Bank of England: An unsurprising rate hold

Executive summary:

- BoE unsurprisingly decides to hold off on a rate increase

- We believe signs of a cooling job market and slowing wage growth are giving BoE reason to sit tight

- Markets now firmly believe the latest rate cycle has peaked

Today, the Monetary Policy Committee (MPC) unsurprisingly voted in favour of keeping the Bank of England (BoE) policy rate at 5.25%.

The 6-to-3 majority was more convincing than the surprise September hold decision. The three dissenting members that preferred an interest rate increase to 5.5% were Megan Greene, Jonathan Haskel and Catherine Mann.

This BoE decision was largely in line with market expectations. Of the 73 economists polled by Reuters, 61 had predicted that the BoE would stay on hold while the remaining 12 forecast a hike to 5.5%.

Money market prices now imply that the Bank of England is done with rate hikes for the cycle and could start cutting rates in about a year’s time.

Progress on cooling down job market

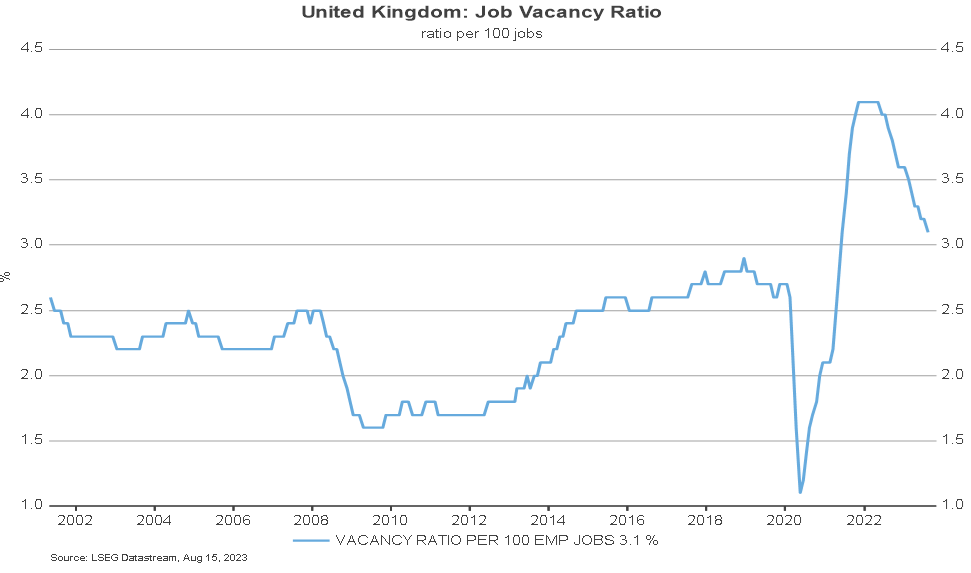

We think the signs of a less overheated labour market and slowing wage pressure convinced the Bank of England to sit tight today. As we show in the chart below, the job market paints a picture of diminishing strength, with the ratio of job vacancies to employee jobs continuing to decline. Data from the Office for National Statistics (ONS) also recorded a fourth consecutive upturn in unemployment.

Click image to enlarge

Secondly, there are tell-tale signs of a slowdown in the growth of average weekly earnings. In August, earnings growth dipped by 0.4 percentage points to 8.1% year-on-year, including bonuses, and by 0.1 percentage point to 7.8% year-on-year, excluding bonuses.

However, progress on bringing price inflation down was slightly slower than economists had expected, but still better than the BoE had projected in their August forecast. In September, the annual consumer prices index (CPI) was unchanged compared to August at 6.7%. The core CPI, which excludes volatile elements like food and energy, slipped from 6.2% to 6.1%. With current inflation still far from the 2% target, the MPC members need to be mindful of their credibility in meeting the price stability objective and would be ill-advised to declare victory prematurely.

Market reaction

As peak rates come into view, gilt yields dropped sharply prior to the meeting this morning. The post-meeting reaction was therefore more muted. As of the time of writing, the ten-year gilt yield slid by 6 basis points to 4.34% after the decision. However, it is 17 basis points lower than yesterday’s close and way off its 2023 high of 4.70%.

Since the last MPC meeting, the pound sterling weakened marginally from 1.23 to 1.22 against the US dollar, slowing down its descent. Sterling's valuation against the greenback currently stands at a much-discounted level , potentially limiting the prospect of further depreciation.

The bottom line

1 The purchasing power parity exchange rate for GBP/USD is around 1.48. Source: Organisation for Economic Cooperation and Development.

Any opinion expressed is that of Russell Investments, is not a statement of fact, is subject to change and does not constitute investment advice.