Japan fundamentals trump politics

Executive summary:

- Uncertainty around the policy objectives of new Japanese Prime Minister Shigeru Ishiba has sparked some recent volatility in markets. However, Ishiba has since softened his stance on key measures, including monetary policy.

- The Japanese economy remains on solid footing, with consumer spending at healthy levels and corporate earnings moving higher.

- We expect the Bank of Japan to proceed more cautiously when considering future rate increases.

- We view Japanese equities as slightly positive and government bonds as negative, and are neutral on the yen.

Shigeru Ishiba has been announced as the new prime minister of Japan, and has called a snap election for the 27th October. This announcement of an election is customary for new LDP (Liberal Democratic Party) leaders.

Markets have seen elevated volatility since the announcement on uncertainty around policy priorities. Prior to being elected, Ishiba had endorsed further normalisation of monetary policy from the Bank of Japan (BoJ)—in contrast to his main opponent, who had advocated for a maintenance of easy policy. Additionally, he has been a vocal proponent for further increasing defence spending.

However, as the LDP leadership election approached last month, Ishiba promised that he would stick with the measures that had been in place under outgoing Prime Minister Fumio Kishida. More recently, Ishiba has softened his stance on the Bank of Japan, noting that the Japanese economy is not ready for another rate hike.

The first poll since Ishiba became prime minister showed an approval rating of 51%, which is one of the lowest inaugural approval ratings in history. That said, it is still very likely that his party will win the election and he will remain prime minister.

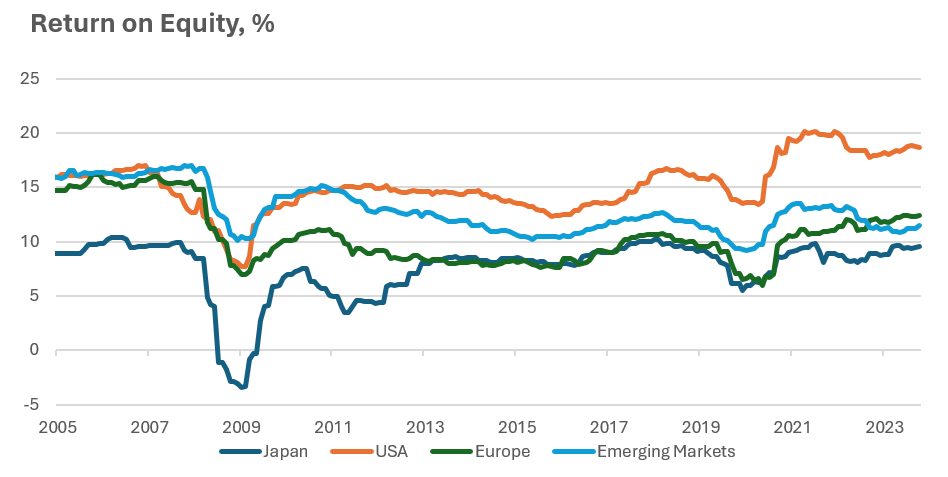

CHART 1: Return on equity by market (as a percentage)

Source: LSEG Datastream, 30 September 2024

The second watchpoint is the BoJ’s stance on monetary policy. It’s likely that the central bank will take a more cautious approach to raising rates after the volatility that rippled through markets in early August following the bank’s announcement of another rate increase. BoJ Governor Kazuo Uedarecently indicated as much, noting that financial market volatility is something the BoJ will take into account when considering rate changes. Other recent comments from Prime Minister Ishiba also suggest there is increasingly little pressure on the BoJ to rapidly normalise interest rates.

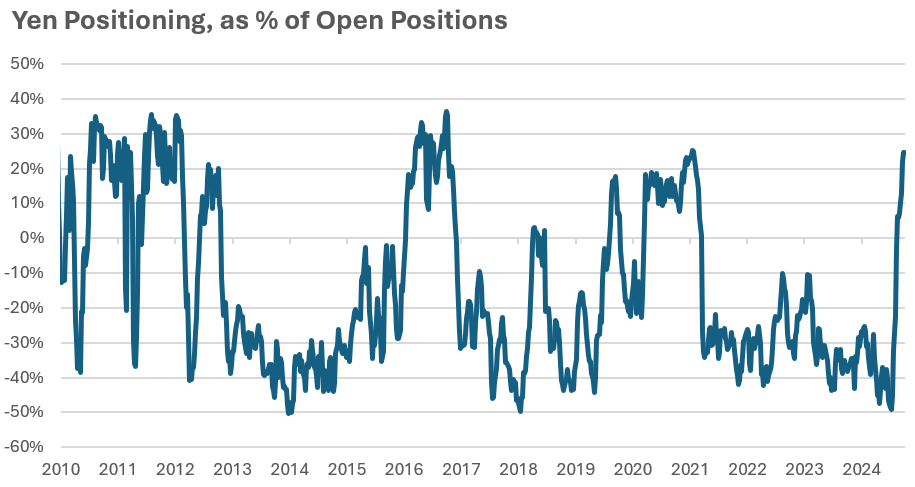

The third watchpoint for investors is positioning in the Japanese yen. The so-called carry trade in the yen—where investors borrow in yen and invest in higher-yielding currencies—had been a big deal in currency markets this year. The U.S. Commodities Futures Trading Commission collates data on aggregate positions in futures and options, and was showing large shorts in the Japanese yen (see chart below) during the first half of 2024. The volatility from July onward saw that positioning clean out, with CFTC data now showing slight long positioning. With the U.S. Federal Reserve (Fed) now clearly in an easing cycle, we are unlikely to see much downside pressure on the yen.

CHART 2: Yen positioning as a % of open positions

Source: LSEG Datastream, Russell Investments. 30 September 2024

Our outlook for Japanese markets

At Russell Investments, we assess markets through a lens of cycle, valuation, and sentiment. Applying this framework to Japanese assets gives us the following views:

Japanese equities

Our overall assessment is slightly positive. The business cycle is neutral. The domestic economy is in a decent place, but the risks of a recession in the U.S. remain elevated, which could lead to upward pressure on the Japanese yen. Valuations are modestly expensive, with forward earnings multiples at 15.5 times. Sentiment is driven by positive momentum.

Japanese government bonds

Our overall assessment is negative. The cyclical outlook is slightly negative, given the tail risk that the Bank of Japan raises rates further. Valuations are expensive, both on an absolute basis and compared to global government bonds (for example, we believe that U.S. Treasuries are close to fair value).

Japanese yen

Our overall assessment is neutral, but the yen could prove to be an attractive diversifier if the global economy hits a rough patch. The cyclical outlook is supported by the elevated U.S. recession risk and the safe-haven status of the yen. Valuations appear quite cheap, while sentiment has moved from significantly oversold to potentially overbought (as the CFTC chart shows).

The bottom line

Shigeru Ishiba’s selection as prime minister sparked some consternation in markets due to uncertainties around his policy objectives. However, Ishiba has since softened his stance on normalising monetary policy, and we also expect the BoJ to exercise greater caution in raising rates moving forward. In addition, the Japanese economy remains on solid footing, with consumer spending at healthy levels and corporate earnings continuing to grow. Amid this backdrop, it’s prudent for investors to keep calm and carry on.