Listed vs unlisted infrastructure: A misunderstood rivalry?

Executive summary:

- Traditionally infrastructure portfolios have been divided into listed and unlisted segments, with investors choosing between one or the other. In practice, integrating both into portfolios strengthens investment approaches in the current economic landscape.

- Listed infrastructure typically focuses on lower-risk profiles (super-core and core), featuring stable, mature assets with predictable revenue streams that are easier to trade.

- Unlisted infrastructure assets allow for direct control and higher yields while enabling access to additional risk profiles. Unlisted assets often have lower correlation with financial markets and provide stable, long-term returns that are insulated from market volatility.

- When building portfolios, we recommend investors utilise both segments of the market to maximise their opportunity to access attractive returns while managing risks including portfolio volatility and liquidity.

In today's financial climate, marked by interest rate and geopolitical uncertainties, infrastructure investment offers financial and strategic opportunities. However, traditionally infrastructure portfolios have been divided into listed and unlisted segments, with investors choosing between one or the other. In practice, integrating both into portfolios strengthens investment approaches in the current economic landscape.

Risk and Return Profiles

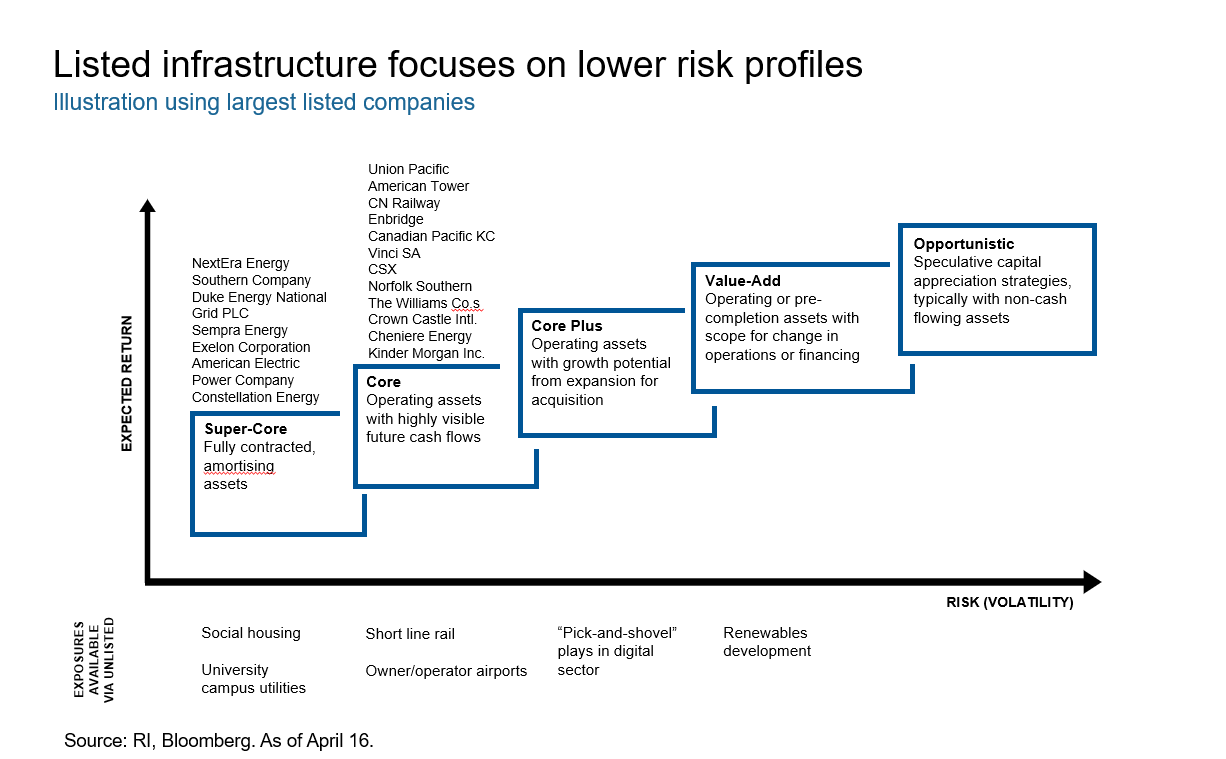

Exhibit A

To understand how listed and unlisted infrastructure assets can complement another, it is necessary to appreciate their individual strengths. As illustrated in Exhibit A, listed infrastructure typically focuses on lower-risk profiles. Companies such as NextEra Energy and Union Pacific represent stable, mature assets with predictable revenue streams that are easier to trade. This makes them appealing to investors seeking income and lower volatility. However, these entities often reflect the broader market dynamics, making them susceptible to market fluctuations.

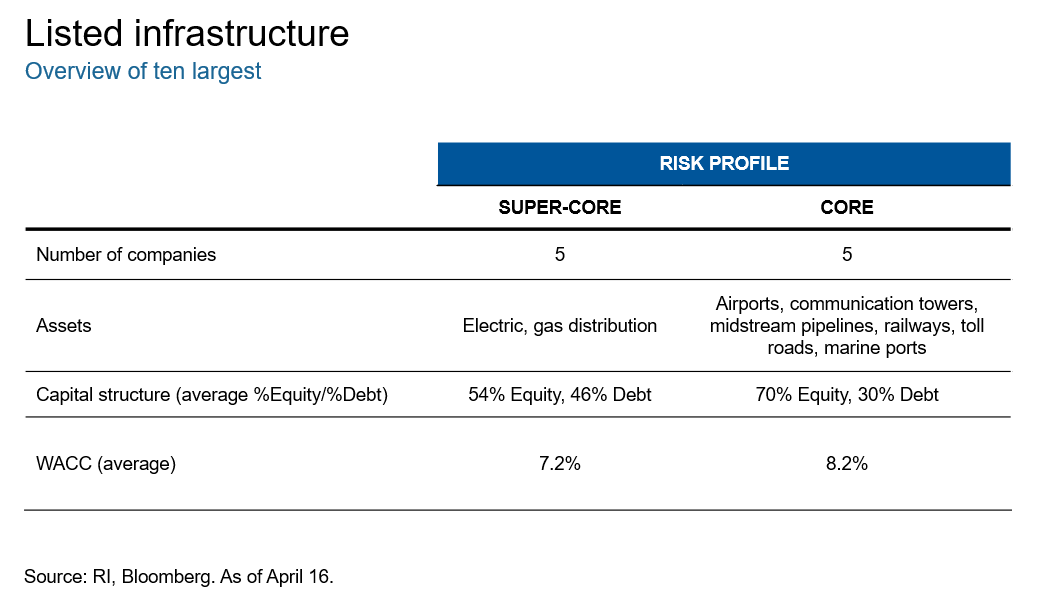

Exhibit B

Looking at a more detailed composition of the ten largest listed infrastructure segment in Exhibit B, reveals an even split between super-core and core assets. Super-core assets are typically those with extremely low risk and high predictability in cash flows, such as regulated utilities, while core assets, still low-risk, offer slightly higher returns and include sectors like toll roads and airports.

This balance between 'super-core' and 'core' within the largest listed infrastructure space underscores the sector’s appeal to a range of investors, particularly those looking to mitigate the impact of current economic turbulence while still positioning for growth. Interestingly, super-core assets have a lower weighted average cost of capital (WACC) as financial theory would suggest (source: RI, Bloomberg as of April 16, 2024).

Unlisted Infrastructure

Conversely, unlisted infrastructure caters to a segment that favours direct control and higher yields. Investments in assets like an independent railway with exclusive market control in the Southeastern U.S. or a major aviation hub in Australia (shown in Exhibit C) allow for greater strategic management and potential upside from operational improvements. These assets often have lower correlation with financial markets and provide stable, long-term returns that are more insulated from market volatility.

Sector-Specific Analysis

Exhibit C

The synergy between listed and unlisted infrastructure investments is strong. Listed infrastructure offers liquidity and market correlation, making it suitable for investors seeking exposure to infrastructure with the flexibility of public markets. Unlisted infrastructure provides control, stability, and potential for higher returns, making it suitable for long-term investors focused on capital preservation and steady income.

When building portfolios, we recommend investors utilise both segments of the market to maximise their opportunity to access attractive returns whilst maintaining resilience to market volatility and other financial stresses.