How advisers deliver value in challenging times

We believe advisers are never more important than during periods of significant change. As the market transitioned from growth to value, change was everywhere, making the need for advice and reassurance with clients greater than ever.

Over the past two years, people have reassessed many aspects of their lives. This included the Great Resignation, as workers considered their employment options, and also resulted in a sustained migration out of large cities to regional communities as many businesses implemented longer-term work-from-home or hybrid arrangements. Along with significant increases in virtual shopping and rising interest rates, many people have taken this time to work out what their ‘new normal’ is going to be.

Those advisers who helped their clients remain invested through the turbulence, who helped them prepare for an uncertain future, who worked with the determine their post-pandemic goals, can look back with a real sense of having provided true value.

Our 2022 Value of an Adviser Report clearly shows that the total value of services provided by a financial adviser is substantially higher than the typical advice fee. We’ve also updated our easy-to-remember formula to reflect the changing nature of the adviser-client relationship. The “c” has been updated to illustrate the many and varied combinations of choices and trade-offs that advisers help clients navigate through. The “E” of the formula also highlights both the technical and emotional expertise that advisers provide in all stages of a client’s wealth journey.

Our 2022 Value of an Adviser is A+B+C+E+T

A is for Appropriate asset allocation

How an individual is invested has a huge impact on achieving their investment goals. Yet, this critical step of the advice process is often undervalued and under-appreciated.

In the superannuation environment, there are generally two types of non-advised investors. Disengaged investors who are defaulted into a one-size-fits-all asset allocation, with very limited or no reference to their personal circumstances or needs. The other type is engaged investors who build their own portfolios – which comes with its own risks.

Appropriate asset allocation is not just about maximising returns, but also managing risk. By risk, we mean volatility, which is often what causes investors to doubt their investment plan and pull money out of the market.

In periods of steadily rising markets, it can be easy to underestimate the value of a professionally managed portfolio. During these periods, we often see the asset allocation of DIT portfolios drift away from the initial asset allocation. A disciplined approach to portfolio management and rebalancing can ensure it retains its original asset allocation – and therefore remains appropriate for an investor’s stated goals – while also potentially reducing risk.

B is for Behavioural coaching

The last two years have been a clear demonstration of the importance of remaining invested through thick or thin. An investor who fled for the exits in mid-March 2020 when the pandemic emerged, would have had a difficult time to find the best re-entry point, with no real market “dips” to take advantage of. This is where the value from an adviser’s behavioural guidance shows up on the bottom line.

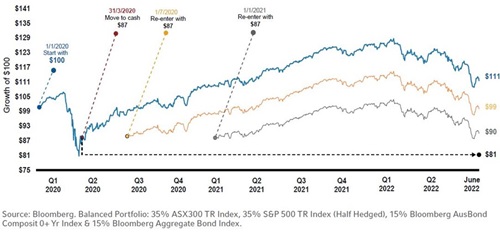

The chart below shows the difficulty of finding a new point of entry once an investor pulls out of the markets. Remaining invested for the entire two years of the pandemic would have seen a $100 investment on the 1st Jan, 2020, rise to $111 by the end of June 2022. But an investor who moved to cash in March 2020 and then returned to the market a few months later at the end of the second quarter, would only have $99 at the end point. Meanwhile, an investor who moved to cash in March 2020 and stayed in cash until January 2021, would have only $90 at the end point.

Fear impacts opportunity

This is where we believe an adviser can be a valuable guide. Keeping their clients focused on the long-term rather than falling prey to emotions when markets get volatile can potentially bring better returns.

C is for Choices and trade-offs

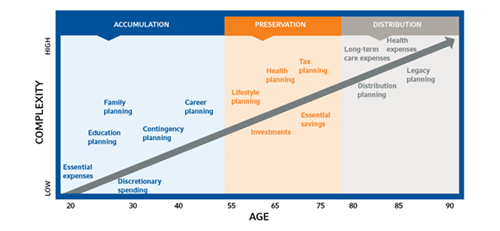

Let’s face it, people’s lives become more and more complicated over time, and to help achieve an individual’s goals, an adviser will need to incorporate a range of inputs into the design of a strategy.

Every client has a unique set of circumstances, preferences and considerations, and the sheer number of decisions to be made alone can lead to decision fatigue, which increases the risk of poor client outcomes.

An adviser can help evaluate and prioritise these decision points to meet the individual’s unique set of needs at various points throughout their life.

E is for Expertise – emotional and technical

A common misconception is that financial advisers are purely investment managers, whose only job is to select investments to achieve a certain level of return.

While navigating the technical aspects of investments, legal, tax, superannuation and insurance requirements are key to success, the reality is that there’s much more to a good advice relationship.

In the best of times, advisers help clients achieve life-long goals, and celebrate personal and family milestones along the way. In challenging times, advisers can really add value through cases of trauma, illness, financial crises, estate planning and death.

This unique combination of technical skill and emotional expertise provides a priceless form of value to their clients – leaving them feeling more secure, more prepared to deal with the unexpected and ultimately having peace of mind.

While articulating such intangible value is challenging, and overwhelming majority of those that have experienced the technical skills and emotional support of an adviser see value in their relationship.

T is for tax-smart planning and investing

Tax is often considered the realm of the accounting profession, but managing and optimising investment tax is also an area of expertise for financial advisers.

Investment tax isn’t just about what goes into your tax return, as it can also have an impact on an asset’s value or portfolio returns. Providing a more tax-effective approach to investing is an area where advisers can demonstrate some of the more specific strategies that can deliver real gains for clients.

Advisers are also increasingly playing a role in helping clients to maximise their tax incentives and benefits at different life stages. From childcare rebates and family tax benefits through to health care cards and aged pension implications. Business owners have additional opportunities to be considered for grants and incentive programs.

Tax is a key consideration for many investors and it is important for advisers to highlight the direct and indirect tax implications for their recommendations.

Communicating adviser value

The waning of the pandemic and the new geopolitical environment could be the perfect time for advisers to reassess the full value they deliver, and how they communicate that value to clients.

Our formula shows that even if advisers were only able to help them avoid the behavioural mistakes that many investors made in the market turbulence, they’ve likely already provided value above and beyond their fee. Add to that their other services, appropriate asset allocation, the customised client experience and expertise given, and the savings from a tax-effective approach, and it seems clear that the total value advisers deliver is significant.

To learn more about the 2022 Value of an Adviser Report, click here.