Incumbent party wins Taiwan leadership election, loses local parliamentary majority. What could this spell for markets?

Executive summary:

- La Ching-te’s victory in Taiwan’s elections maintained the Democratic Progressive Party’s hold on the leadership.

- However, the DPP lost its majority in Taiwan’s local legislature, making compromise with other parties likely necessary in order to pass any new spending bills or authority initiatives. This should lessen the potential for dramatic shifts in policy and be a net positive for markets.

- We don’t expect Taiwan Strait tensions to intensify this year, due to China’s improving relationship at the margin with the U.S. and China’s likely focus on domestic growth.

The incumbent Democratic Progressive Party (DPP) won a third consecutive term in Taiwan over the weekend. However, the DPP received its lowest winning percentage since 2000 and has been pushed into a minority authority, having lost its majority in the Legislative Yuan. The new political leader of Taiwan, Lai Ching-te, rose from the more aggressive pro-independence wing of the DPP, but moderated his stance on the cross-strait relations through the campaign. We believe the outcome of the elections reduces the risk of escalation in Taiwan Strait tensions this year, with the next key watchpoint for investors the naming of the local Legislative Speaker in February.

Cross-strait Relationship a key focus in the elections

For those that are less familiar with Taiwanese politics, a bit of background. The cross-strait relations tend to be a big question when it comes to Taiwanese elections. The DPP is in favour of independence from China. Historically, the opposition Kuomintang Party (KMT) has been in favour of closer relationships with China central government. This year, the Taiwan People’s Party (TPP) also ran on a policy platform that was more closely aligned with the KMT than the DPP.

In the lead-up to the election, both parties made some moves toward the centre. For example, Lai Ching-te dampened down his stance from resist China to protect Taiwan to seek peace to protect Taiwan. Similarly, the KMT was less averse to military purchases than it had previously been, noting that increasing the defence capability was a viable strategy.

A closer look at the results

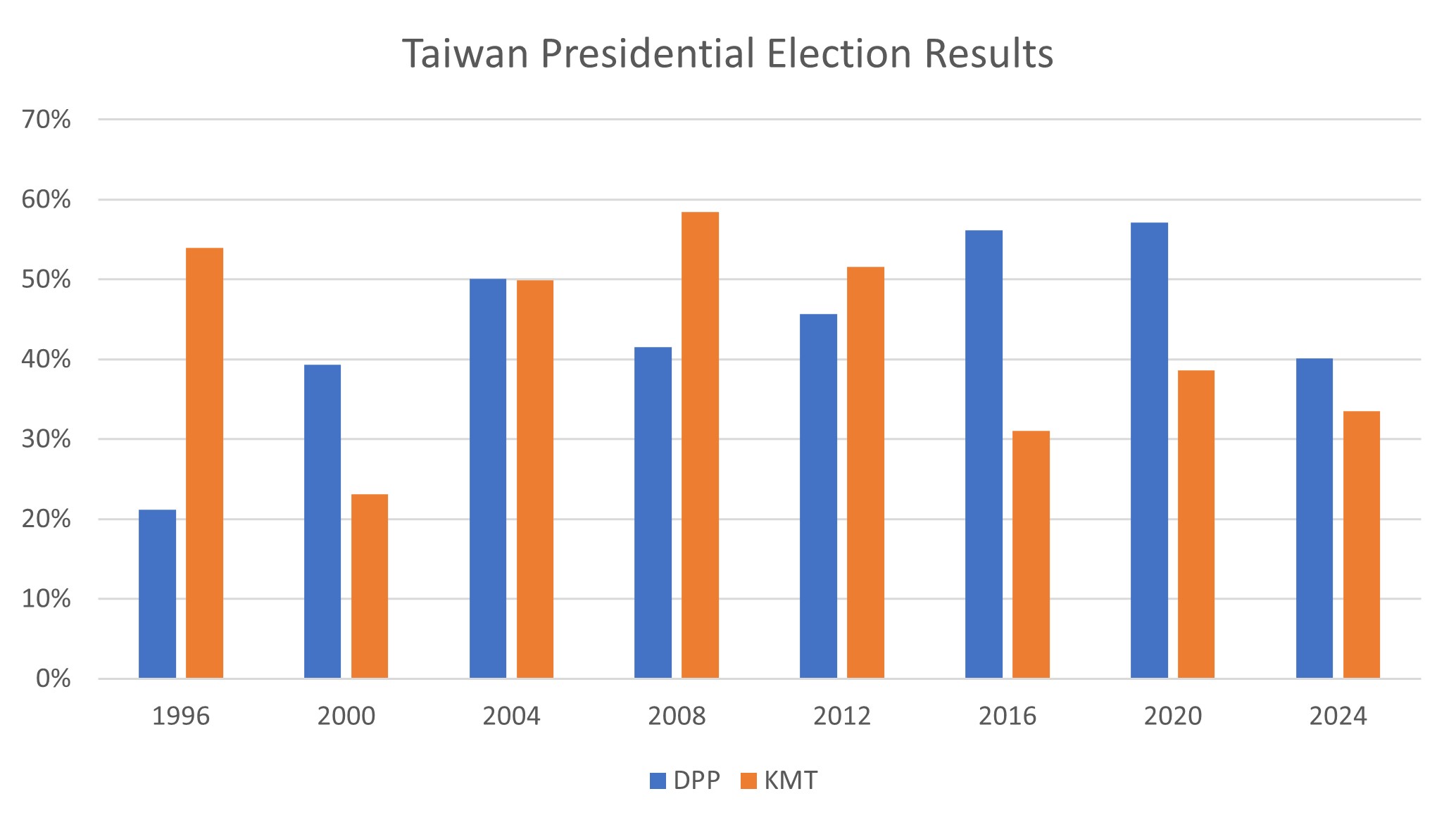

The chart below shows that the DPP’s vote share was the lowest since 2000, which as mentioned above is also the lowest winning percentage over that period. In the Legislative Yuan, the DPP has lost its majority—indeed, the KMT has one more seat than the DPP. This means it is going to be difficult for the DPP to pass new legislation without working closely with the TPP and the two independent parties. Effectively, this creates a scenario where a lot of compromise will have to be made between the parties for any new spending bill or authority initiative. This should reduce the potential for dramatic shifts in policy, which tends to be good news for markets.

Source: Central Election Commission

China reacts to the results

It’s important to consider China’s reaction to this election. Coming into the poll, China had labelled Lai Ching-te as a “dangerous separatist” and indicated it would be displeased with his victory. Since the result, however, it appears that Taiwan Strait tensions have lowered given the split parliament, with China noting that “the DPP can by no means represent mainstream opinions on the island.” We will be closely monitoring the commentary from Beijing, but for now this appears encouraging.

The outlook for the Taiwan Strait tensions this year

Along with the results of the elections, there are a couple of other reasons to think that tensions are unlikely to escalate this year. First, the relationship between China and the U.S. is improving at the margin, and an increase in the Taiwan Strait tensions would be a setback to this relationship—something China likely wants to avoid. Second, China is quite focused on the domestic economic growth situation after a lacklustre 2023, and we expect this matter will command most of its attention.

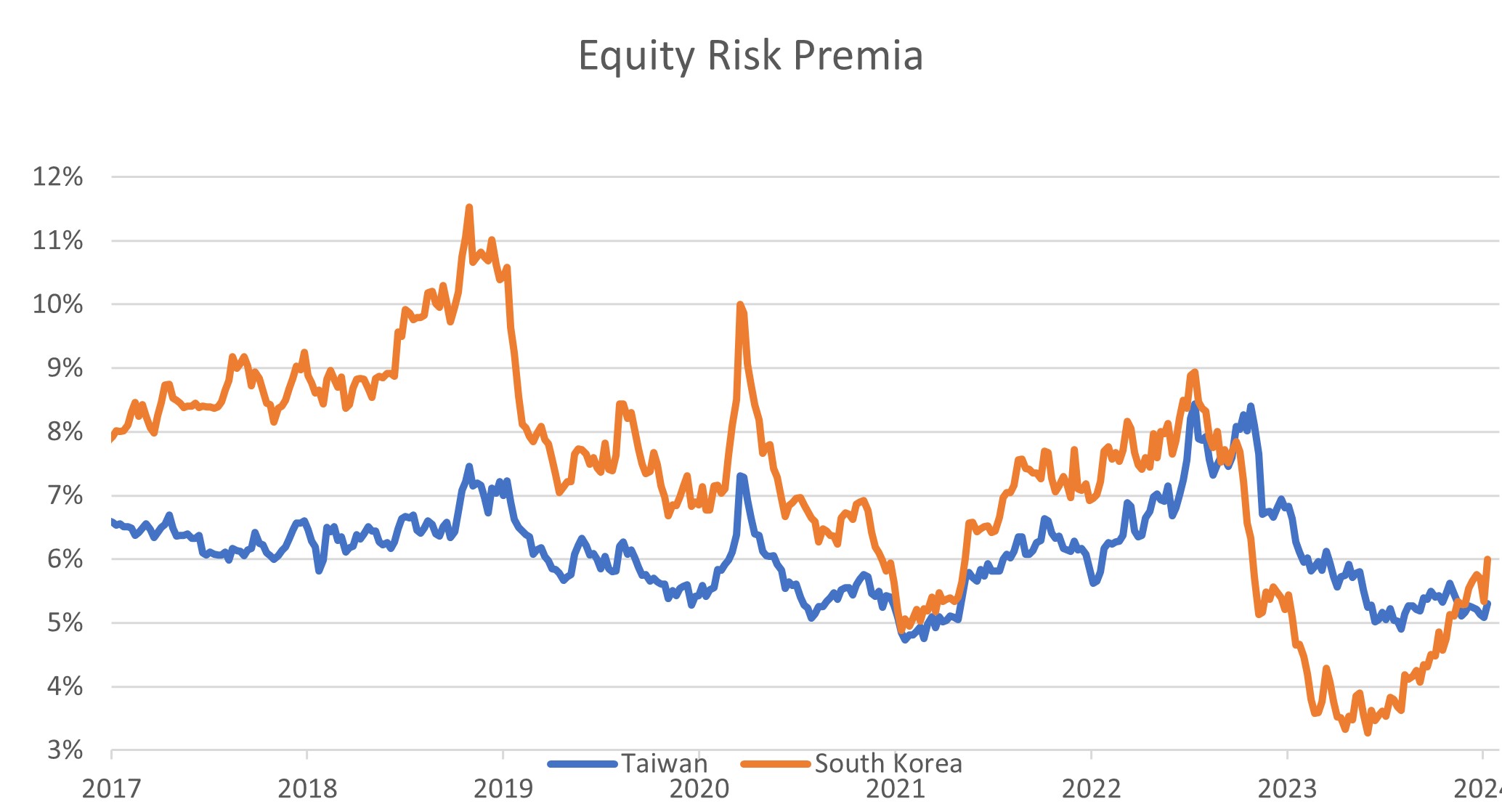

This all indicates to us that tensions on the Taiwanese Strait are unlikely to intensify in the months ahead—which should prove to be good news for Asian markets. We have seen our proxy for the equity risk premia (i.e., the additional return above government bonds demanded by the market) in Taiwan tighten over the last couple of months, indicating a reduction in perceived risk.

Source: LSEG Datastream, 15 January 2024. Equity risk premia calculated as the earnings yield less the 10 year government bond yieldKey watchpoints for investors

We believe the next big watchpoints for Taiwan will be the naming of the Legislative Speaker in February—given the divided Legislative Yuan—followed by the formal taking of office by political leader—elect Lai in May.

At first glance, the potential for the Taiwan Strait tensions to not escalate further would appear to remove one of the concerns that investors have had from a geopolitical perspective. However, given the backdrop of still-elevated global recession risks, we do not believe the Taiwanese election results are a green light for equity markets to take off. Additionally, there are a number of other geopolitical risks still present in the global economy, including the upcoming U.S. elections and any potential shift in U.S. policy toward China.