Momentum vs Asymmetry: Why downside management strategies are even more important now

Momentum: Benign Economics

Developed economies are in the "sweet spot" of moderately above-trend growth, continuing low inflation and low interest rates (easy monetary policy — or in the case of the U.S. Federal Reserve (the Fed), very gradual tightening). It’s a supportive environment for just about every part of a portfolio. A benign economic environment can see markets trend higher thanks to positive market sentiment.

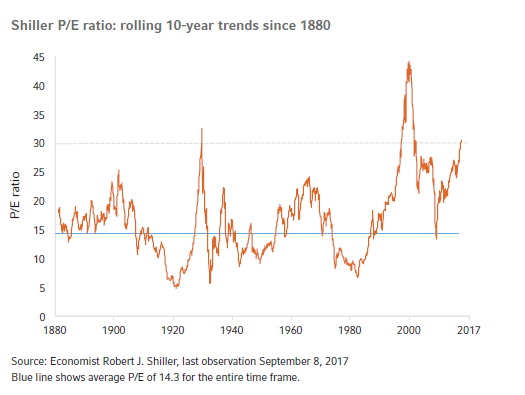

Asymmetry: Extremely expensive U.S. share markets

On the other hand, however, we believe U.S. share markets are extremely expensive relative to historical levels which makes the market vulnerable to any unwelcome news

Prices for U.S. shares, as measured by the S&P 500 as of September 2017, are trading at 30 times cyclically adjusted earnings1, which is the most expensive level ever outside of 1929 and the late 1990s. This creates asymmetry in the expected returns going forward.

Downside risks could be significant

Share markets can keep grinding higher with positive momentum. But at current valuations, our analysis suggests the upside potential is limited, and the drawdown potential could be significant.

The two big risks in our view are either a recession scare or an inflation scare that sends interest rate expectations significantly higher. Both seem unlikely in the near term, although we believe fixed income markets seem to be underestimating the potential for U.S. inflation pressures and Fed rate hikes in 2018.

Further, our U.S. business cycle index model points to rising recession probabilities (25% as of 15 September 2017). Overall, we think the U.S. economy is still on a path of moderate growth with low probability of recession over the next year, but risks are building at the three-year horizon.

Another worry is the potential for a sharp spike in volatility. The low level of the CBOE Volatility Index®(VIX Index) underlines the degree of investor complacency. The issues that could cause a volatility spike are hard to predict, but an obvious current candidate is the tension around North Korea.

Downside management strategies becoming increasingly important

At Russell Investments, we have been advising caution about the outlook for markets over the past 2 to 3 years as equity and bond markets became increasingly expensive and vulnerable to pull-backs. Our portfolio managers have been dynamically managing our client portfolios by including a variety of downside management strategies to achieve long-term goals, while managing the progressively larger risks of drawdown.

We have also prepared a comprehensive toolkit of resources to help our clients and their end investors to stay calm and make considered decisions if the anticipated market fluctuations do amplify and increase volatility.

For further information, please see

1 It's the elevated level of the cyclically adjusted price earnings ratio (CAPE) that makes us nervous about asymmetry – that the downside for S&P 500® Index returns is larger than the upside. A high CAPE means that future returns are likely to be disappointing. The average annualized return over the following three years when the CAPE has been above 22-times earnings trends is less than 5%. It also increases drawdown risk dramatically. The average drawdown over the following three years when the CAPE has been above 22-times is around -21%.