Mama Mia! Here We Go Again: Italian budget woes unnerve investors

Italy is in trouble once more.

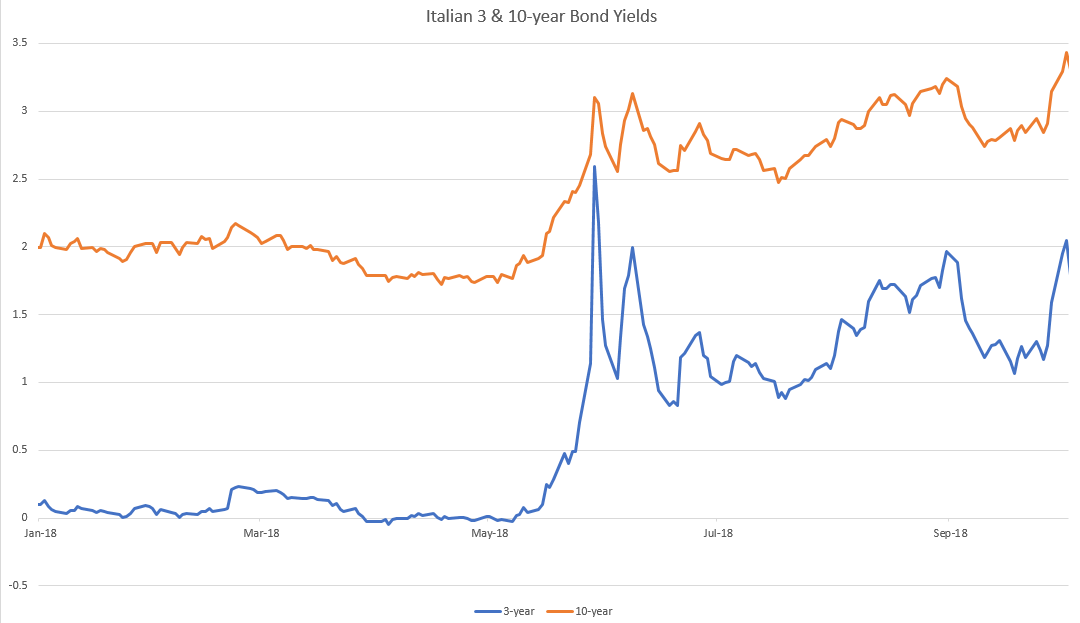

The 10-year Italian bond (BTP) yield has risen 80 basis points to 3.55%1 since late last month on news that the country’s draft budget plan is targeting a 2.4% of GDP (gross domestic product) fiscal deficit for 2019. At one level, this should not be surprising. A coalition pairing of the right-wing populist Lega Nord (League) party and the left-wing populist 5-Star Movement (M5S) party was never a recipe for stability, in our view. Why? Both had promised a fight with European Union leaders in Brussels over fiscal rules and both campaigned on unaffordable promises. Markets were initially calmed by the appointment in June of the fiscally conservative economics professor, Giovanni Tria, as finance minister. This created the impression that the new government would not be too fiscally irresponsible—an idea which has since largely gone by the wayside.

The BTP yield at 3.55% may look attractive, especially considering it's above the June peak when the coalition government was formed. There are still, however, several issues that we believe need more clarity before we can be confident the worst is over:

- Will Finance Minister Tria resign? Tria had been frequently reported in the press in the lead-up to the draft budget announcement as favouring a 1.6% of GDP deficit.2 The 2.4% deficit is a challenge to his credibility.

- Do the ratings agencies downgrade Italy further? Moody's has Italy on negative outlook and will report later this month. Moody's expectation was a 2.1% deficit—less than the current proposed budget. Already, it's rating of Baa2 is just two notches above sub-investment grade.3

- How much latitude will the European Commission allow Italy? The draft budget was submitted on October 15, and is currently under review. It's unlikely, in our view, that the EU will allow a deficit larger than 2% of GDP.

- Will politics push Italy to the fiscal brink? M5S is losing political support, while League is gaining support on its anti-immigrant platform. We think M5S may push to retain the larger deficit target to fund its expensive universal income scheme.

- Can Italian banks manage the losses on their bond holdings? Almost 20% of Italian bonds are owned by Italian banks and these make up 10% of their aggregate assets.4 Our view is that a 4% 10-year BTP yield could trigger enough mark-to-market losses to create concerns about bank solvency. This could kick-off off the dreaded doom-loop, where investors flee BTPs on worries about a government bail-out for the banks, which magnifies the losses for the banks.

We believe that, in terms of sentiment, neither 2-year nor 10-year BTPs are strongly oversold yet. Furthermore, as it stands, we think that there are too many unanswered questions to comfortably take on Italian risk. While Tria did make some supportive remarks recently about the deficit improving from 2020, we will need more concrete evidence that M5S and the Lega are prepared to revise down their fiscal expansion plans. We expect that ultimately the bond market will force a backdown (like the experience of Syriza in Greece). The main risk in our view, however, is that Italy may move even closer to the brink before that occurs.

Source: Thomson Reuters, last observation Oct. 2, 2018

The backstory

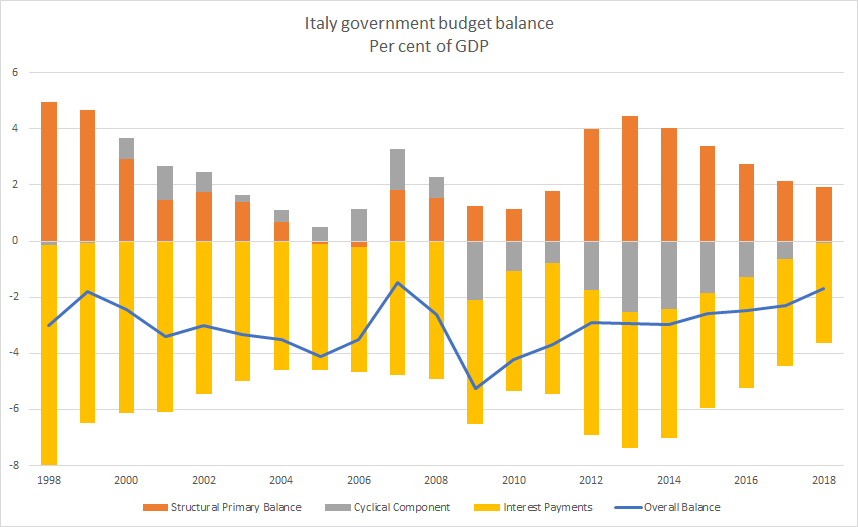

Italy has run a primary fiscal surplus (the primary balance excludes interest payments) for the past 12 years, so in this regard the country has run responsible fiscal policy. The problem is that interest payments (the legacy of past fiscal prolificacy) mean the overall budget position is in deficit. This year's targeted deficit is 1.7% of GDP. The previous government's plan was to reduce that to 0.8% in 2019. The Lega/M5S plan to increase the deficit to 2.4% represents a significant easing and is three times the deficit agreed by the European Commission.4

Source: Thomson Reuters Datastream, May 5, 2018

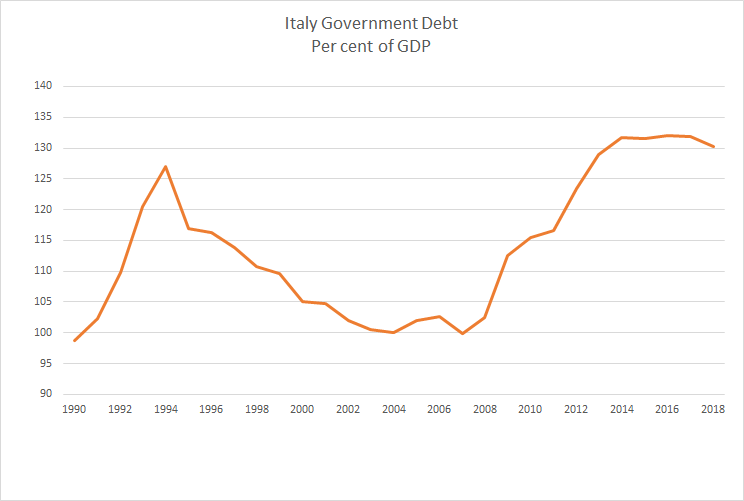

Italy's debt/GDP ratio has been hovering around 130% since 2013.

Source: Thomson Reuters Datastream, April 25, 2018

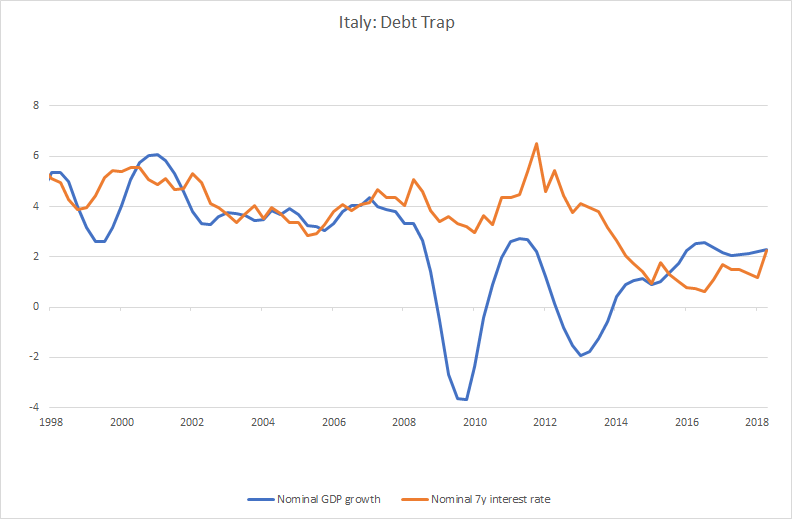

Italy's 7-year bond yield (a proxy for the average yield on government debt) is now above the growth rate of nominal GDP. This will cause the debt/GDP ratio to increase unless the government runs a fiscal surplus.

Source: Thomson Reuters Datastream, Q2 2018

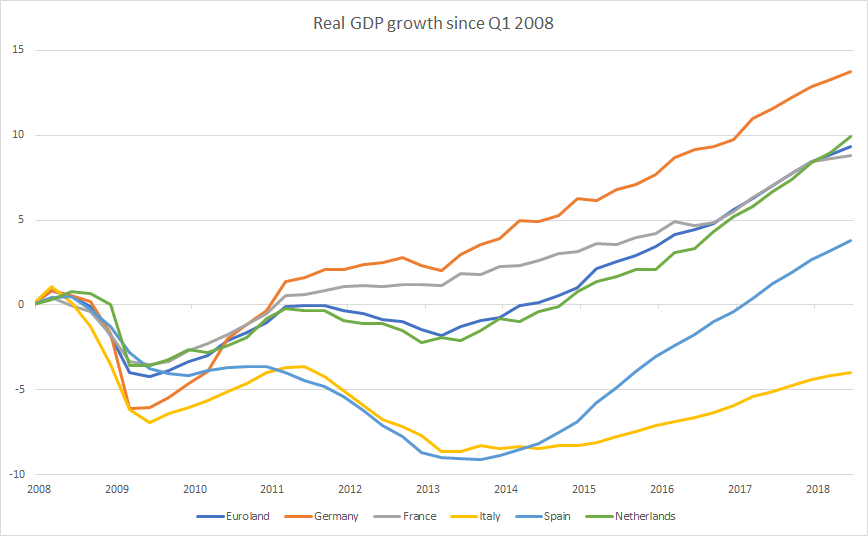

Furthermore, Italy's economic performance has been disappointing and has not recovered from the 2008 financial crisis.

Source: Thomson Reuters Datastream, Q2 2018

The dominant political trend since the March election has been rise of the Lega party and the decline of M5S. From our standpoint, this creates a risk that M5S will attempt to reverse its decline by escalating a fight with Brussels and pushing for its expensive universal income policy.

Bottom line

The market reaction to the 2.4% deficit target shows just how little fiscal space Italy has. BTPs look attractive after the sell-off, but we believe that neither the 2-year or 10-year bonds are strongly oversold yet—and we think there is too much uncertainty to take on Italian risk. In short, while Tria has made comforting comments about the longer-term deficit outlook, these need to be backed by the leaders of the Lega and M5S parties to have credibility.

Unless—or until—that happens, mama mia may continue to be the phrase of the day for investors.

1 Source: As of Oct. 11, 2018

2 Source: https://www.reuters.com/article/us-italy-budget/growth-to-help-curb-italy-debt-despite-higher-deficit-tria-idUSKCN1MA0KL

3 Source: https://www.reuters.com/article/eurozone-bonds/ratings-worries-push-italian-bond-yields-higher-idUSL8N1WQ1HM

4 Source: Banca D'Italia Banks and Money statistical release, September 2018. https://www.bancaditalia.it/pubblicazioni/moneta-banche/2018-moneta/en_statistiche_BAM_20180911.pdf?language_id=1

5 Source: https://www.euractiv.com/section/economic-governance/news/commission-prepares-to-reject-italys-budget/