One year after the banking crisis, how are regional banks faring?

Executive summary:

- When the regional banking woes unfolded in March 2023, we argued that the challenges were not likely to be systemic

- We continue to think that the challenges facing regional banks are likely contained, though near-term market volatility is always possible

- Regional bank valuations have not fully recovered, and many investors remain on the sidelines

The bottom line: We continue to think that regional banks do not pose a systemic risk. Investors may benefit from using any unforeseen periods of market volatility to close any regional bank underweights.

U.S. equity markets have been on an impressive winning streak in 2024, with the S&P 500 repeatedly breaking through all-time highs. With all the market excitement today, it can be hard to believe that it’s only been around a year since the failure of two large regional banks in the U.S.: Silicon Valley Bank and Signature Bank. In this article, we’ll take an updated look at the state of the U.S. regional banking system, and why we continue to believe that investors should not be worried about systemic risks in regional banking. We’ll also discuss how our underlying money managers view opportunities in the regional banks and in small cap equities in general.

A refresher on the U.S. banking system and regional banks

If you asked a random pedestrian to name a U.S. bank, there’s a good chance they might say Wells Fargo or J.P. Morgan. But the U.S. banking system is made up of more than just global giants. At the opposite end of the spectrum, Bloomberg notes that the smallest bank in the U.S. has only one branch with one full-time employee. And in between these two extremes, there are some banks that may operate in a few but not all of the states in the U.S. These banks are commonly known as regional banks.

Beyond the difference in asset size and geographic reach, regional banks also face a more relaxed regulatory regime compared to larger, systemically important banks. The reduced regulatory burden means that regional banks might be permitted to engage in slightly riskier behavior.

For instance, regional banks are often more concentrated in their underwriting. According to the FDIC, more than 75% of outstanding loan balances of community banks (defined by the FDIC as those having assets less than $10 billion) were real-estate related at the end of the third quarter of 2022. Meanwhile, real-estate loans only made up 25% of the outstanding loan balances of all U.S. banks.

Moreover, regional banks might have a greater duration mismatch than their larger counterparts. Banks tend to make long-term loans to debtors, and finance those with short-term funding from depositors. This creates a natural duration mismatch, i.e., the value of the long-term loans (assets) on a bank’s balance sheet tend to be more sensitive to changes in interest rates than the value of the short-term deposits (liabilities). While banks try to manage the extent of the duration mismatch, it’s likely that some regional banks, with less regulatory oversight than larger banks, are willing to operate with greater duration mismatches.

Now that we’ve explored the business model of regional banks, we can more easily understand the sources of stress within the regional banking system. First, certain parts of the commercial real estate segment, such as office buildings, came under pressure as a result of the increase in hybrid and remote working arrangements in the aftermath of the COVID pandemic. By early March 2023, the Green Street Commercial Property Price Index for the office sector had fallen by nearly 30% compared to its pre-pandemic peak. The decline in commercial real estate valuations led to worries about whether some regional banks would see higher default rates from borrowers in the commercial real estate sector, and thereby incur greater losses.

Second, in order to fight off inflation, the Federal Reserve (Fed) raised interest rates aggressively. The federal funds rate went from a pandemic era low of near zero, to more than 4.5% in early March 2023. The rapid rise in interest rates created a more pronounced effect on the banks with the largest duration mismatches, which tended to be regional banks.

While these dynamics were a common theme among regional banks, the exact magnitude to which each bank was impacted differed.

SVB and Signature Bank failures caused headlines, but the fallout was limited

Silicon Valley Bank (SVB) was an example of a bank that was affected by the duration mismatch. As a result of the losses stemming from the duration mismatch, SVB tried to raise funds by issuing new shares. But investors were reticent to give more money to SVB. Meanwhile, as consumers caught wind of the news, they became nervous. When people begin to lose confidence in a bank, they might decide to withdraw their funds and move their money elsewhere. When too many people rush to make withdrawals, it creates a run-on-the-bank situation that can result in banks not being able to satisfy all withdrawal requests. Silicon Valley Bank ultimately became insolvent in early 2023 and closed. Shortly thereafter, Signature Bank also failed.

Although these two regional banks were far from the largest banks in the U.S., they were still large enough to spur worrisome headlines in the financial press. After all, Silicon Valley Bank was the second-largest bank failure since the failure of Washington Mutual in 2009.

Our team of investment and financial experts carefully monitored the developments in the regional bank as things unfolded. At the time, we argued that we did not think the failures of SVB and Signature Bank would create systemic risks for the regional banking sector. SVB and Signature Bank were more prone to the challenges of commercial real estate and duration mismatches than some of their other regional bank peers.

Moreover, the government had acted quite quickly to contain the impact and restore public confidence. First, the U.S. government announced that all deposits at SVB and Signature Bank would be insured against losses, even those deposits that exceeded the normal FDIC insurance limits. Second, the government implemented an emergency liquidity program that would allow banks to tap capital without having to sell their U.S. Treasuries at depressed prices, thereby helping to mitigate realized losses.

Our call turned out to be right: in 2023, the FDIC noted a total of only five bank failures. To put that into context, the U.S. had a total of more than 4,600 banks as of Q3 2023. And with U.S. equity markets hitting all-time highs, it appears that the regional banking woes have faded quickly from investors’ memories.

The path ahead for regional bank fundamentals

Although checking the rearview mirror is a good idea, looking at the road ahead is equally if not even more important. While there is always a degree of uncertainty inherent in forecasting, we continue to believe that regional banks challenges will not pose systemic risks to the broader economy.

You may have seen some headlines in the financial press about the ongoing challenges in the commercial real estate sector. It’s true that commercial real estate has not yet found a floor, and valuations in commercial real estate are lower than they were a year ago. But we think that the possibility for potential interest rate cuts by the Fed in 2024 will help put a floor in commercial real estate valuations.

In addition, declining interest rates also mean that the duration mismatch will no longer be a headwind for regional banks. As interest rates fall, the typical duration mismatch would instead cause the increase in value in the bank’s assets to be greater than the increase in value in the bank’s liabilities, thereby actually improving the bank’s financial position.

Moreover, the financial community has not sat by idly, but instead has been carefully studying the mistakes of SVB and Signature Bank to see what lessons can be learned. Although regional banks are still less regulated today than their systemically important peers, the regulators have nevertheless been keeping a more watchful eye on this space.

Meanwhile, the sheer publicity of the regional banking woes in 2023 likely led many regional banks’ management teams to be more conscientious of risk in their operational decision making and loan underwriting. After all, no executive wants their bank to become the next SVB.

Finally, although the Bank Term Funding Program is set to end in March 2024, the Fed now has a playbook they can turn to in the event that additional risks in the regional banking system pop up.

While it is not impossible to see more isolated incidents with a handful of regional banks in 2024, we nevertheless believe that there are enough controls in place to prevent these risks from becoming widespread.

Valuations in regional banks and small cap equities are compelling

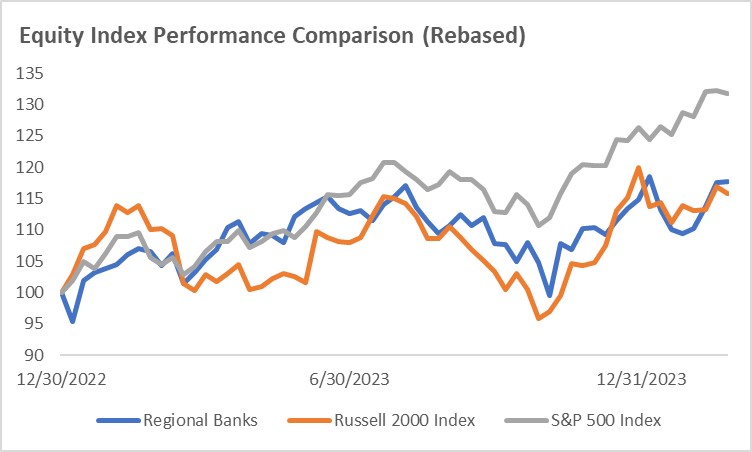

While we are not too concerned about systemic risks in the regional banking sector, it’s evident that the failure of SVB and Signature Bank has nevertheless taken a toll on relative stock performance. From Dec the end of December through February 2024, regional banks and small cap equities have both underperformed the broader S&P 500 Index.

Source: LSEG Datastream, data through February 2024. Rebased such that Dec 30, 2022 = 100 for each index. Regional Bank performance is proxied by the KRX 100 Index

The regional bank worries have also contributed to the underperformance of small cap equities as a whole. Regional banks are a stable fixture in many small cap equity indices. Roughly 8% of the Russell 2000 Index is comprised of regional banks, and 16% of the Russell 2000 Value Index is comprised of regional banks. In addition, many small cap companies rely on regional banks for access to capital. If there is anxiety about regional banks failing or coming under more scrutiny, investors could worry whether it would be more challenging for small cap companies to obtain financing.

The underperformance in regional bank stocks and small cap equities has created attractive valuations. Regional banks’ price-to-tangible book value (P/TBV) is approximately 1.4x, which is similar to Global Financial Crisis and COVID troughs. On a price-to-earnings (P/E) basis, regional banks are trading at a historically high discount of about 50% compared to the broader S&P 500 index.

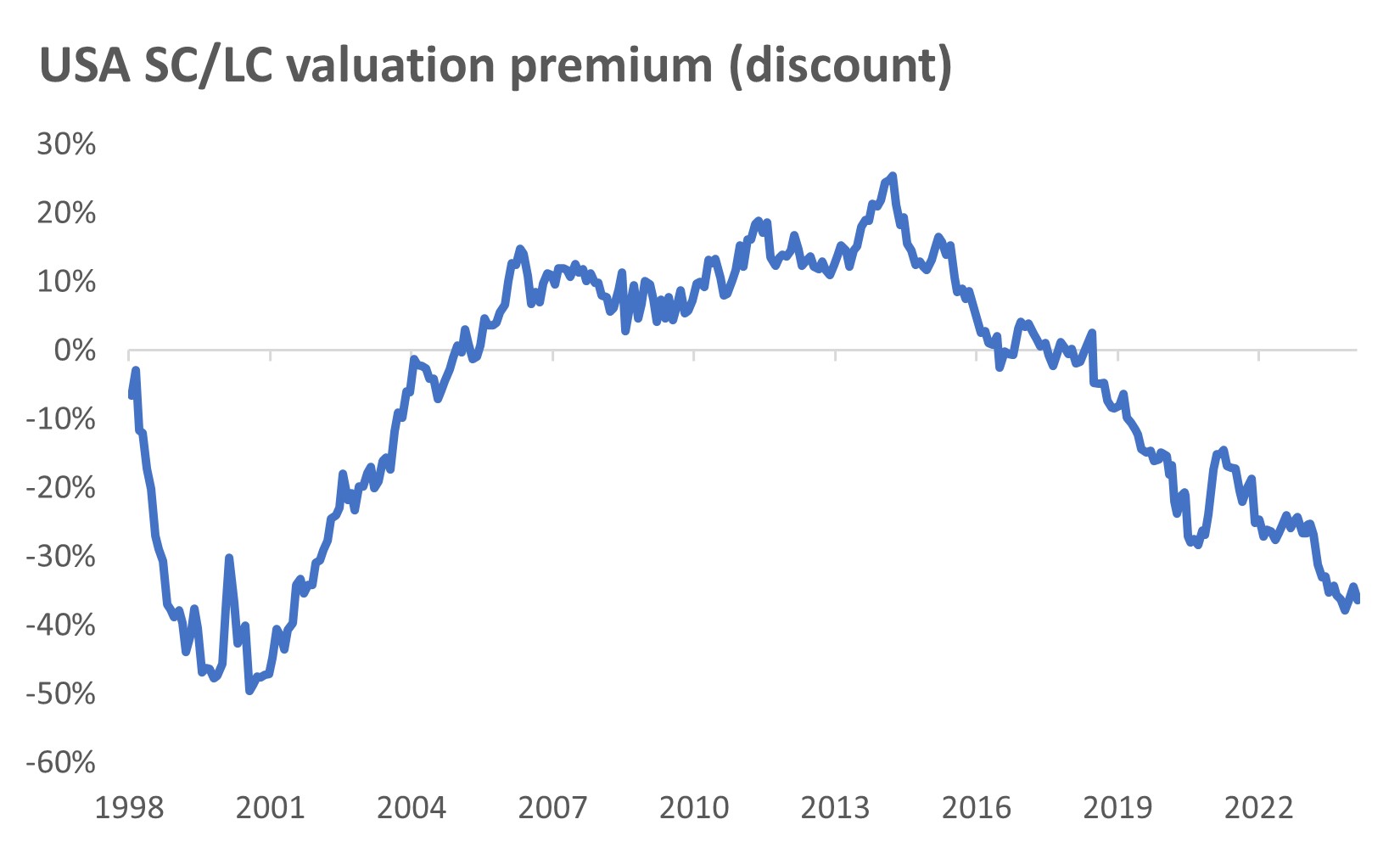

Valuations for U.S. small cap equities in general are also attractive. Across a composite of relative valuation measures, small cap is trading at a significant discount to large caps.

Source: Russell Investments, LSEG Datastream, data through February 2024. Composite valuation metric based on relative EV/EBITDA, P/E, P/S, and Adjusted CAPE ratios.

The bottom line: Amid regulatory concerns in the banking sector, considering sticking close to your strategic asset allocation

Despite the compelling valuations of regional banks and small cap equities, it might still be too early to think about tactically overweighting these asset classes. Many of the sector specialists that we partner with have mentioned that despite improving fundamentals among the regional banks, ongoing investor concern about regulatory scrutiny could still create a ceiling on regional bank performance in the near-term.

For small cap equities more broadly, some of the sector specialists are seeing potential areas of opportunity in interest-rate sensitive areas (such as Industrials). However, if a recession were to materialize in 2024 (and we continue to believe that recession risks are above-average, even if they may be down from their peak), small cap equities could still remain challenged.

Overall, our mix of signals suggest that investors should still stick close to their strategic asset allocations, but investors could potentially consider using market volatility to close any underweights that may have arisen in these areas.