The Year of the Rabbit: China's 2023 growth outlook

2023 is set to be a year of fading economic growth, with recession risks elevated in both the U.S. and Europe. However, the economic situation in China appears to be improving as the three big challenges that China has imposed on itself begin to alleviate. In this article, we’ll discuss why we think that 2023 could be the year that China pulls the rabbit out of the hat and achieves solid economic growth.

China making progress on overcoming key challenges

We have discussed the challenges China has faced in previous articles—namely, the zero-COVID policy, a struggling property sector and tech regulation. Since December, we have seen increasingly encouraging news on all three fronts.

It has been well documented that China is in the midst of reopening its economy after three years of its stringent zero-COVID policy. Right now, the virus is spreading quickly and it is hard to get reliable data on the scale of the outbreak, given that testing requirements have been dropped. Plausible estimates suggest that close to 30 million people a day are contracting COVID-19. In the near term, this is likely to put further strain on the healthcare system and could lead to some reversals of the reopening approach in certain areas. As the end of February approaches, however, it is likely that a substantial proportion of the population will have developed some level of immunity to the virus.

Excess savings could boost consumer spending

Like the phenomenon that we saw in developed countries, there is substantial pent-up demand within China. Travel bookings for the upcoming Lunar New Year are significantly higher than the last two years, and Chinese consumers have built up a significant amount of savings—it is estimated that there is close to $900 billion in excess savings. Of course, those savings are not equally distributed, but should nevertheless provide a boost to domestic consumption through 2023.

Lending restrictions on real-estate developers easing

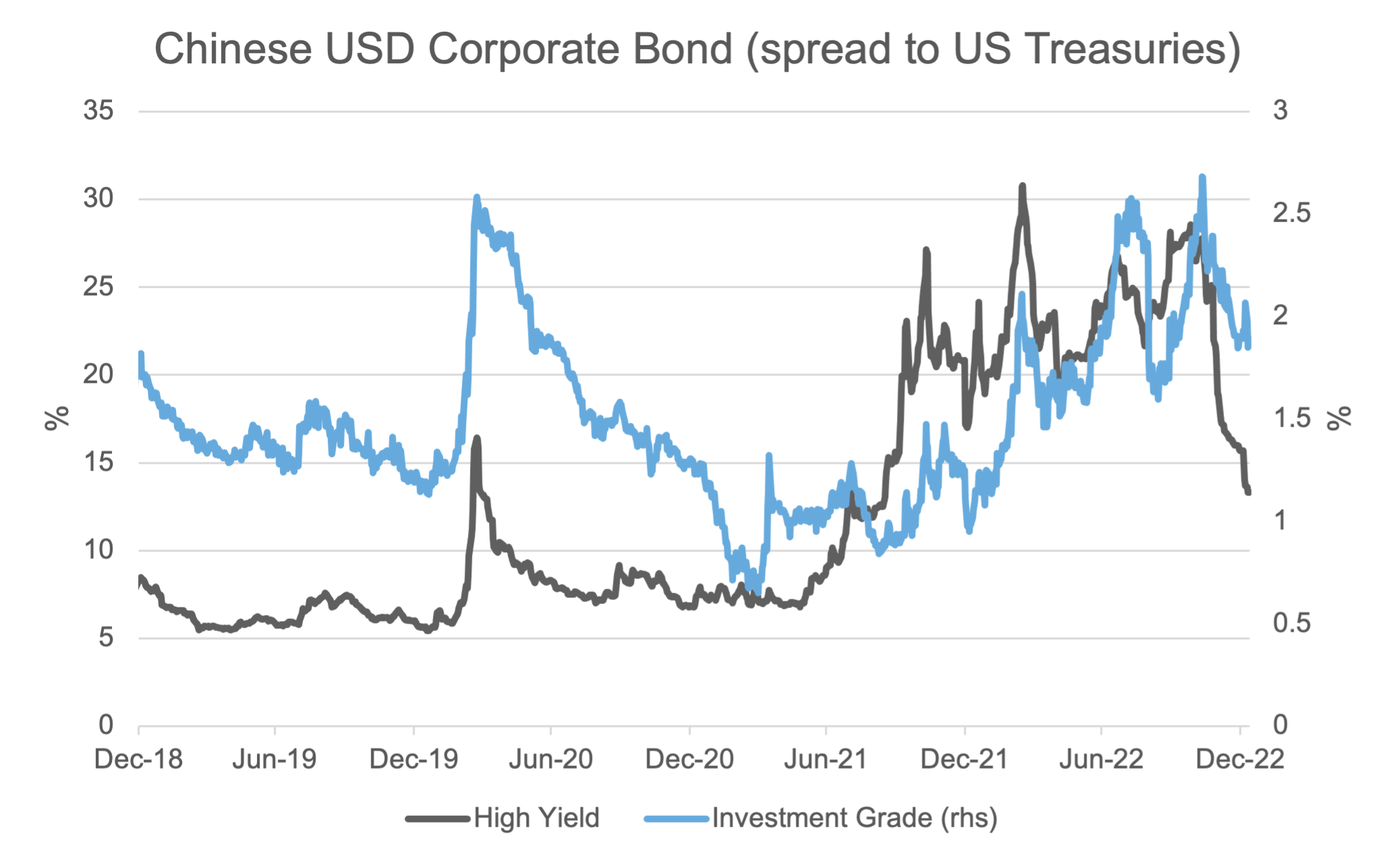

The Chinese government has also been loosening some of the restrictions that it placed on the property sector—chiefly, around the three red lines policy that aimed to reduce the amount of debt property developers had. The easiest way to show this alleviation is through the credit spread of Chinese high yield U.S. dollar (USD) bonds—that is, the extra interest rate offered for Chinese high yield bonds (issued in USD), relative to U.S. Treasuries. Property developers account for a large majority of USD high yield issuers, comprising nearly 80% of the index. After peaking at above 30%, these spreads have come down to 14%. It is important to note that this is still an elevated level, but a vast improvement nevertheless.

Source: Refinitiv Datastream, Russell Investments, 10 January 2023

Could housing demand increase this year?

The next watchpoint for the property sector is for signs of improved demand for housing. Consumer confidence and willingness to buy property has been falling, which has led to a significant decline in property sales and prices. There have been several measures announced to try and improve the appetite for property purchases, including lowering the down payment required and loosening restrictions on where individuals can buy property. It is still too early to tell if these measures have been effective, given that recent COVID-19 lockdowns impacted the ability of individuals to view properties, but we should have a much better gauge over the next couple of months.

Is more fiscal stimulus on the way in 2023?

Finally, it is important to discuss what we think is likely to come from government policy in 2023. We continue to expect that there will be more fiscal stimulus put to work from the Chinese government this year, with an emphasis on providing a boost to households.

The reason for this is that the Chinese economy has three key engines that it can utilize to boost growth: net exports, construction and consumption. Given our view that the developed world is going to slow this year, we believe net exports will be challenged. While the pressures in property are being alleviated, it is unlikely that we are going to see a big recovery in property construction this year. However, we do believe that we’ll see a pickup in infrastructure construction, given the rise in project approvals seen in 2022. This leaves household consumption as the most reliable potential driver through 2023, and so we think that government policy will be targeted this way.

What might this look like? It could consist of various measures, including direct transfers to households and subsidies on various household goods or automobiles, as well as further measures to improve the demand for property purchases. We should have a much better picture of how supportive fiscal policy will be after the National People’s Congress meeting in March, where the government will hint at the desired growth rate and outline specific policy initiatives.

What are the implications for investors?

We believe that China’s improving growth prospects are likely to impact investors in three key ways. First, an improving China in the face of a slowing global economy would likely be a positive for emerging markets (EM) equities, which are heavily weighted to China. This would be amplified if we see a continued decline in the U.S. dollar, given EM assets tend to do very well relative to developed equities when the dollar is declining.

Second, a stronger Chinese economy would likely provide support for commodities—especially energy and base metals, given the increasing travel outlook and the potential for more infrastructure spending.

Third, an improving Chinese outlook would support regions and countries such as Europe and Australia that are large exporters to China. Already, we’ve seen signs of this, with both the euro and the Australian dollar appreciating on the positive news from China so far.

The bottom line

After being battered last year by the triple headwinds of COVID-19 lockdowns, a declining property market and tech regulations, China’s economy looks poised for a recovery in 2023. We believe that European, Australian, commodities and emerging-markets investors stand a good chance of benefiting the most from such a rebound.