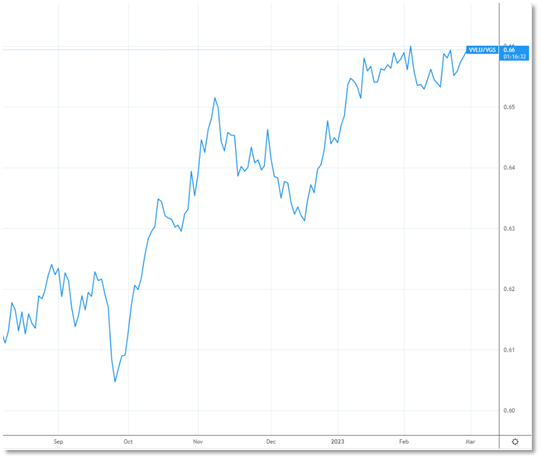

As equity markets rallied off their October lows and continued to rally through January, our CVS process, together with our recessionary outlook, indicated that it was an attractive time to reduce equity risk within our portfolios. From a Cycle point of view, the uncertain outlook for markets did not support being overweight growth assets, while Valuations were seen as expensive due to the strong rebound in equity markets. In addition, our Sentiment indicator was not in the oversold territory needed to justify having equity risk that was greater than the benchmark during January. As a result, we made the decision to trim equity risk. We also took the opportunity to rebalance our overweight to Australian equities versus global equities back to neutral and trimmed our overweight to value stocks. Our overweight to value stocks had benefited the portfolios during the previous six months. This is demonstrated in Figure 5 below, which compares the relative performance of the Vanguard Global Value Equity Active ETF and the Vanguard MSCI Index International Shares ETF, where the upward trending line demonstrates outperformance of the factor value.

Figure 5: Relative daily price performance of the Vanguard Global Value Equity Active ETF (VVLU) divided by the Vanguard MSCI Index International Shares ETF (VGS). Line moving upwards demonstrates outperformance of VVLU.

Source: TradingView. Line moving upward shows value outperforming.

Current positioning within the managed portfolios is close to benchmark with some additional defensive and diversifying exposures. Over the past six months, we incrementally added duration above that of the benchmark as Australian government bond yields and U.S. Treasury yields moved higher, signalling improving value using our CVS process. Figure 6 below shows the rise in Government bond yields during 2022.The addition of bonds provides diversification benefits in multiple scenarios; one being that if the global economy enters a significant recession earnings downgrade will likely see equities underperform. Another is if inflation continues to decline but the global economy experiences a softer landing. In this scenario, central banks will likely cut interest rates with equities performing comparatively better than in the previous scenario. A situation where this bond exposure will not pay off is if inflation remains higher than central bank targets, forcing them to raise interest rates higher than the market currently expects. In this scenario, the addition of defensive options strategies on both the U.S. and Australian share markets will provide some protection. Our underweight to high-yield debt will add a further layer of benchmark relative protection in this scenario.

Figure 6: Rise in U.S. and Australian Government bond yields during 2022.

Source: TradingView.

Whilst we remain relatively neutral to benchmark outside of the aforementioned tactical positions, we believe the bigger game in town is remaining vigilant and awaiting opportunities to add back risk via equities and credit; either during dislocated markets or when the Fed eventually pivots, and the cycle is considered more attractive.

The bottom line

Given the uncertain economic outlook and our greater than 50% probability of a U.S. recession, we remain focused on the strategic asset allocation (Design) of the portfolios. In addition, we have incorporated some defensive positions which should provide diversification benefits as growth slows. We recently trimmed our equity exposure in response to the strong rally in share markets and moved underweight high-yield debt on the basis that credit spreads are not attractive given this late stage in the economic cycle. Further, we have adopted an overweight allocation to duration, which score positively using our CVS framework, and added defensive equity options strategies. These equity options strategies provide downside protection whilst enabling participation if share markets continue to rally. Importantly, we remain vigilant and ready to add risk whenever suitable opportunities arise.