Power of compound interest

Like a snowball gaining size on a slope, compound interest helps your super balance gather momentum.

By Emma Barrett - 3 min read

A little about Emma

Emma is the Director, Member Services for Russell Investments. She is responsible for the development and delivery of the member proposition, focusing on encouraging members to engage with their super so that they achieve better retirement outcomes.

There are few things in life that can deliver as big a boost for as little effort as the power of compound interest. Simply put, compound interest is when you earn interest on both the money you’ve saved and the interest you’ve already earned.

A common analogy to explain how compound interest works is to think of a snowball rolling down a hill.

Even if you’ve never seen a real snowball, you’ve probably seen one of the many cartoons using the effect for comedy value. A snowball starts small but picks up snow as it rolls. The further it goes and the more momentum it gains, the bigger it gets.

But only part of the effect is due to how long the snowball keeps rolling. The bigger the snowball gets, the larger its surface, so the more snow it can pick up on each roll.

A similar thing happens when you start saving into an account that pays interest or a super account that delivers investment returns.

A simplified example

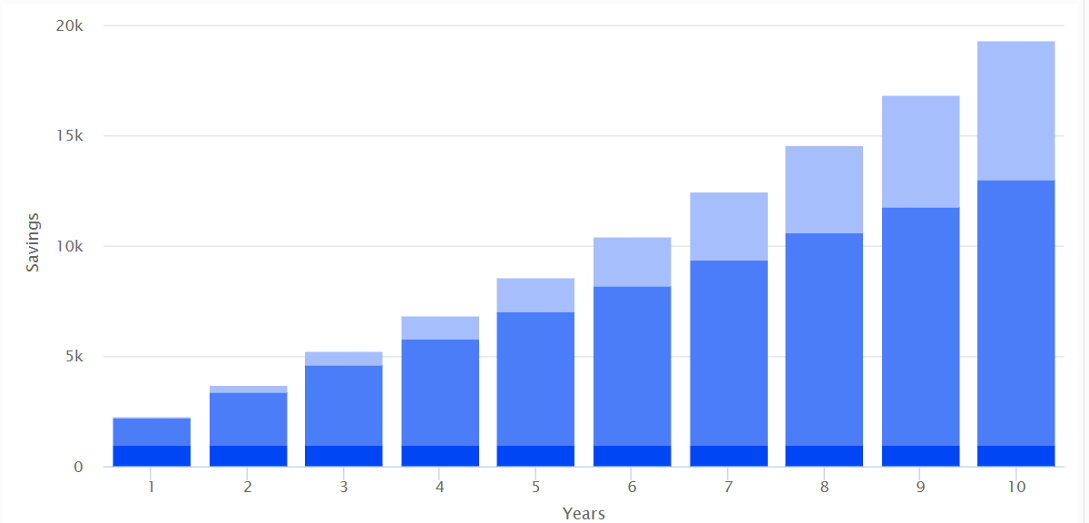

To use a basic financial example, if you start with $1,000 and save $100 each month, earning an annual return of 7 per cent (paid monthly), you’ll have $19,318 after 10 years—with $6,318 of that having accumulated thanks to compound interest.

Source: moneysmart.gov.au Figures shown in future dollars, as per disclosed assumptions and methodology.

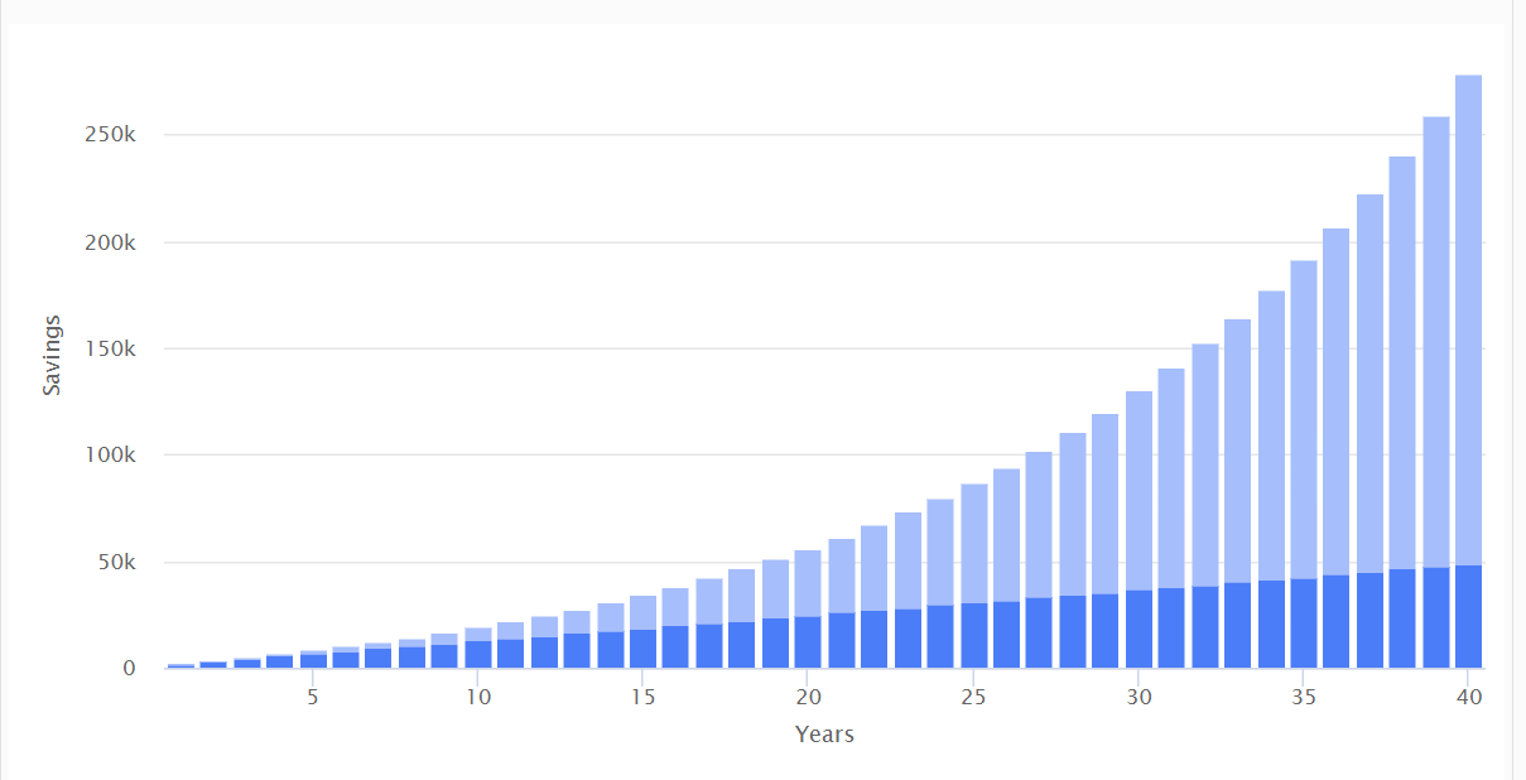

Stretch that out over 40 years of savings and you end up with $278,793, with an impressive $229,793 coming from total interest earned.

Source: moneysmart.gov.au Figures shown in future dollars, as per disclosed assumptions and methodology.

These figures are for illustration purposes only and don’t necessarily reflect the outcomes you would achieve from your superannuation, but the same snowballing principles do apply.

Compound interest can transform regular super contributions into substantial retirement funds through the process of earning returns on both the principal and the accumulated interest.

Contributions to superannuation accounts are taxed at a concessional rate, and the earnings within the fund are also taxed at a lower rate compared to other forms of investment income. This favourable tax treatment means more money stays in the fund to benefit from compounding. Plus, the longer your super remains invested, the more pronounced the compounding effect becomes.

Starting early, making consistent contributions, and taking advantage of the tax benefits associated with super could lead to a more secure and comfortable retirement. All this is very important, because your super balance at retirement will have a big influence on how much income you’ll be able to generate to support the retirement lifestyle you have in mind. The beauty of super is that you can add extra to your balance to turbo-charge your account’s growth.

How to grow your snowball

One way your super balance can grow is with super guarantee (SG) payments your employer makes into your fund. Starting from July 1, 2024, employers will generally contribute 11.5 per cent of your salary or wages to your super fund as SG payments.

Many people also have the flexibility to add to their funds using before-tax contributions (capped at $30,000 from 1 July 2024), such as salary sacrifice or personal deductible contributions, and after-tax contributions (capped at $120,000 from 1 July 2024). You can find some clever tips on how you can top up your super savings in other articles on Zest.

Other options for boosting your super balance, such as spouse contributions, government co-contributions and the low-income super tax offset may also be available, depending on your circumstances.

You can use GoalTracker® to see how different types and amounts of extra contributions could affect your own super balance at retirement.

No matter how much you add to your super fund, compounding has the power to help grow your balance in the long run. In general, the more you add to your account and the earlier you make those additions, the greater the potential for future growth—because you’re building on a bigger snowball, so to speak.

Zest! recommends

SUPER 101

Get to know your super

As one of our valued members, you have a lot of control over your super. Watch our quick video to find out what you need to do.

By Ofalyn Ayuk

Issued by Total Risk Management Pty Ltd ABN 62 008 644 353, AFSL 238790 (TRM) as trustee of Russell Investments Master Trust ABN 89 384 753 567. Nationwide Super and Resource Super are Divisions of the Russell Investments Master Trust. The Product Disclosure Statement (‘PDS’), the Target Market Determinations and the Financial Services Guide can be obtained by phoning 1800 555 667 or by visiting russellinvestments.com.au or for Nationwide Super by phoning 1800 025 241 or visiting nationwidesuper.com.au. Any potential investor should consider the latest PDS in deciding whether to acquire, or to continue to hold, an investment in any Russell Investments product. Russell Investments Financial Solutions Pty Ltd ABN 84 010 799 041, AFSL 229850 (RIFS) is the provider of MyTracker and the financial product advice provided by GoalTracker Plus. General financial product advice is provided by RIFS or Link Advice Pty Ltd (Link Advice) ABN 36 105 811 836, AFSL 258145. Limited personal financial product advice is provided by Link Advice with the exception of GoalTracker Plus advice, which is provided by RIFS.

This communication provides general information only and has not been prepared having regard to your objectives, financial situation or needs. Before making an investment decision, you need to consider whether this information is appropriate to your objectives, financial situation and needs. If you'd like personal advice, we can refer you to the appropriate person. This information has been compiled from sources considered to be reliable but is not guaranteed. Past performance is not a reliable indicator of future performance. To the extent permitted by law, no liability is accepted for any loss or damage as a result of reliance on this information. This material does not constitute professional advice or opinion and is not intended to be used as the basis for making an investment decision. This work is copyright 2024. Apart from any use permitted under the Copyright Act 1968, no part may be reproduced by any process, nor may any other exclusive right be exercised, without the permission of Russell Investments.