Uncertain times for Italian politics: Questions and watch points

Relief rally as new Italian government is formed

Events have moved quickly with the Lega/ 5 Star Movement (M5S) coalition government now approved by President Mattarella and due to be sworn in this afternoon. Guiseppe Conte will be prime minister with M5S leader Di Maio and League leader Salvini as deputy prime ministers. The contentious proposed Minister of Finance Savona has been relegated to the less important position of European Affairs ministers and his replacement is Giovanni Tria. At first glance, Tria is more moderate than Savona, but he too has in the past complained about the strictures of the euro.

Financial markets have reacted with relief as the forming of a government removes the risk and uncertainty of new election. In particular, it has lowered the risk of a near-term election as a quasi-referendum on eurozone membership.

We think having clarity is more important at this juncture than having the ‘right’ coalition. However, the relief might not last very long if Tria is considered a wolf in sheep’s clothing and/or if the new government aggressively pushes forward on its unaffordable fiscal plans.

That said, with respect to both Tria’s room for manoeuver as well as the fiscal plans, we continue to focus on constraints versus preferences. The constraints posed by President Mattarella and financial markets have shown themselves to be formidable. From that perspective, we expect a lot of the fiscal plans will be either abandoned or scaled back. If we are right, the deal to form a government might be the start of a reversal in sentiment and value, i.e. the start of a move from oversold and cheap to more neutral levels.

In that light, we are supportive of investors who want to increase exposure to Italian assets (or eurozone financials) and take a small overweight position. There is still a lot of risk on the cycle front but with a government in place we think investing at current levels gives a positive skew in future returns.

Looking over the longer term - what will happen next?

What happens over the next year or two will determine not only what Italy’s relationship with the eurozone and its institutions will be, but it will also determine whether current market pricing provides us with an opportunity.

We are keeping a close eye on the following topics:

Looking over the longer term—What could happen next?

What happens over the next year or two will determine not only what Italy’s relationship with the eurozone and its institutions will be, but it will also determine whether or not current market pricing provides investors with a potential opportunity.

With this in mind, we are keeping a close eye on the following topics:

Eurozone membership

We believe that the risk to Italy’s membership of the eurozone is limited. The euro still has the support of ±60% of Italians and both Lega and M5S have noticeably toned down their euroscepticism. President Mattarella is clearly trying to protect Italy against anti-euro moves.

Governance

For now, we have a coalition government of M5S and Lega. Of course, this can change quickly given the volatility of Italian politics. We should not discount the Democratic Party (PD) and Forza Italia. However, for now we are focusing on what a coalition with Lega and M5S will get done as opposed to what they want they do. We continue to believe that the constraints imposed by both President Mattarella and financial markets will force a new government to tone down its fiscal plans significantly.

The European Central Bank (ECB)

The ECB might have an important role if things worsen significantly from here. At that point, it will have to assess the situation and determine whether the risk to the eurozone is such that it needs to provide support – or whether it needs to teach Italy a lesson. Given Italy’s importance and size we suspect it will choose the former and provide support to specific banks using Emergency Liquidity Assistance (ELA). Or, it may be via the financial system in general through new LTROs (long-term refinancing options) and an extended quantitative easing program. However, we only expect this to happen if Italy slides into a crisis that threatens the eurozone’s overall recovery.

Banks

The risk of a doom-loop (i.e. where increased sovereign risk weighs on the banking sector and starts a vicious downward cycle) is real, but not as large many fear. Italian banks are, by and large, quite well capitalised, and it would take a very big decline in government bond prices before they would be at risk of insolvency.

What's on the cards for financial markets?

Italian bonds

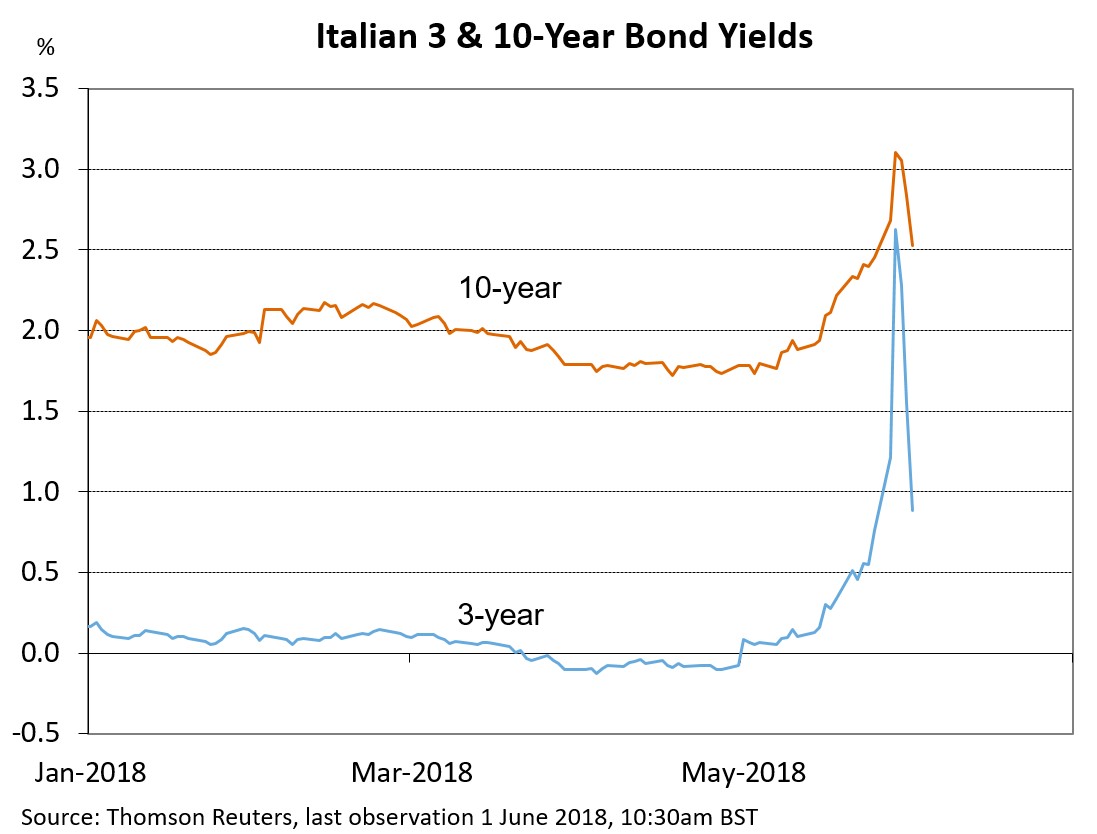

From valuation and sentiment perspective, Italian bonds are still cheap and oversold, but less so after the relief rally, particularly at shorter durations. On the other side of the equation, German Bunds are now overbought and expensive. Italian equities have only recently pushed into oversold territory and are not yet considered particularly cheap. The Italian yield curve has flattened dramatically over the past few days and weeks, which shows that the market is particularly worried about the next two years (see chart below).

The euro

The euro at 1.15 vs the USD has again proven to be a strong support level. The euro is cheap and oversold. There are still a lot of cycle risks, but current levels now look attractive.

Uncertainty? Look at value, sentiment and the political risks

The uncertainty surrounding the political developments in Italy is such that we are operating in an environment best described as hazy, foggy and muddy. In these circumstances we use a two-step approach in our investment process. First, we look at the guidance from our price sensitive building blocks: value and sentiment. Those are currently telling us that Italian assets are cheap and oversold. Second, we look at the political risks that are weighing on our cycle building block. Are those risks growing or lessening and what are the different scenarios we can envision?

Political risks have eased, for now at least. This incrementally improves the outlook for our cycle score. Combined, our Cycle Value Sentiment (CVS) building blocks are more positive, supporting a modestly constructive view on Italian assets.