UK Election: A hung parliament

- The lack of a Conservative majority realises a hung parliament. The impact of this on Brexit is hard to predict.

- Markets are likely to move into ‘risk-off’ mode seeing a decline in sterling, UK equites and gilts.

- Investors should prepare for increased market volatility as we expect a chaotic and difficult time for Westminster.

- Russell Investments’ Multi-Asset funds have no structural overweight allocation to UK assets.

The campaign

The election campaign turned out to be a lot more interesting than many expected when Prime Minister May announced her wish to hold a snap election. At the time, the Conservatives were almost 20% ahead in the polls and it seemed as though the British public overwhelmingly favoured Theresa May over Labour-leader Jeremy Corbyn to deliver Brexit negotiations. As a result, the media and political analysts widely expected a resounding victory and an increased Conservative majority in the House of Commons to more than 100 seats.

But then the campaigns got under way…To everyone’s surprise the Conservatives were quickly put on the defensive about hot topics like social care, while Labour found traction on issues such as education and housing. This reversal and subsequent narrowing of the polls turned a coronation into a battle.

In the end, however, that battle was not clearly won.

Brexit negotiations

A hung parliament has now kickstarted a very chaotic and difficult time for Westminster, the outcome of which is difficult to envisage. Could we see Labour and the SNP cobble together a coalition (maybe with the help of the Lib-Dems)? In any case, the UK’s departure from the European Union looks set to be delayed or turned into a very Soft Brexit.

What are the implications for UK assets?

Sterling

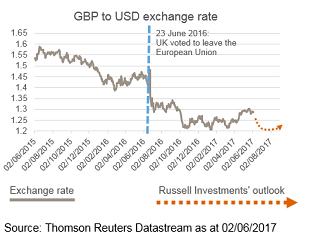

Since the referendum on 23 June 2016, the British pound exchange rate has been the best barometer for the market’s perception of the risks and opportunities.

After falling more than 15% in trade-weighted terms during 2016, sterling recovered almost 8% over 2017. However, it quickly fell back by 3% in May as the Conservative polls started to narrow during the run up to the election.

Looking ahead, we think the pound will fall initially, but the downside is limited by favourable valuations (see chart).

Equities

Equity markets will fall on the back of heightened political uncertainty. The fall in equity markets is likely to be softened by a weaker pound, but the medium-term outlook for stocks very much depends on how the political uncertainty is resolved. Overall, the outlook for UK stocks is also closely linked to global economic prospects.

Gilts

In such an environment, we project that 10-year gilt yields will fall in a risk-off move. If the formation of a government is delayed significantly, this may eventually lead to a review of the UK’s credit rating and higher yields.

Economic outlook

Our bottom line is that whilst this general election result feels like a crucial event for those in the UK, it does not carry with it the same market significance as others have over the past year, namely the French or Italian elections. Indeed, the post-Brexit economy has done well so far, but we continue to believe that the slowdown in corporate and housing investment, in combination with downward pressure on real wage growth, will slow economic growth in 2017 and 2018.