2021-22 super fund returns: a short analysis

High inflation, rising interest rates and market volatility impacted super fund returns in 2021-22 but when it comes to performance, time is a healer.

By Daniel Choo - 3 min 20 sec read

A little about Daniel

Daniel Choo manages the diversified portfolios on behalf of Russell Investments Master Trust members and retail investors. The portfolio management team allocates between different asset classes such as shares, bonds, property and currencies.

Superannuation funds have started sending 2021-22 annual statements to members—and you will receive yours soon. Over the past few years, superannuation investment performance has been strong. But across super funds in general, people saving for retirement will be learning that their returns in 2021-22 have been lower than they would have been used to.

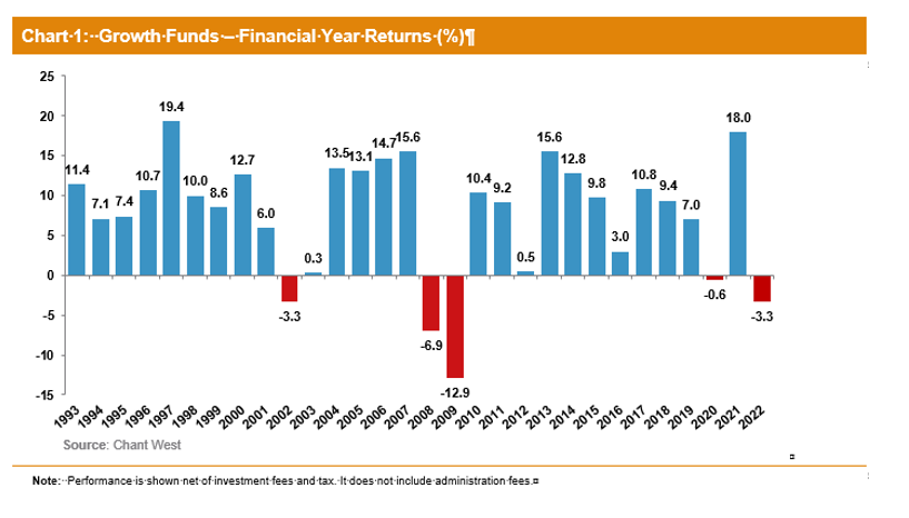

For only the fifth time in 30 years of compulsory superannuation, and after double-digit gains in 2021, practically all super funds are reporting negative returns for the 2021-22 financial year.1 In fact, Chant West data shows that the median MySuper growth option from across the industry was down 3.3 per cent over the year.

Context for returns

Superannuation is a long-term investment. Unless you are imminently planning to retire, what matters most is achieving long-term returns that compound over time. To get this outcome, investment portfolios need to include some risk and that results in the occasional negative return over short periods. Over the past 10, 20 and 30 years, superannuation returns have been strongly positive and kept super balances growing.

As you can see from the chart below, over time, super funds have far more positive years than negative.

Click to enlarge

Source: Chant West. Past performance is not a reliable indicator of future performance.

Want to know more about our 2021-22 annual performance? Check out our commentary.

There’s no denying losses hurt, but it’s important to put things into perspective.

Chant West’s figures show the median super return was still up 7.5 per cent compared with its high point at the end of January 2020 before the onset of the COVID-19 pandemic.2

What’s more, the overall fund performances have picked up since the end of June 2022, with superannuation research house SuperRatings noting the median growth option rose by an estimated 3.5 per cent in July 2022. Obviously, this is outside of the reporting period, so those returns aren’t reflected in 2021-22 statements.

So, what happened in the last financial year to derail fund returns for the entire super industry?

Events that ruled the 2021-22 financial year

There were several global events of concern over the 2021-22 period that made investors nervous and caused market volatility. Here are some of the key events:

- Fresh COVID-19 lockdowns and an economic slowdown in China

This slowed down a lot of the country's economic activity, increased the unemployment rate and impacted supply chains. As one of the world's largest economies, exporters and trading partners, China's economic activity is crucial to global growth.

- The Russia/Ukraine conflict

No one expected this conflict to escalate in Q1 2022 and to significantly slow down global growth. The conflict continues to be a humanitarian crisis, as well as a major disrupter of markets with its impact on energy and food prices.

- An uncertain outlook for the US economy >

An overheated labour market, restrictive monetary policy settings and continued risk of recession made things uncertain for the world's largest economy.

- High inflation

Supply chain shortages, rising labour costs and a spike in energy prices drove inflation higher. The chart below shows just how much inflation rose over the past 12 months.

Click to enlarge

In general, share prices suffer when inflation is high, as companies’ input costs increase, reducing profit margins, unless they have strong pricing power to increase rates to their customers. Similarly, higher interest rates can lower company profitability and slow business growth as the costs to finance activities and asset acquisitions are higher.

- Rising interest rates

To combat rising inflation, central banks started increasing interest rates—in many cases, for the first time in over a decade. The Reserve Bank of Australia, for instance, started lifting rates from 0.1 per cent in April 2021 to 1.85 per cent in August. This followed 11 years of flat and falling interest rates.

Together, all these events had an impact on investment performance. Financial markets hate uncertainty. It increases the risk that investments will not turn out the way they are expected to—and this leads to volatility and weaker returns as investors try to respond to unpredictable and often fast-changing circumstances. The Australian share market performance illustrates the point - it fell by around 10 per cent over the financial year ending June 2022.

|

Understanding volatility In recent months, there’s been a lot of talk about volatility. Here’s what our experts have to say.

|

Lessons from history

The good news is that past experience shows us that markets recover. As mentioned at the start, investment markets rebounded strongly in July. For more, check out our annual statements information page.

Over the long term, an appropriate investment strategy, coupled with regular contributions to superannuation, will help to safeguard your financial position and allow you to build a nest egg that will support the retirement lifestyle you desire.

- Chant West Multi Manager Survey, May 2022.

- Super Members Spared The Worst In A Rough Year For Markets, Chant West, 19 July 2022.

Issued by Total Risk Management Pty Ltd ABN 62 008 644 353, AFSL 238790 (TRM) as trustee of Russell Investments Master Trust ABN 89 384 753 567. Nationwide Super and Resource Super are Divisions of the Russell Investments Master Trust. The Product Disclosure Statement (‘PDS’), the Target Market Determinations and the Financial Services Guide can be obtained by phoning 1800 555 667 or by visiting russellinvestments.com.au or for Nationwide Super by phoning 1800 025 241 or visiting nationwidesuper.com.au. Any potential investor should consider the latest PDS in deciding whether to acquire, or to continue to hold, an investment in any Russell Investments product. Russell Investments Financial Solutions Pty Ltd ABN 84 010 799 041, AFSL 229850 (RIFS) is the provider of MyTracker and the financial product advice provided by GoalTracker Plus. General financial product advice is provided by RIFS or Link Advice Pty Ltd (Link Advice) ABN 36 105 811 836, AFSL 258145. Limited personal financial product advice is provided by Link Advice with the exception of GoalTracker Plus advice, which is provided by RIFS.

This communication provides general information only and has not been prepared having regard to your objectives, financial situation or needs. Before making an investment decision, you need to consider whether this information is appropriate to your objectives, financial situation and needs. If you'd like personal advice, we can refer you to the appropriate person. This information has been compiled from sources considered to be reliable but is not guaranteed. Past performance is not a reliable indicator of future performance. To the extent permitted by law, no liability is accepted for any loss or damage as a result of reliance on this information. This material does not constitute professional advice or opinion and is not intended to be used as the basis for making an investment decision. This work is copyright 2022. Apart from any use permitted under the Copyright Act 1968, no part may be reproduced by any process, nor may any other exclusive right be exercised, without the permission of Russell Investments.