Executive summary:

- Tax Day can often be painful for investors who receive income from their portfolios

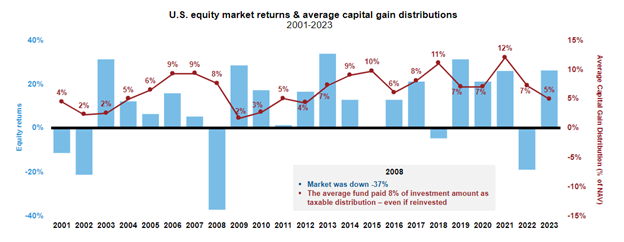

- Over the past 20 years, U.S. equity mutual funds have generated an average of 7% of Net Asset Value in capital gains, regardless of the U.S. market’s performance

- Direct Indexing can help investors manage their tax liabilities by allowing them to apply tax losses against gains in their portfolio or other sources of income

April 15 is undoubtedly one day that is not enthusiastically celebrated by most people. It is safe to say that the discomfort around Tax Day likely ranks right up there with your annual physical or renewing your driver’s license.

One area of fiscal pain that many investors dread every April is the taxes owed on their investments from the dividends, interest income, and/or capital gains realized. Some of these command a higher tax rate than others, and one of the biggest sources of “tax drag” on a portfolio is often on realized capital gains – or the difference in the price between what someone paid for an investment and what they sold it for. Most portfolio managers – whether for a typical mutual fund or a Separately Managed Account (SMA) – do not consider taxes in their investment process. Unless a portfolio manager or financial advisor conducts regular tax-loss harvesting, it’s likely that the fund or SMA will generate capital gains.

Over the past 20 years, actively managed U.S. equity funds have distributed an average of 7% of their Net Asset Value (NAV) in capital gains annually. (See chart below). Many SMA managers have the potential to generate capital gains that are higher than this. Moreover, there seems to be no clear correlation between the market’s performance and the average capital gains distribution. Just consider what your clients would be feeling if they experienced a year like 2008 and then had to pay a tax bill as well!

Source: Morningstar Direct. U.S. Stocks: Russell 3000® Index. U.S. equity funds: Morningstar broad category ‘U.S. Equity’ which includes mutual funds and ETFs (and multiple share classes). For years 2001 through 2020 % = calendar year cap gain distribution ÷ year-end NAV, 2021 through 2023 % = total cap gain distribution ÷ respective pre-distribution NAV. For years 2001 through 2013, used oldest share class. 2014 forward includes all share classes. Indexes are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

It makes you wonder if there might be a better way to approach taxable investments.

Consider a solution that incorporates tax management

There is! Depending on their situation, investors could consider tax-managed mutual funds or a tax-optimized Direct Indexing strategy to help them maximize their after-tax wealth. We’ve written extensively about tax-managed investing and you can read a lot more about it here. But for the right client, a direct indexing strategy can be an efficient and effective way to reduce an investor’s tax burden both now and in the future.

Direct indexing for tax management

Direct indexing allows investors to own a sampling of securities that make up an index and hold them in a separately managed account (SMA). This gives the investor the ability to build a personalized portfolio that mimics an index mutual fund or exchange-traded fund (ETF) while maintaining the flexibility of holding the underlying securities. The advantage of this structure is that any loss taken on the sale of a declining security can be used to offset gains (across the household level), which can help reduce the investor’s tax liabilities.

Moreover, since the objective of direct indexing is to track a particular index, and indexes have no turnover outside of reconstitution, the manager does not have to trade often. Instead, the manager can strategically sell losing positions, then replace those positions with other securities that still allow the portfolio to continue to closely track the index. These losses can be held in the portfolio indefinitely and can either be used to offset gains in another part of their overall portfolio or carried forward to be used in future years if there are no gains elsewhere to offset.

The potential for capital gains exists in all markets

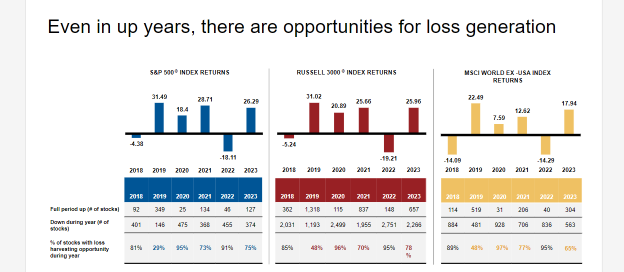

Most managers of typical, tax-agnostic investment portfolios focus on generating higher returns, and therefore usually sell their winners when they believe those stocks are no longer attractive. By doing so, they realize a capital gain. Since U.S. stocks (represented by the S&P 500 Index) have risen fairly steadily over the past 15 years (with only a few short-lived setbacks)1, even stocks that fell in 2023 could still be well above the price the portfolio manager paid for the initial purchase. This explains the disconnect between overall market (or portfolio) performance and the tax bill that an investor could receive. As you can see from the chart below, there are always stocks that will decline even amid broad market gains.

Analysis is based on S&P 500, Russell 3000 and MSCI World Ex-USA Index constituents as of 12/31/2023. "Full period up" indicates stocks that were never down YTD at the end of any month during the year. "Down during year" means stock was down YTD for at least one month during the year. Stocks that do not have full year returns were excluded. Index returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment. Indexes are unmanaged and cannot be invested in directly.

Utilizing a direct indexing portfolio allows an investor to replicate the index of their choice, minimizing the capital gains realized along with the potential of generating net tax losses to offset other gains or a part of their income. It’s no wonder direct indexing is expected to grow 12.5% annually over the next five years.2 Maybe it’s time for you to initiate a conversation with your clients about this strategy, so next April 15 won’t be so painful.

1 Source: https://www.investopedia.com/ask/answers/042415/what-average-annual-return-sp-500.asp

2 Source: Cerulli Associates: https://www.cerulli.com/press-releases/direct-indexing-growth-projected-to-outpace-etfs-mutual-funds-and-separate-accounts-over-next-five-years-according-to-cerulli